Analyzing Coursera’s IPO Filing: $293.5M Revenue, $281M Paid to Partners, 12K Degree Students

Revealed: Rhyme’s acquisition cost, Andrew Ng’s DeepLearning.AI revenue, no. of degree students, and more.

TL;DR

- Coursera’s revenue increased by 59% to $293.5M in 2020. Its losses increased to $66.8M, up from $46.7M in 2019.

- Since 2017, Coursera has paid $281M to its 200 university and industry partners.

- Half of the 2020 consumer revenue came from users registered before 2019.

- Coursera has 12k degree students enrolled across 25+ degrees.

- Consumer segment represented 65% of the revenue in 2020 but 90% in 2017.

- By late 2020, 3.2M learners had bought an offering, and 50k were enrolled in Coursera Plus.

Early this year, I compared Coursera and Udemy, two providers that we expected to go public in 2021. And for one of them at least, it looks like this has now been confirmed.

Last week, Coursera filed their S-1 form, indicating that the company plans to be listed on the New York Stock Exchange under the symbol “COUR”.

The form is a prospectus containing the company’s “basic business and financial information”. Coursera’s S-1 form is 240 pages long. I printed it and read it over the weekend. In this article, I go over some of the details that caught my attention.

If you don’t know anything about me (why would you?), I am the founder and CEO of Class Central. I started Class Central as a side-project way back in November 2011 as a way to keep track of Stanford’s free online courses. Back then MOOCs weren’t called MOOCs and Coursera wasn’t yet Coursera.

Technically speaking, Class Central predates Coursera (they grow up so quickly!). Through Class Central, I’ve been covering Coursera in detail. In fact, I’ve probably written more about Coursera than anyone else out there. For instance, I’ve written end-of-year analyses of the provider, described their monetization journey from 0 to $100+ million in revenue, and published a guide that went viral (and caused Coursera some PR headaches) on how to download courses when they were about to be shut down on Coursera’s old platform.

I have also completed close to a dozen courses on the platform.

So to me, this S-1 feels like the series finale of a TV show I’ve been following for ages: all the plots and subplots have been resolved. I finally get to discover whether my theories and speculations over the years were correct.

In this article, I am going to focus on Coursera’s past and share details about the business itself. I am not going to evaluate Coursera as an investment opportunity. Another disclaimer is that Class Central is an affiliate partner of Coursera.

This is the first time I have read an S-1, and it is quite possible that I misinterpreted something. If that’s the case, please let me know in the comments.

Overview

| 2017 | 2018 | 2019 | 2020 | |

| Total | $95.6m | $141.8m | $184.4m | $293.5m |

| Consumer | $85.7m | $107.5m | $121m | $193m |

| Enterprise | $7.4m | $26.0m | $48.2m | $70.8m |

| Degrees | $2.5m | $7.4m | $15.1m | $29.9m |

| Net Loss | ($53.3m) | ($43.6m) | ($46.8m) | ($66.8m) |

At the end of 2020, Coursera had raised $461.8 million, and accumulated $343.6 million in deficit and $285.5 million in cash equivalents and marketable securities. According to Coursera, this money and revenues “will be sufficient to meet our cash needs for at least the next 12 months.”

According to the S-1 prospectus, Coursera “expect to incur significant losses in the future” and “can provide no assurance as to whether or when we will achieve profitability”.

Boosted by the pandemic, the company’s revenue grew by 59% in 2020 to $293.5 million, compared to a growth of 23% in 2019. These are the numbers before Coursera shares its revenues with its content partners.

Coursera divides its business into three major categories: Consumer, Enterprise, and Degrees.

Coursera’s CEO Jeff Maggioncalda joined the company in mid-2017. Under his tenure, Coursera has been able to reduce its dependence on the Consumer segment. The Consumer segment generated 65% of its revenues in 2020, compared to almost 90% in 2017.

The Consumer segment is very lucrative for Coursera, but it wasn’t growing quickly enough for a company that ambitioned to go public for quite a while, as the table below shows. Until the pandemic, Coursera’s growth came from its degrees and enterprise business.

| 2018 | 2019 | 2020 | |

| Total | 48% | 30% | 59% |

| Consumer | 26% | 13% | 59% |

| Enterprise | 261% | 80% | 47% |

| Degree | 191% | 104% | 97% |

The Degrees and Enterprise segments combined generated $100 million in revenues for Coursera in 2020. Due to Coursera’s freemium model, the Consumer segment also generates leads for its Enterprise and Degrees segment (more on this later).

Out of Coursera’s 77 million learners at the end of 2020, 3.2 million had paid for a course or offering, up from 2.3 million a year before.

Coursera’s biggest source of revenue is the United States. According to the prospectus, “we [Coursera] generated 51% of our revenue outside the United States during both of the years ended December 31, 2019 and 2020”. Outside of the US, no single country generated more than 10% of the revenue.

| 2019 | 2020 | |

| United States | $90m | $143.5m |

| Europe, Middle East, Africa | $52.1m | $83.3m |

| Asia Pacific | $27.7m | $40.7m |

| Other | $14.7m | $26.m |

| Total | $184.4m | $293.5m |

Learners

| Registered Learners | New Registered Learners | |

| 2017 | 30.1m | 6.9m |

| 2018 | 37.3m | 7.3m |

| 2019 | 46.4m | 9.2m |

| 2020 | 76.6m | 30.6m |

The table above clearly shows the impact of the pandemic on Coursera. Coursera attracted as many learners in 2020 alone as its closest competitor did in its entire existence.

In my opinion, Coursera had the best response to the pandemic among all online education players. Coursera’s pandemic response had four key components: free certificate courses, free COVID-19 courses, free Coursera for Campus, and free Coursera for Government. You can find more details about their pandemic response in Coursera’s 2020: Year in Review.

Coursera’s top five countries by registered learners are as follows:

- United States — 15 million learners

- India — 10.6 million

- Mexico — 4.1 million

- Brazil — 3.2 million

- China — 3.1 million

Over 80% or around 60 million of Coursera’s learners are outside of North America. These can be broken down further as follows:

- Latin America — 15 million learners

- Europe — 14 million

- Asia — 12 million (excluding India)

- Middle East and Africa — 7 million

- Oceania — 1 million

Enterprise

Coursera Enterprise business has grown from $7.4 million in revenue in 2017 to $70.8 million in 2020.

Pluralsight, another public company which offers a catalog subscription and primarily sells to enterprises made $391.9 million in 2020. So this might be Coursera’s most promising prospect for future growth.

Coursera’s Enterprise segment consists of three verticals:

- Coursera for Business: As of December 31, 2020, over 2,000 organizations, including over 25% of all Fortune 500 companies, were Coursera for Business paying customers.

- Coursera for Campus: As of December 31, 2020, over 130 colleges and universities were Coursera for Campus paying customers.

- Coursera for Governments: As of December 31, 2020, over 100 government agencies and organizations were Coursera for Government paying customers.

Coursera’s Paid Enterprise Customers grew from 240 at the end of 2019 to 387 at the end of 2020. Coursera defines “Paid Enterprise Customer” as a “customer who purchases Coursera via our direct sales force”.

These customers accounted for 70% of the Enterprise segment revenue in 2019 and 79% in 2020.

Degrees

| No. of Degrees | Revenue | Students | |

| 2016 | 2 | ||

| 2017 | 4 | $2.5m | |

| 2018 | 12 | $7.4m | |

| 2019 | 16 | $15.1m | 6,217 |

| 2020 | 26 | $29.9m | 11,900 |

Coursera announced its first online degree, Illinois’ iMBA, back in 2015 at a price of $22k. Over 1,500 students have graduated since 2017, and the University of Illinois has replaced its on-campus MBA with its iMBA.

Since then, Coursera’s Degree segment has grown to 26 online degrees from 13 university partners, with almost 12k students by the end of 2020 generating $29.9 million.

According to Coursera, the cost of acquiring a degree student is under $2,000, which I understand is well below the industry average.

These degrees cost anywhere between $9,000 and $45,000. Class Central has compiled a comprehensive list of MOOC-based degrees, including the ones from Coursera. You can find the list here.

All the degrees are master’s degrees except one: the Bachelor of Science in Computer Science (BSc in CS) from the University of London.

The iMBA and BSc in CS seem to be Coursera’s most popular degrees, generating respectively 3,200 and 4,800 applications for its latest cohort.

Actual enrollment numbers per degree are not available, but in last year’s Coursera Partners Conference, Coursera’s CEO shared these numbers:

- 300+ students in the University of Colorado Boulder’s online master’s degree in electrical engineering.

- 2000+ students in the University of London’s online bachelor’s degree in computer science.

A Product at Every Price

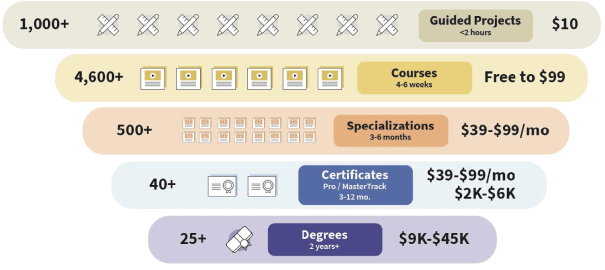

Coursera included a nice little image to showcase their catalog of products — with tiers ranging from $10 to $45k. In 2020, Coursera introduced a catalog subscription called Coursera Plus which gives access to a majority of the provider’s middle three tiers for $399 a year.

This is Coursera’s second attempt at a catalog subscription, and it seems to be paying off. According to the prospectus, there are 50,000 Coursera Plus subscribers. The prospectus also mentions that Coursera Plus is available at a monthly price, which was first reported by Class Central but so far hasn’t been rolled out to all learners.

Within a few months, we noticed that Coursera’s Guided Projects catalog rapidly went from zero to over 1,000 offerings. It looks like Coursera really wanted to push for Guided Projects in its S-1 — they are mentioned 27 times.

Guided Projects are the result of Coursera’s 2019 $10 million acquisition of Rhyme (more details below), an edtech startup based in Sofia, Bulgaria. Guided Projects are created by “subject matter experts” and cost $9.99. Since their launch in April 2020, Guided Projects have logged 2.5 million enrollments.

As I wrote in my 2020 Analysis of Coursera, at Class Central we’re not big fans of Guided Projects and even stopped listing them on our platform. We felt that a lot of these didn’t fit well alongside the university courses in our catalog (nor on Coursera’s, frankly).

Most recently (literally today!), we’ve seen Coursera doubling down on this approach with Community Guided projects — courses created by its users.

This might be a way for Coursera to compete with Udemy, the only other course provider with a scale similar to Coursera (in terms of learners). In a recent Class Central analysis of Udemy, we found that Udemy’s marketplace approach has allowed them to grow to 157k courses and 425 million enrollments.

Payment to Content Partners

| 2017 | 2018 | 2019 | 2020 | |

| Consumer Gross Profit | $43.7m | $57.6m | $64.6m | $106.5m |

| Consumer Gross Margin | 50% | 54% | 53% | 55% |

| Enterprise Gross Profit | $4.7m | $19.0m | $34.2m | $49m |

| Enterprise Gross Margin | 64% | 71% | 71% | 69% |

| Degrees Gross Profit | $2.5m | $7.4m | $15.1m | $29.9m |

| Degrees Gross Margin | 100% | 100% | 100% | 100% |

Since Coursera relies on its partners to create courses, it also shares a percentage of the sales with them. The part of the revenue it keeps is called “Gross Profit” for that particular segment. And the “Gross Margin” is the “Gross Profit” as a percentage of the segments’ revenue.

In the case of Degrees, the Gross Margin is 100% because Coursera receives a service fee per enrolled student. The degree student is not under contract with Coursera but with the university itself, who collects the revenue and pays a portion of it back to Coursera.

Based on the data, I concluded that Coursera has paid $281 million to its 200 university and industry content-creation partners since 2017 (not counting degree revenues).

The S-1 doesn’t provide a breakdown of which universities or industry partners received which revenue. But it specifically mentions Coursera co-founder Andrew Ng’s company DeepLearning.AI.

Back in 2017, almost six years after he introduced his Machine Learning class, Andrew Ng announced that he would be launching a Deep Learning Specialization. Since then, DeepLearning.AI has expanded to 45 courses and specializations.

| Revenues | |

| Total | $14.7 million |

| 2018 | $6.3 million |

| 2019 | $4.1 million |

| 2020 | $4.3 million |

In 2020, the Consumer segment provided 65% of the revenue but 57% of the gross margin. Overall, gross margin for Coursera stands at 53% in 2020, up from 51% in 2019. As the Enterprise segment revenues increase with a gross margin of 69% in 2020, this will further move the needle in Coursera’s favour.

Freemium For The Win

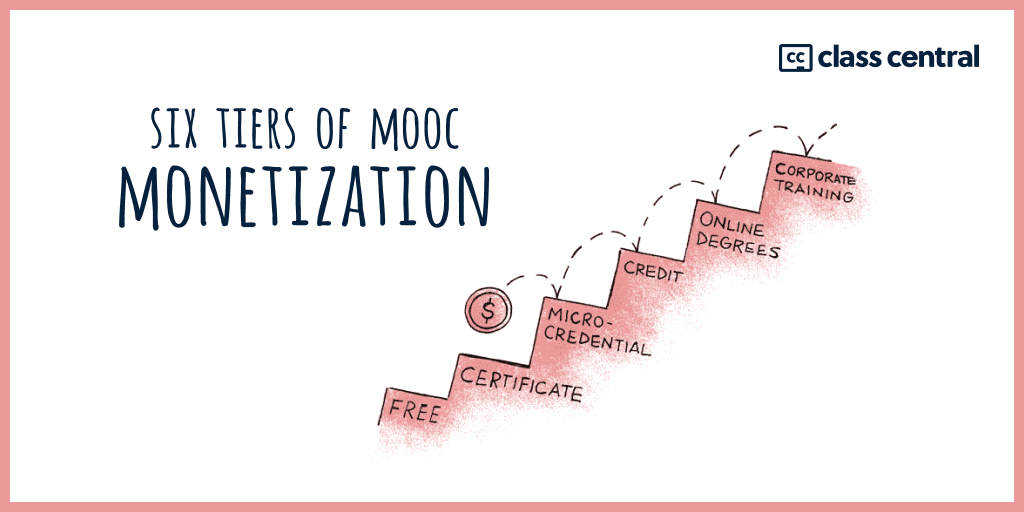

Back in 2018, I proposed a generic model to capture MOOC monetization in six different tiers. Each pricing tier adds value on the tiers below.

Essentially, the same product is being monetized at different pricing levels, with the free product acting as a marketing channel that feeds customers into other higher-priced products.

The Coursera S-1 provides plenty of evidence for the success of this freemium model. Here is what it says:

“In 2020, over 50% of our cash receipts from Consumer offerings came from individual learners who were registered on our platform as of December 31, 2019.”

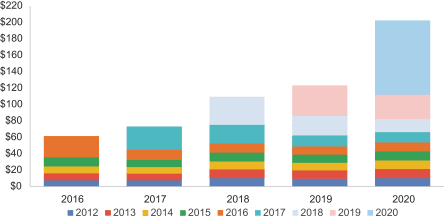

They also provide a table of revenue by cohort i.e the year a learner joined the platform. If I am reading the (blurry) graph correctly, Coursera is still earning millions of dollars of revenue every year from learners that joined the platform in 2012 (like me!).

Similarly 50% of all Degree students were previously registered Coursera learners, and 30% of leads for Coursera for Enterprise were sourced from its consumer platform.

The 30.6 million new learners that joined Coursera in 2020 will provide Coursera with revenue for years to come.

Rhyme Acquisition

Back in August 2019, Coursera acquired Rhyme, a startup dedicated to creating authoring tools for hands-on online projects. At the time, the cost of this acquisition wasn’t disclosed.

Coursera’s S-1 reveals that they purchased the company for $7.7 million — 50% in cash and 50% in stock. The company also granted the founder stock worth $1.25 million (vesting over 4 years) and $500k in joining bonus, bringing the total effective purchase price to $10 million.

Since the acquisition, Rhyme’s technology has been used for its 1000+ Guided Projects which were heavily emphasized in the prospectus.

Executive Incentive Compensation Plan

The executive incentive compensation plan disclosed by Coursera in its S-1 gives us an idea of what Coursera expected of 2020 before the pandemic hit:

- $242 million in annual revenue — achieved $293.5 million.

- $10 million in cash from new content — achieved $11 million.

- 7,000 degree learners — enrolled 7,918.

I am also wondering if “cash from new content” was one of the reasons for expanding Guided Projects so aggressively.

Risk Factors

Coursera’s S-1 details a number of risk factors: from changes in government regulation to climate change (California wildfires) to natural disasters to reputation risks due to a number of different reasons.

To bolster its reputation, on February 1st, Coursera became a Delaware public benefit corporation (PBC). It also became a Certified B Corporation™ (“B Corp”), which is not legally binding but provides a score that you can find here for Coursera.

But as a PBC, Coursera states that producing a “positive effect for society may negatively impact our financial performance”. A drop in its B Corp score is also included as a risk factor.

The Risk Factors section was over 30 pages long and I just skimmed it without going into detail because it felt that Coursera was trying to CYA.

Daphne Koller

Maybe it was common knowledge and I just missed it, but it looks like Coursera co-Founder Daphne Koller is no longer involved in the company. When she stepped down as the president of Coursera back in 2016, she assumed the role of co-chairman of the board along with her co-founder Andrew Ng.

According to her LinkedIn profile, she stopped being Coursera co-chairman in April 2019. In Coursera’s S-1, she was only mentioned once, in a letter from Andrew Ng.

Daphne is now the founder of two companies: Insitro and most recently another education startup called Engageli, which she co-founded with her husband.

Tags

P0b

I’m saddened that Coursera is going IPO as I have been a regular user since 2014 and have attained over thirty-six class completion certs. Compared to Udemy, which is my second favorite MOOC platform that I use mostly for com sci, FE web dev, Coursera has a lot more substance in terms of humanities category classes.

In my experience, whenever a business goes public, it’s never a good thing for consumers, only the top shareholders. Further, I think it’s an enormous mistake for Coursera to go IPO. I predict it will be bought out by some larger entity which will depreciate the brand substantively before it finally implodes under the shareholer demand for ever increasing profits.

Consequently, I expect Coursera to immediately decrease the number of classes offered and at the same time, jack up the price tag and then completely nixing any financial aid whatsoever (shareholders frown on anything that benefits end users or consumers, esp. the financially strapped ones.

mpj

That’s the worst case scenario, though not too far fecthed in my non- qualified personal opinion. I am sure the people who bought the shares expect benefits , which probably means raising pricing across the board.

On the other hand, no business can be sustainable indefinitely with losses. So I am afraid us customers will have to choose whether Coursera is worth to pay for, or be prepared for it to dissappear.

Maybe new ones will spring up though…

Rakesh K Meet

Quite an insightful article. Wish all these MOOC platforms scale up further and democratise education across nations..

Steven To

Amazing brief of Coursea. and now I know what Class Central is!

Evaldas

Thank you for an informative article!

Dimitris

Thank you for this very interesting article!

One short question for a point I didn’t understand that clearly (pardon my english!)

“Out of Coursera’s 77 million learners at the end of 2020, 3.2 million had paid for a course or offering, up from 2.3 million a year before.”

That means 3.2 million unique learners paid within 2020, or since 2012 (in that case 900.000 learners within 2020)?

Dhawal Shah

3.2 million cumulative, so 900,000 in 2020.

Dimitris

Thanks a lot!

Kampus Swasta Unggulan

How does the revenue generated by Coursera compare to the amount paid to partners, as indicated in the IPO filing?