2U Commences Layoffs, Recenters Strategy Around edX

2U is laying off staff to reduce payroll costs by 20% and reorganizing operations under the edX umbrella.

Yesterday, 2U announced its first round of layoffs. This is part of their plan to undertake “significant headcount reductions representing 20% of total budgeted personnel spend that will take place in Q3.”

The official 2U announcement was very vague, but some of their (ex-)employees have been posting about it on LinkedIn, and it appears part of the staff laid off belonged to the curriculum development team.

It’s unclear how many people were laid off and if edX employees were also impacted.

For the rest of my analysis, I’ll talk about the changes impacting edX, as opposed to 2U or its partners.

Strategy Shift

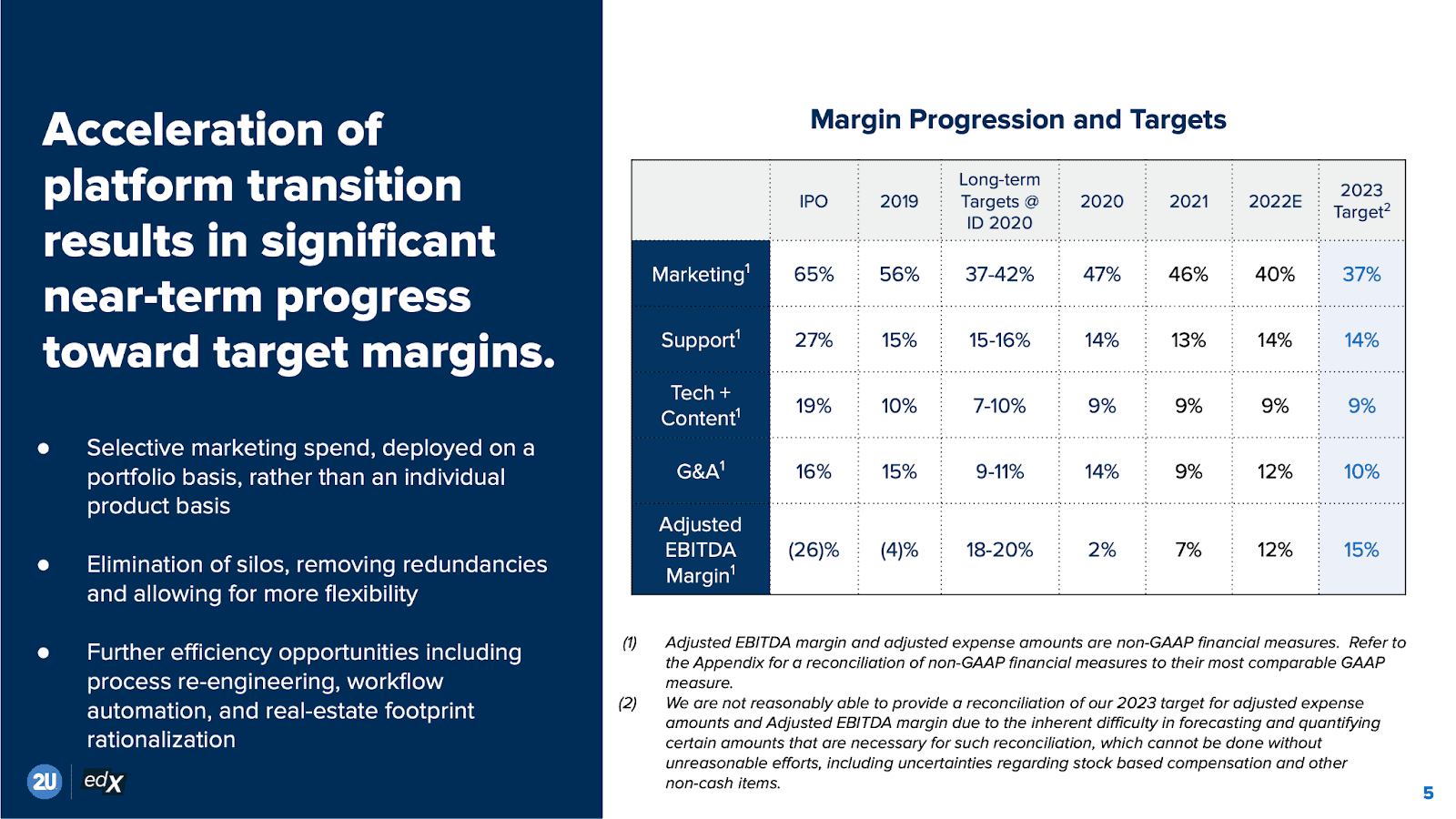

Last week, as part of 2U’s 2022 Q2 Earnings Report, the company announced a massive strategy shift that reduces revenues and expenses, but increases profitability. I read the earning’s call briefs. Here’s my summary of the new strategy:

- Reduce expenses by reducing personnel and by closing offices.

- Adopt a new marketing framework, using edX’s organic reach and moving away from paid ads.

- Lower tuition costs, leading to an increase in enrollments.

As part of this strategy, 2U will become a “platform company” by unifying all its operations under the edX brand, which 2U valued at $250 million. More on that later.

EdX Be Gone?

But the one thing that wasn’t mentioned at all were “free courses.” What’s the strategy or commitment when it comes to growing edX (or what edX used to be before the acquisition)?

To recap, last year 2U acquired edX for $800 million. In February, after the 2022 Q1 earning report, 2U stock dropped by 50%, and its market cap fell below the edX purchasing price.

When 2U acquired edX, the dominant narrative was that this combination will pose a threat to Coursera, which I was skeptical about. To quote the then edX CEO and founder Anant Agarwal:

“2U’s people, technology, and scale will expand edX’s ability to deliver on our mission and enable all learners to unlock their potential.”

Almost a year after the acquisition was announced, at Class Central, we’ve yet to see any changes that will help edX compete with Coursera. We’ve seen edX promoting 2U’s bootcamps, degrees, and executive education via edX.org, though.

According to the earnings report, in Q2 2022, edX had revenues of $10 million and operating expenses of $17.1 million. EdX contributed $7.1 million to 2U’s Alternative Credit Segment. I think this means that $2.9 million of edX’s revenue came from degrees.

In the same quarter, Coursera made ~$110 million in segments other than degrees. The gulf between Coursera and edX is huge: in terms of revenue, Coursera makes in a week what edX makes in a quarter.

In my extensive analysis of the acquisition, I noted that it was an opportunity for Coursera, because it took away edX’s ideological advantage: being a nonprofit that aligns well with many universities’ missions.

It’s unclear to me why universities would keep launching courses on edX, since they can monetize much better on Coursera. Additionally, Coursera courses are free-to-audit throughout the year, while edX has a time-based paywall on their courses.

In Q2 2022, 2U made $241.5 million, and their losses reached $62.9 million. This means that the real opportunity for 2U is optimizing these two numbers by diverting edX learners towards their expensive degrees and bootcamps, rather than them signing up for low-cost or free-to-audit edX courses.

Back when the acquisition was announced, I couldn’t see a business case for 2U to actively invest in edX to take on Coursera. And I still can’t.

One Brand to Rule Them All

A core aspect of the “platform strategy” is to “consolidate individual businesses under the edX umbrella.” When I read 2U’s annual report for 2021, I learned that they valued the edX brand at $250 million.

The former edX CEO Anant Agarwal will take on a new role as its first ever Chief Platform Officer. Previously, he was the company’s first ever Chief Open Education Officer, a job that lasted 9 months.

Currently, 2U has four brands: 2U itself, and their acquisitions, edX, GetSmarter, and Trilogy Bootcamps. Quite possibly, 2U will fold its other brands under the edX umbrella, further eroding edX’s pre-acquisition nonprofit roots, since GetSmarter and Trilogy Bootcamps are full-on for-profit businesses.

Under the new marketing framework, the Executive Education business will be impacted as it shifts away from paid spend. 2U won’t be expanding this business and “plan to make it as profitable as possible, and simply build programs off of our growing marketplace and organic presence.”

This makes me think GetSmarter is already on its way out. 2U believes the future of its Alternative Credential Segment lies in Trilogy Bootcamps. And by cutting expenses, they hope to be EBITDA positive by the end of 2023.

Mission Accomplished

Currently, a big chunk of 2U spendings go toward sales and marketing — 44% of their revenue in Q2 2022, to be exact.

The goal of this restructuring is to get this number to 37% by the end of 2023. And 2U CEO Chip Paucek is already claiming victory:

“As we make all of these changes, I’m proud to say that by year’s end we’ll have answered the question from our IPO eight years ago. Yes, you can build a sustainable education business in higher ed at scale.”

But to achieve this goal, 2U had to lower their 2022 revenue guidance from $1.07 billion at the midpoint to $960 million.

Tags

Marcus

Informative post Dhawal! One thing i determine on edX: Some few courses on edX have see massive price increases. For example, the course “An Introduction to Credit Risk Management” costs 49€ before, now they have listed this course for 195€!

For me it is the question, what is the reason for this price hike? Is more content a justification ? Or the inflation? I think, this are the first tries to make the company more profitable under the new owner 2U.

Marcus

New post from me: Not only the mentioned course in my first comment is more expensive as before. When you browse a bit through their catalogue, my impression is, there was a hidden price hike through many courses. New price is now mostly over 100$ from before 49$.

Would be great when you could do some research Dhawal wheter is this true, or not.

DL

edX is more expensive than Coursera, period. No many will be able to afford that price hike in lieu of incoming recession or economic crash!

Magee

Their bootcamp experience when I last dug into it, also did not rise to the quality of those schools who are leaders the coding bootcamp industry. They benefit from being “associated” with big name universities and what candidate students assume that means about the quality of their product but they are separate products entirely. Full disclosure: I work for one of those nation-leading bootcamps so take from my opinion what you will.