2U Market Cap Falls Below edX Acquisition Price. Google to Blame?

2U, the online education giant that acquired edX last year, just saw its stock price drop by half.

2U is no stranger to stock price collapses.

Last week, 2U announced its 2021 results and 2022 forecast. They weren’t well received. Its stock price collapsed from ~$18 a share to ~$9, resulting in a market cap of less than $700 million.

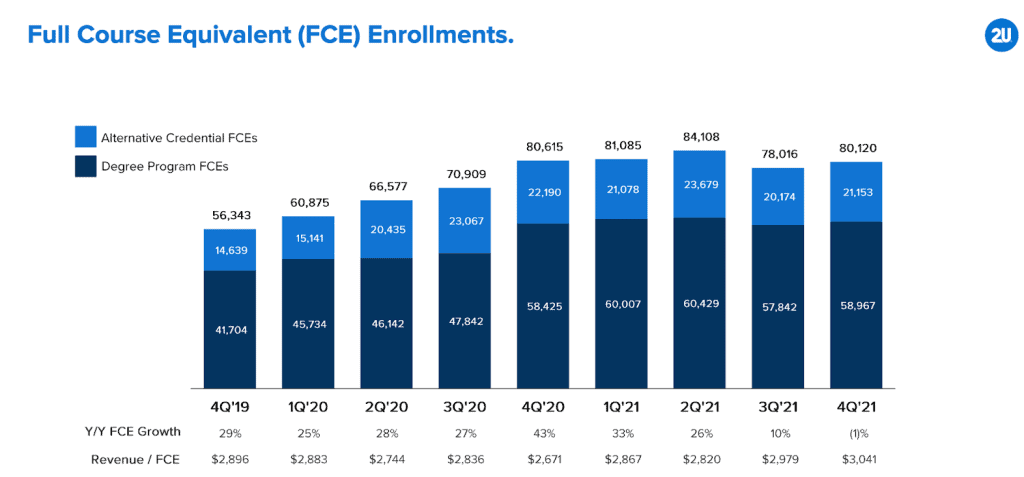

One of the potential reasons is that since Q3 2021, 2U has seen a drop in enrollments across its Degree and Alternative Credential Segments. I might have a theory on why this happened, since it’s something that impacted Class Central as well.

Before continuing, you might want to read my in-depth analysis and personal take on 2U’s acquisition of edX, 2U + edX Analysis: Win for 2U, Risk for edX, Opportunity for Coursera, as well as how edX’s 2021 went, EdX’s 2021: Year in Review.

2U Revenues Over the Years

| 2019 | 2020 | 2021 | 2022 (projected) | |

| Revenue | $574.7m | $774.5m | $945.7m | $1.05–1.09b |

| Degree Program Segment | $417.2m | $486.7m | $592.3m | |

| Alternative Credential Revenue | $157.5m | $287.8m | $353.4m | |

| Losses | $235.2m | $216.5m | $194.8m | $215– 235m |

In 2021, 2U’s revenue grew by 22% to $945.7 million. The two years prior, the revenue had grown by 35% and 40% respectively.

But its projection for 2022 is $1.07–1.09 (around 15% growth on the high end) with increasing losses.

2U has been maintaining its revenue growth rate by buying a company every two years. 2U originally started as a degree provider, but through the acquisitions of GetSmarter and Trilogy Education, it has boosted the revenue of its Alternative Credential Segment.

| edX | June 2021 | $800 million |

| Trilogy Education | April 2019 | $750 million |

| GetSmarter | May 2017 | $103 million |

The edX acquisition will add to its revenue growth, given its size, not much compared to its previous purchases. We know from edX’s tax returns that it made around $70 million in revenue in the fiscal year 2020 (not including donations).

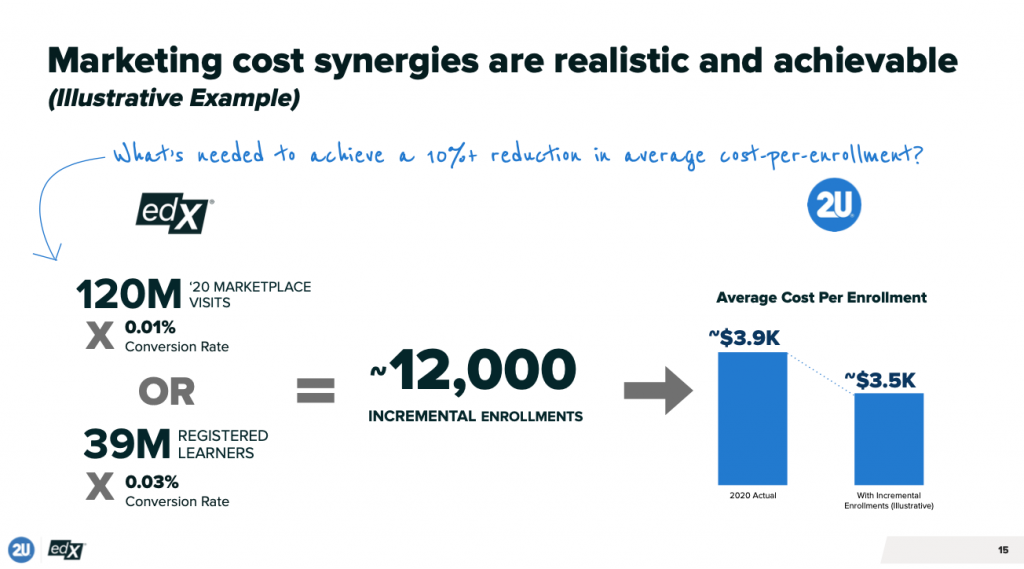

But the edX acquisition is more about reducing the overall cost-per-enrollment.

Why 2U Bought edX

In 2020, 2U spent a whopping $3.9k on average acquiring a single student. This is more than the cost of any edX program, excluding their online degrees. It’s probably a blended cost spanning their different pricing tiers:

- GetSmarter: ~$2k

- Trilogy Bootcamps: ~$10k

- Online Degrees: $25k – 70k

The higher the cost of the program, the higher the average cost of acquiring a single student.

According to 2U, the edX acquisition can reduce these costs by 10–15%, resulting in $40–$60M in annual savings. Here’s their reasoning: if 2U could convert either:

- 0.01% of edX’s 120M “marketplace visits” (I’m assuming visits to edX.org); OR

- 0.03% of edX’s 39M registered learners;

This would result in an extra 12k enrollments, reducing the mean acquisition cost from $3.9k to $3.5k.

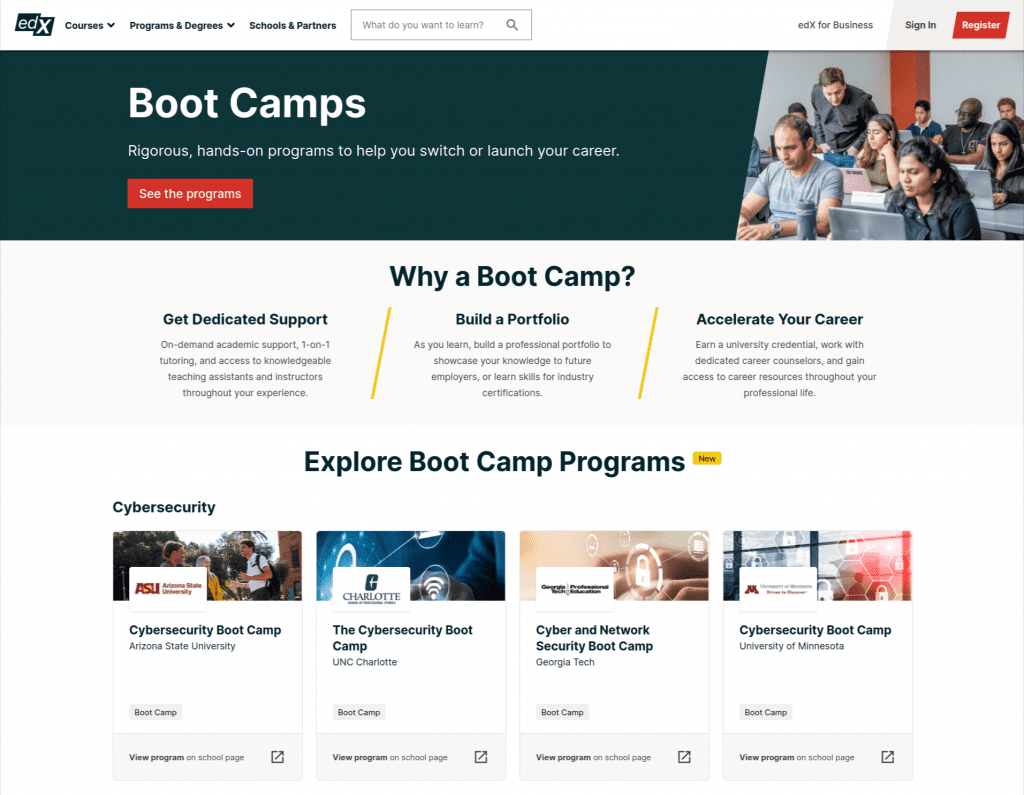

In my analysis of 2U’s acquisition of edX, I mentioned that I wouldn’t be surprised to see edX serving as a storefront for 2U programs. Recently, we’ve seen edX promoting 2U degrees, Trilogy Bootcamps, and GetSmarter Executive Education, as you can see above.

The edX acquisition was finalized in November, so we do not know yet if these integrations have reduced the cost-per-enrollment for 2U, but 2U’s future might depend on it.

This is what the 2U CFO had to say about their 2022 forecast:

“Our outlook for 2022 reflects a disciplined growth strategy and continued progress towards profitability, which is prudent given the digital marketing environment. With the addition of edX and our transition to a platform company, we have established a strategic and financial framework for achieving our mid-term goals and creating shareholder value.”

This “digital marketing environment” is why 2U was willing to fork over $800 million to acquire edX. In 2U’s presentation on the acquisition, the strengths of edX’s “marketplace” are mainly described in terms of how well edX does on Google:

- Top 5 education sites on Google

- #3 share of voice in non-branded search terms

- 75 domain authority

In online education, Google is a big factor in your cost-per-enrollment. This makes organizations like 2U especially vulnerable to algorithm changes.

Google Algorithm Changes

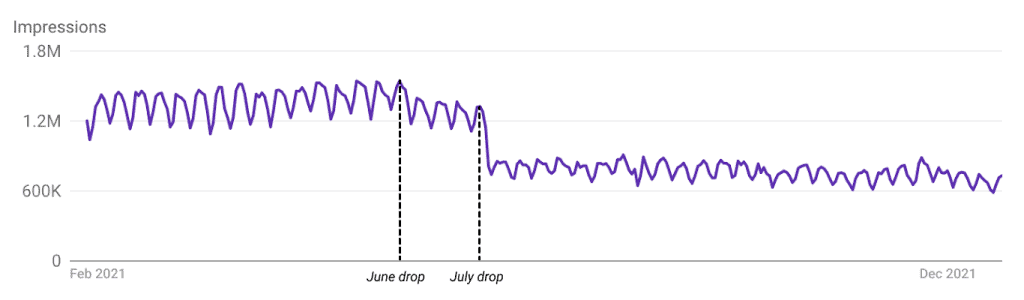

Last year, I noticed a sudden and significant drop in Class Central traffic from Google due to its algorithm changes. It happened in two phases: a smaller drop in June and a larger drop in July, as you can see above.

Basically within a one-month period, Class Central saw its traffic from Google reduced by 40+%. The decline continued, and we eventually were down >50%.

After chatting with other players in online education, I learned that the impact of Google’s algorithm update might be widespread, and it’s quite possible 2U also was impacted, leading to the sudden decline in enrollments in 2021 Q3 and Q4.

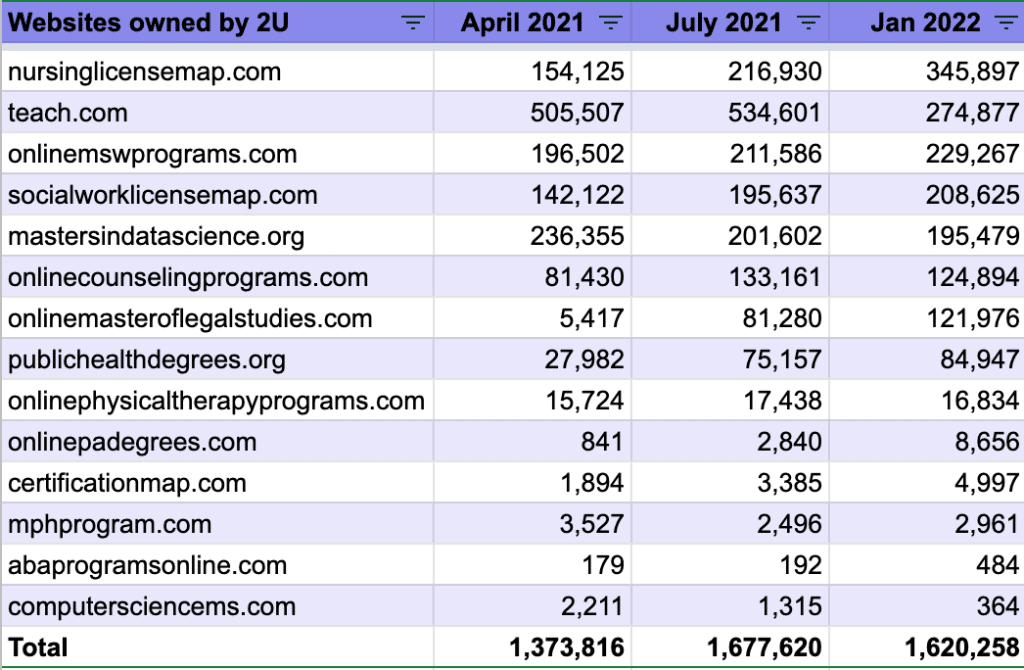

2U itself operates a number of websites that are geared towards capturing users for specific search terms on Google. Once a user lands on these websites, they are directed towards programs offered by 2U.

To get a better understanding of how it works, I wrote in detail about the online degree marketing engine in my analysis of 2U’s acquisition of edX last year. I also analyzed the SEO content strategies of top course platforms like MasterClass, Coursera, and edX.

A recent WSJ article also goes deeper into 2U and USC marketed a $100k+ online degree: USC Pushed a $115,000 Online Degree. Graduates Got Low Salaries, Huge Debts.

I found and analyzed 14 websites operated by 2U. Some benefitted from the algorithm changes, some were harmed, and some were seemingly unaffected. Overall, 2U came out slightly ahead.

2U’s 2021 marketing and sales budget was a massive $456 million. These websites represent a small part of 2U’s acquisition channels. 2U might rely on many websites and pages, including those hosted by its university partners domains, to acquire leads that can turn in enrollments.

I don’t have evidence, but Google’s algorithm changes might be one of the factors for the sudden decline in enrollments in Q3.

It might also be that after the edX acquisition, 2U decided to slow down some of its marketing expenses to reduce losses. To acquire edX, 2U took out a loan of $475 million “with attractive terms”.

The loan term is 3.5 years with “~$42 million of annual interest expense”, according to the investor presentation. This is further going to put strain on 2U’s finances and increase pressure on the edX acquisition to deliver results.

Tags