10 Best Bookkeeping Courses for 2024: Keep Track of Money

Elevate your financial skills with our curated course list for business owners, entrepreneurs, and budding bookkeepers, to guide you through financial management.

Whether you’re starting your own business, working in finance or seeking career advancement, bookkeeping is a valuable skill to have. Bookkeeping is basically keeping a record of your finances. If this is what you’re looking to learn, keep reading!

In this Best Courses Guide (BCG), I’ve carefully selected the 10 best free and paid bookkeeping online courses for you from the 150+ bookkeeping courses in our catalog by following a well-defined methodology that you can find below.

Click on the shortcuts for more details:

- Top Picks

- What is Bookkeeping?

- BCG Stats

- Why You Should Trust Us

- How We Made Our Picks and Tested Them

But if you want to jump straight to the results, here are my top 10 picks. You can click on a course to jump to the corresponding section:

What is Bookkeeping?

Bookkeeping is the practice of recording the financial information of an individual or a business, and is part of the accounting process. Day-to-day financial transactions such as revenue, taxes, interest, loans and others can be recorded and stored, and the accuracy and efficiency of documentation determines the overall financial health of the organization.

Research shows that methods of keeping accounts have existed as far back in history as 2600 BCE when Babylonians wrote records on clay slabs. However, most businesses today use computer-based methods for bookkeeping such as a simple spreadsheet or more advanced software.

Why are Bookkeeping Skills Important?

Bookkeeper salaries vary greatly by country, location, and company size. In the US, the median wage in 2022 was $45,860, and in the UK, the average salary is £26,000. In Canada, the average salary ranges from CAN$40,000 to CAN$60,000, while in Australia, it’s just under AU$70,000. In New Zealand, the average salary is NZ$45,000. Salaries may vary based on job responsibilities, experience and location.

Bookkeepers with strong technical skills, including cloud computing and automation, are in high demand and can offer additional value through data analysis.

BCG Stats

- Combined, these courses have accrued 700K enrollments

- 2 courses are free or free-to-audit and 8 courses are paid

- The most-represented course provider in the ranking is Udemy, with 6 courses

- Courses are offered via 5 different providers

- The bookkeeping subject accounts for over 150 courses in Class Central catalog.

Best Beginner-Friendly Course to Master Accounting and Bookkeeping (Udemy)

My pick for the best bookkeeping online course for beginners is Accounting & Bookkeeping Masterclass – Beginner to Advanced on Udemy.

The lessons start from the basics and move up to the preparation of financial statements and then into more complex and frequently used areas of accounting. It is suitable for beginners with no prior knowledge of accounting, and can be taken by accounting and finance students, business students, aspiring accountants, professionals, entrepreneurs, business owners, investors and startup founders.

In this course:

- Learn accounting rules and standards

- Understand different types of accounting and information produced

- Familiarize with essential terminology

- Discuss Cash and Accrual Accounting, Double-entry concept, Bookkeeping, General Ledger

- Advanced topics include Trial Balance, Financial Statements, Fixed Assets, Depreciation, Inventory Accounting, Accounting for leases

- Concepts are taught through videos, readings, quizzes

- Downloadable resources provided.

Irfan Sharif is a chartered accountant with a bachelor’s degree in commerce and 12 years experience in accounting, finance, and business intelligence. He has trained 20,000+ students from 50+ countries.

| Provider | Udemy |

| Instructor | Irfan Sharif |

| Level | Beginner |

| Workload | 14 hours |

| Enrollments | 92.7K |

| Rating | 4.6/5.0 (4.7K) |

| Certificate | Paid |

Best Short Courses for Beginners and Intermediate Learners (LinkedIn Learning)

My analysis of the best short bookkeeping online course is actually a collection of two courses offered by Jim Stice and Kay Stice on LinkedIn Learning. Concepts are taught through a combination of videos, practice exercises and quizzes.

After completing both the courses, you’ll have developed the essential skills and knowledge needed to effectively manage the financial records of a business or organization.

What you’ll learn:

Accounting Foundations: Bookkeeping

- Basics of bookkeeping and financial statement creation

- Financial statements including the balance sheet, income statement, and statement of cash flows

- Four steps in the bookkeeping process: routine bookkeeping, analyzing transactions, using accounts to categorize transactions, and exercising caution with revenues, expenses, and dividends.

Advanced Bookkeeping Techniques

- Advanced accounting strategies for managing financial entries

- Debits and credits, journal entries, adjusting entries, closing entries, and correcting errors

- Journal entries for receiving financing, buying assets, and recording revenues and expenses

- Closing entries and correcting errors.

Jim and Kay Stice are brothers who have been teaching accounting for decades, with over 70 years of experience in the classroom. They have over 30 courses in the LinkedIn Learning library.

| Provider | LinkedIn Learning |

| Instructors | Jim Stice and Kay Stice |

| Level | Beginner to intermediate |

| Workload | 2-4 hours |

| Enrollments | 252K |

| Rating | 4.8/5.0 (6.3K) |

| Certificate | Paid |

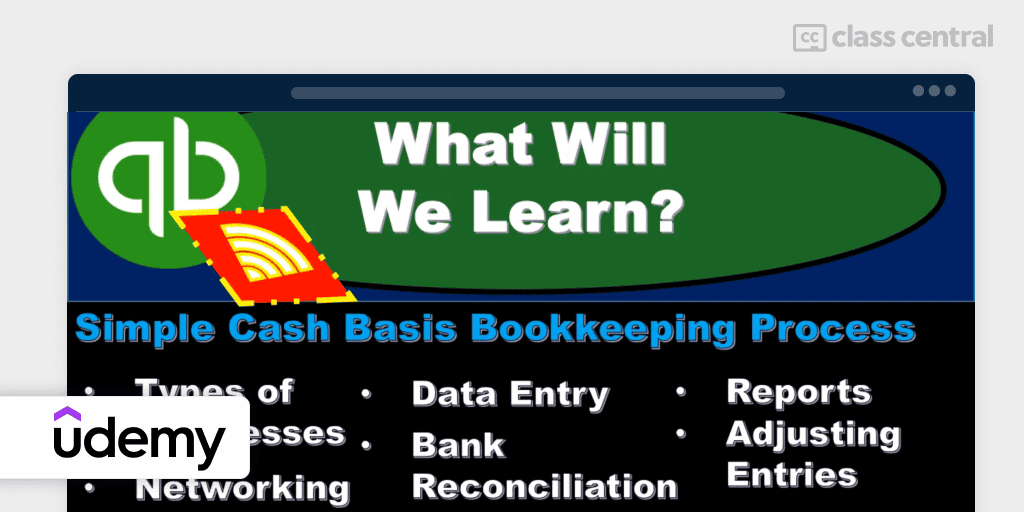

Also Great Three Course Series for Beginners and Intermediate Learners (Udemy)

Ron Trucks offers a collection of three courses on Udemy. After completing all three courses, you will have a comprehensive understanding of bookkeeping fundamentals, including debits, credits, the accounting equation, analyzing and recording transactions, as well as end-of-the-month and end-of-the-year closing entries, depreciation, prepaid items, accrued payroll, inventory and QuickBooks. Concepts are taught through a combination of videos, readings and quizzes. Downloadable resources are also provided.

Bookkeeping Basics #1: Understand the Fundamentals

- Key principles of financial management, including setting financial goals, creating a budget, managing cash flow, and understanding financial statements

- Different sources of funding, such as loans and investors, and the importance of managing risk.

Bookkeeping Basics #2: Understand The Mechanics

- Fundamental Accounting Equation, bookkeeping accounts, balancing T-accounts/ledgers, accounting cycle’s steps, interim and final financial reports, adjusting and closing activities

- How to record adjusting entries

- Why annual bookkeeping records are closed each year.

Bookkeeping Basics #3: QuickBooks™ Desktop Fundamentals

- QuickBooks, including how it records transactions, navigating the program, recording and printing checks, sales activities, deposits, vendor payments, account reconciliations, customizing reports, and creating a new company file.

- Explore the differences between QB Desktop and QB Online.

Ron Trucks founded his privately owned firm guiding and coaching small businesses and non-profit organizations over 25 years ago. He has also been a business management adjunct instructor at Jefferson College in Hillsboro, MO for over 15 years. He has served on various boards and in many volunteer positions including the Board of Directors of a $500 million credit union.

| Provider | Udemy |

| Instructor | Ron Trucks |

| Level | Beginner to intermediate |

| Workload | 11-14 hours |

| Enrollments | 39K |

| Rating | 4.7/5.0 (6.7K) |

| Certificate | Paid |

Also Great Concise Bookkeeping Basics for Beginners (Udemy)

Bookkeeping Basics Explained (Bookkeeping & Accounting) provides a thorough explanation of bookkeeping and accounting basics, covering main accounts, financial reports, and step-by-step instructions for bookkeeping and accounting. By the end of the course, you’ll have a strong understanding of the subject even if you had no prior knowledge.

In this course, you’ll learn about:

- Basics of bookkeeping: debits and credits, basic bookkeeping vocabulary, preparing a bank reconciliation, bookkeeping practice worksheets and exercises, and common bookkeeping mistakes

- Accounting software such as setting up and getting started with accounting software, and how to use QuickBooks Online to record transactions

- More advanced bookkeeping topics: preparing a balance sheet and income statement, accounts receivable and accounts payable, month-end or year-end accruals, mortgage or loan amortization, recording amortization (depreciation) of tangible capital assets, and recording term deposits, investments, dividends, and interest received from investments

- Other topics: recording a return of capital from an investment, adjusting an investment to fair market value, closing dividends into retained earnings, writing-off bad debts, and setting up an allowance for doubtful accounts

- Learn through a combination of videos, readings and quizzes, plus downloadable resources.

Calvin Lee, MBA, CPA, CA, CPA (Illinois) is an accountant, consultant, teacher, and author who has provided accounting and consulting services to large Fortune 500 companies. He is a top ranked instructor at Schulich School of Business, York University.

| Provider | Udemy |

| Instructor | Calvin Lee |

| Level | Beginner |

| Workload | 4-5 hours |

| Enrollments | 18.9K |

| Rating | 4.7/5.0 (2.1K) |

| Certificate | Paid |

Best Course for Beginners with Basic Knowledge of Accounting (Udemy)

Graduates and inexperienced professionals who want to boost accounting and bookkeeping skills and enhance career prospects will get a lot out of Effective Bookkeeping and Payroll. You’ll have the ability to handle office accounting, bookkeeping, and payroll management duties efficiently. A basic knowledge of accounting fundamentals is highly recommended.

What you’ll learn:

- Generally accepted accounting principles (GAAP) and how to implement internal controls

- How to maintain subsidiary ledgers and special journals, reconcile accounts, and correct wrong amounts and wrong accounts by reverse entries

- Perform sales tax calculations and set up a yearly budgeting plan

- Understanding accounting for merchandising, performing accounting for cash, and managing a payroll system

- Learn through a combination of videos, quizzes and downloadable resources.

Schmidt is a certified public accountant (CPA) who taught in college for 5 years, but most of her experience has been as a controller at a Fortune 500 company.

| Provider | Udemy |

| Instructor | Sue Schmidt |

| Level | Beginner |

| Workload | 14 hours |

| Enrollments | 7.1K |

| Rating | 4.6/5.0 (1.4K) |

| Certificate | Paid |

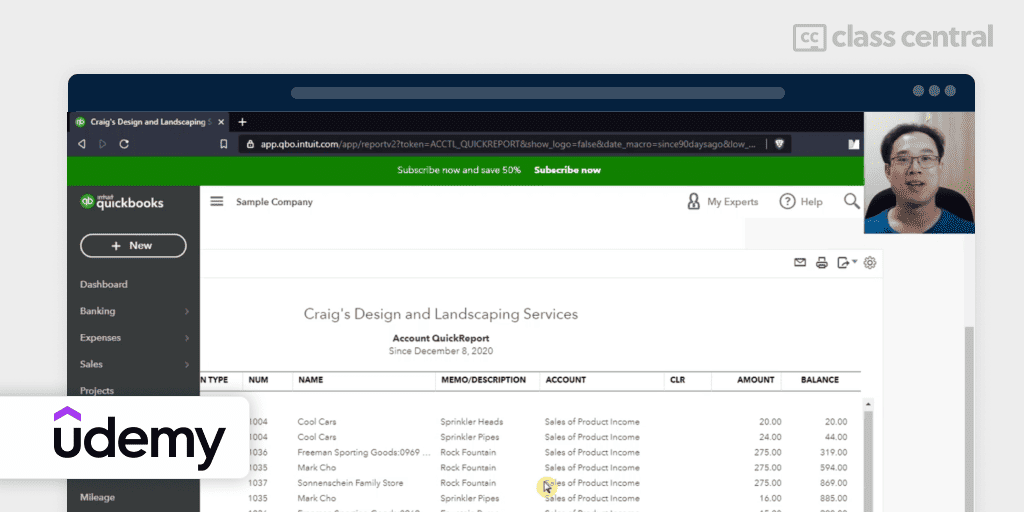

Best Beginner-Friendly Course Focused on QuickBooks Online (Udemy)

QuickBooks Online-Bookkeeping Business-Easy Way will teach you how to create a business plan for bookkeeping using QuickBooks Online. By the end of the course, you’ll have a solid understanding of all necessary concepts, apply this knowledge to real-world situations and confidently offer bookkeeping services to clients.

In this course:

- Learn about the relationship between the bookkeeper, the business, and year-end tax and financial statement preparers

- Practice entering data directly into the QuickBooks register from a bank statement, compare and contrast the cash basis system to a full accounting cycle system, and perform bank reconciliations

- Learn about options for entering specific accounting data into QuickBooks, and how to write down and organize financial data to quickly go back to it when questions arise

- Discuss and export month-end and year-end reports, and year-end adjusting entries, including common adjusting entries and different options to enter them into the QuickBooks system

- Learn through a combination of videos, readings and downloadable resources.

Bob Steele has experience working as a practicing Certified Public Accountant (CPA), an accounting and business instructor, and curriculum developer. He has a master of science in taxation from Golden Gate University and a bachelor’s degree in business economics from the University of California Santa Barbara. He has also helped create an accounting website at accountinginstruction, and a YouTube channel called Accounting Instruction, Help, and How Too.

| Provider | Udemy |

| Instructor | Robert (Bob) Steele |

| Level | Beginner |

| Workload | 14 hours |

| Enrollments | 37.5K |

| Rating | 4.8/5.0 (403) |

| Certificate | Paid |

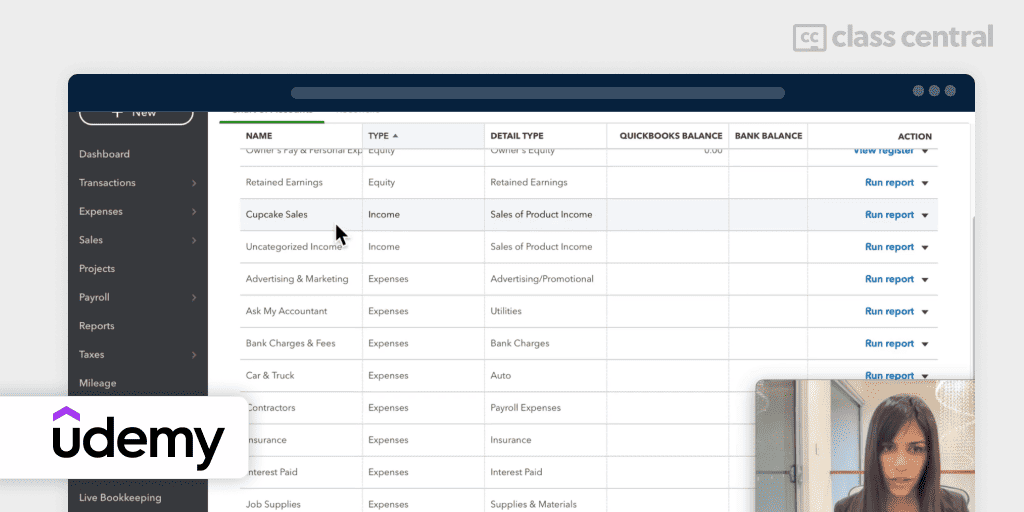

Best Short Course for Quickbooks Online Beginners (Udemy)

Quickbooks Online in 90 Mins – For Bookkeeping & Accounting is designed to teach you the basics of Quickbooks Online, one of the most popular accounting software for small businesses, step by step in just 90 minutes. It is ideal for individuals who want to learn the fundamentals of Quickbooks Online quickly and efficiently such as business owners, accounting students and accountants/bookkeepers. This course is designed for beginners, so no prior knowledge of bookkeeping or Quickbooks Online is required.

What you’ll learn:

- Fundamentals of QuickBooks Online: setting up your file and navigating the software with ease, record income and expenses, create customer and supplier invoices, and generate profit and loss statements and other reports

- Receive a bonus best practices guide to help you make the most of the software

- Concepts are taught through a combination of videos, quizzes and downloadable resources.

Shweta Nandlal is a qualified CA and CPA and has been responsible for a client portfolio worth over $50 million as a manager in one of the top 5 accounting firms in the world. She has been immersed in every aspect of accounting for the past 10 years and communicates her vast knowledge through simple language, clear examples and stories.

| Provider | Udemy |

| Instructor | Shweta Nandlal |

| Level | Beginner |

| Workload | 1-2 hours |

| Enrollments | 4.8K |

| Rating | 4.8/5.0 (452) |

| Certificate | Paid |

Best Course for Beginners from the Developers of Quickbooks (Intuit Professional Development)

Bookkeeping Basics will teach you all about the role of a bookkeeper and the essential accounting concepts needed to read and create financial statements. After completing this free-to-audit course, you will be able to define accounting, summarize the double entry accounting method and explain the ethical and social responsibilities of bookkeepers in maintaining financial integrity. This course is suitable for anyone interested in bookkeeping, regardless of previous experience. It is part of the Intuit Academy Bookkeeping Professional Certificate course.

What you’ll learn:

- Basics of accounting: introduction to the role of a bookkeeper and the accounting equation

- How bookkeepers use the general journal and general ledger to record and keep track of business transactions

- Create trial balances and produce financial statements using accounting software

- Delve into accounting principles and practices, including key assumptions and principles and different types of accounting methods bookkeepers use

- You’ll gain a solid understanding of accounting concepts and measurement, the accounting cycle, and accounting principles and practices.

| Institution | Intuit Professional Development |

| Provider | Coursera |

| Level | Beginner |

| Workload | 16 hours |

| Enrollments | 156.3K |

| Rating | 4.6/5.0 (4.3K) |

| Certificate | Paid |

Best Course for Crafters to Learn the Fundamentals of Managing Finances (CreativeLive)

If you’re a crafter setting up your own business, Bookkeeping for Crafters will teach you the fundamentals of managing finances and how it can benefit your business. You’ll learn how to manage income and expenses, prepare for tax time and predict cash flow fluctuations. The instructor will guide you in developing a personalized system, even if you prefer pen and paper over spreadsheets. This course will give you the confidence and skills you need to start and maintain your own small business ledger.

In this course, you’ll learn:

- Basics of bookkeeping and how it applies to your business

- Why bookkeeping is important, how to set up a chart of accounts, and the difference between cash and accrual accounting

- Track inventory, expenses, and receipts, and learn how to keep your business and personal finances separate

- Other topics include labor and insurance, sales tax, product profitability, budgeting, and cash flow forecasting

- Pricing formulas, the importance of pricing, and when to reinvest or take money out of your business

- Personal finance and how to calculate your sustainable wage.

Lauren Venell is an artist, award-winning product designer and financial educator who gives online classes, participates in live events and contributes to blogs such as design*sponge and craftzine. Her creative work has been published by imprints such as Chronicle Books, Klutz/Scholastic and Quarry, and featured in media outlets including The New York Times, The San Francisco Chronicle, Everyday with Rachel Ray and on Canal+ television.

| Provider | CreativeLive |

| Instructor | Lauren Venell |

| Level | Beginner |

| Workload | 9-10 hours |

| Enrollments | 8.7K |

| Rating | 100% |

| Certificate | Paid |

Best Courses to Prepare for ACCA Exam (ACCA)

Two free courses offered by ACCA on edX will help you start a career in business, finance or accountancy, study business or finance, launch your own start-up, and prepare for the ACCA exams in Recording Financial Transactions (FA1) and Maintaining Financial Records (FA2).

What you’ll learn:

- Business transactions and documentation, including the duality of transactions and the double entry system, the banking process and transactions, payroll, ledger accounts, sales and purchases credit transactions, reconciliations, and the trial balance.

- Generally accepted accounting principles and concepts, the principles and process of bookkeeping, preparing journal entries, recording transactions and events, extending the trial balance, and accounting for partnerships

- Preparing the trial balance and correcting errors.

Intuit, founded in 1983 by Scott Cook and Tom Proulx, is the company behind QuickBooks Online.

| Institution | ACCA |

| Provider | edX |

| Instructor | Isobel Wroath, James Patrick, Krutika Adatia |

| Level | Beginner to intermediate |

| Workload | 60-80 hours |

| Enrollments | 179K |

| Rating | 5.0/5.0 |

| Certificate | Not available |

Additional Tools and Resources: Free Software and Learning Materials

To complement the courses, we understand the importance of having the right tools at your disposal (and free whenever possible). We’ve created a list of free resources and software alternatives to further enhance your bookkeeping journey if you’re a small business owner, a freelancer, or just stepping into the world of finance.

- GnuCash: Ideal for very small businesses or freelancers comfortable with manual data entry and seeking a desktop solution. GnuCash is open-source, allowing for customization by those with coding knowledge. It provides comprehensive documentation. However, for those looking for more automation and cloud-based solutions, Wave or Zoho Books might be a more fitting choice.

- Wave: Best suited for micro businesses, contractors, and service-based businesses operating on a budget. Wave’s platform is user-friendly, offering basic financial management features like income and expense tracking. While it comes with free plans, limitations exist compared to more scalable software. Wave also offers educational resources to help with financial organization and understanding IRS forms.

- Zoho Books: A great option for small businesses already integrated into the Zoho ecosystem. This affordable, cloud-based software automates workflows and offers invoicing and inventory management features. However, its scalability is limited by user caps and few third-party integrations. Zoho Books also provides guides on a range of topics for comprehensive learning.

Why You Should Trust Us

Class Central, a Tripadvisor for online education, has helped 60 million learners find their next course. We’ve been combing through online education for more than a decade to aggregate a catalog of 200,000 online courses and 200,000 reviews written by our users. And we’re online learners ourselves: combined, the Class Central team has completed over 400 online courses, including online degrees.

I (Archisha) am a Guided Project Instructor and a Beta Tester at Coursera, having tested many courses before they’re officially launched. I have taken over 50 online courses in various subjects. I used my experience as an online learner and teacher to evaluate each course in this list.

How We Made Our Picks and Tested Them

Trying to find “the best” can be daunting, even for those of us who live and breathe online courses. Here’s how I approached this task.

First, I combed through Class Central’s Catalog and the internet to find a variety of free and paid open courses, some with certificates. You don’t need to enroll in a university to learn about bookkeeping.

When choosing courses, I considered the following factors:

- Renowned Institutions: I looked for recognized institutions in bookkeeping

- Instructor experience: I sought instructors with extensive experience in bookkeeping and engaging presentation styles

- Popularity: I checked numbers of enrollments and views to find popular courses

- Course content: I examined courses that covered a range of topics and presentation styles, including the basics and more advanced topics

- Learner reviews: I read learner reviews on Class Central, Reddit, and course providers to understand what other learners thought about each course and combined it with my own experience as a learner.

Then, I defined the scope for these recommendations. I chose top courses from a range of sub-fields.

Ultimately, I used a combination of data and my own judgment to make these picks. I’m confident these recommendations will be a reliable way to learn bookkeeping.

Pat revised the research and the latest version of this article.

Jim

@Archisha Quickbooks is the dominant software for bookkeeping, especially for larger businesses. But it’s not free, unlike some of the courses that you’ve ranked. So a free course isn’t truly “free” if its prerequisite software isn’t free.

I’m not arguing to exclude the dominant software in your ranking. I’m just suggesting to include a course that teaches free software, if available as an alternative. Although free software doesn’t have as many features as commercial software, the free software is adequate for basic uses and will improve if open sourced.

Quickbooks does have online competitors that offer a free edition (which can be upgraded with a paid subscription). I’m unsure that those online competitors have attracted a user base that’s large enough yet to support a MOOC. However, those online competitors do offer their own training (though may not be well structured) which is truly free because the prerequisite is also free.

Fabio Dantas

Hi Jim, thanks to your suggestions we will be adding the following resources to this guide:

1. GnuCash: Ideal for very small businesses or freelancers comfortable with manual data entry and seeking a desktop solution. GnuCash is open-source, allowing for customization by those with coding knowledge. It provides comprehensive documentation. However, for those looking for more automation and cloud-based solutions, Wave or Zoho Books might be a more fitting choice.

2. Wave: Best suited for micro businesses, contractors, and service-based businesses operating on a budget. Wave’s platform is user-friendly, offering basic financial management features like income and expense tracking. While it comes with free plans, limitations exist compared to more scalable software. Wave also offers educational resources to help with financial organization and understanding IRS forms.

3. Zoho Books: A great option for small businesses already integrated into the Zoho ecosystem. This affordable, cloud-based software automates workflows and offers invoicing and inventory management features. However, its scalability is limited by user caps and few third-party integrations. Zoho Books also provides guides on a range of topics for comprehensive learning.