2022 Year in Review: The “New Normal” that Wasn’t

The pandemic ushered in a “new normal” in online learning, but it culminated in layoffs and stock drops.

The 2012 MOOC Hype provided a major boost to the online learning business.

It led to FOMO among universities, entrepreneurs (I’m one of them), and venture capitalists. Money poured in, rapidly leading to the creation of a number of online startups (and eventually, to TikTok).

The startups that survived till 2020, including Class Central, gained a second wind with the COVID-19 pandemic. It led to huge funding rounds. Some companies went public, while others got acquired.

But it also seems that many (if not all) overestimated the “new normal.” In 2022, big online learning providers underwent layoffs. And as we enter 2023, we are left with only one major independent MOOC provider.

Online learning is stronger than ever (Class Central ended 2022 with 100% year-over-year growth), but VC-funded online learning companies are struggling to match their lofty valuations.

The “New Normal” that Wasn’t

The real reason online learning received a boost in 2020 was because due to quarantine measures, millions of people around the world had time and energy. The energy quickly dissipated as the quarantine measures dragged on, and as things started opening up again, time dissipated too.

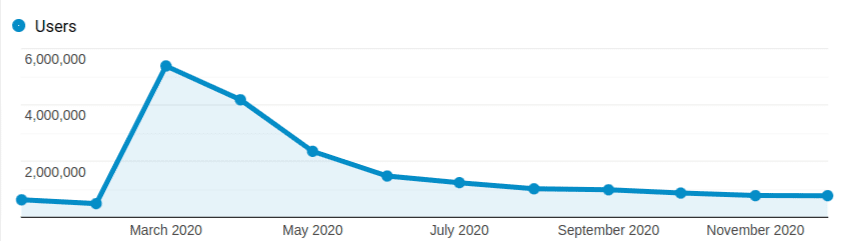

We experienced this first-hand. Of all the people who used Class Central from its inception in 2011 to the end of 2020, 40% (18+ million) did so for the first time in 2020 alone.

But as you can see above, the peak lasted only a few months. Things quickly went back to “normal.” But the “new normal” was higher than before the pandemic.

And how high this was depended on the platform’s catalog and their pandemic response. Like the 2012 MOOC Hype, the pandemic created FOMO and opportunities that some companies were able to capitalize on. Here’s what I wrote in my 2020 year in review titled The Second Year of the MOOC:

“[The pandemic boost] allowed them (online course platforms) to skip forward: they’re now where they would have expected to be two years down the road, in the absence of a pandemic.”

The real impact of the pandemic was free marketing and the influx of new learners. The constraints of time and energy are barriers that online learning platforms still haven’t figured out.

Intoxicated (or deluded) by this idea of a “new normal,” many online learning companies raised a lot of venture capital and rapidly expanded headcount, expecting growth to continue.

But this proved shortsighted, because while the pandemic shone a spotlight on online education, it also prompted a global economic downturn, accompanied by shrinking venture capital. As a result, online platforms turned their focus to sustainability and cost-cutting, leading to a slew of layoffs.

Note

Usually for the end of the year analysis, we do a multiple-article series focused on “MOOCs”, including our popular “MOOCs by The Numbers” (here’s the 2021 edition). But this year, we’re trying something new. There are two reasons for it.

- Class Central has grown. In the last two years, we’ve expanded our catalog beyond what we call “MOOCs” and now list 100,000+ courses. We’d like to do the same for our reporting: cover the entire online learning ecosystem (specifically, the adult learning subset).

- MOOCs aren’t just MOOCs. Coursera remains the only independent player, while its two nearest competitors have been absorbed into “non-MOOC” ecosystems. Even before this, for years, I felt like I was sticking to an arbitrary definition of “MOOC,” forcefully splitting courses and platforms into MOOCs and non-MOOCs.

This is our first time going beyond what we call MOOCs, so we definitely won’t be as thorough as we were in past years. Let us know your thoughts through comments, tweets, or email.

2022 Layoffs

Here’s a compilation of all the layoffs that we know have occurred in 2022 in online learning. For this list we focused on companies that catered to adult learners.

- 2U/edX: In August, 2U announced layoffs that aimed to reduce payroll costs by 20%.

- Coursera: The layoffs were announced in November by Coursera’s CEO, after a year marked by a 50% stock drop. The number of employees affected wasn’t mentioned.

- Udacity: In October, Udacity laid off 55 employees. In addition, Udacity CEO Gabe Dalporto left the company, and Udacity founder Sebastian Thrun took over the reins as Executive Chairman. As far as Class Central knows, this is the fifth time Udacity has cut staff.

- MasterClass: In June, MasterClass cut 20% of their 600-people workforce to achieve “self sustainability.” But Class Central reported about another round of layoffs: “they were laid off with the majority of the content team.”

- Pluralsight: Two weeks before Christmas, the Utah-based company Pluralsight laid off 400 employees. This represents 20% of its global workforce.

- FutureLearn: Just before it announced its acquisition by GUS, FutureLearn conducted a round of layoffs in late November.

- BloomTech: Previously known as Lambda School, BloomTech cut half of its workforce (about 88 employees were impacted). This is the company’s third round of layoffs.

- Skillshare: In June, Skillshare laid off 31 employees.

- Section4: In May, TechCrunch reported that Section4, an upskilling startup launched by prominent NYU professor Scott Galloway, laid off a quarter of its staff.

- FrontRow: FrontRow, a MasterClass clone from India, has lost 75% of its employees in 2022, over two rounds of layoffs. The startup had raised $17 million in total.

- Teachable: In October, Teachable laid off 19 employees according to a Medium post by General Manager Mark Haseltine, who previously was edX’s CTO and CPO.

- Eruditus: India-based Eruditus Group, valued over at $3.2 billion, laid off 50% of their talent acquisition team.

- Thinkific: Canada-based Thinkific which provides a self-serve platform for creators to offer and monetize online courses, laid off 100 employees or about 20% of their staff.

- Reforge: Months after announcing a $60 million Series B round, the CEO announced layoffs on LinkedIn.

- Domestika: The Spanish version of Udemy with a focus of courses for creatives, laid off 150 people.

Valuation Drops

| Market Cap | Change | |

| Coursera | $1.7B | (-54%) |

| Udemy | $1.5B | (-45%) |

| 2U | $480M | (-72%) |

| Skillsoft | $205M | (-86%) |

| Duolingo | $2.9B | (-32%) |

The “markets” have not been kind to online education companies. Companies like Udemy and Coursera that went public in 2021, have seen their stock price constantly decline since their IPO. 2022 was no different, with Coursera’s stock price dropping by 54% and Udemy by 45%.

2U, which acquired edX in mid-2021, has seen its stock price drop since the acquisition from around $40 to $6 per share. Its market cap has dropped well below the $800 million that it paid for edX.

It’d be fair to expect the valuation of private companies like MasterClass or Skillshare, that raised huge funding rounds in 2020 and 2021, to drop similarly or even more sharply. We can see this in Coursera’s case.

Coursera’s last funding round before going public entailed $130 million at a $2.5 billion valuation in July 2020. If we compare Coursera’s Q2 2020 to Q2 2022, we can see that total revenue increased by 70% while B2B revenue grew by 160%. So overall Coursera did well in terms of revenue and was able to break into the lucrative B2B business.

But in terms of market cap, it stands at $1.7 billion, 30% lower than during its last private round. MasterClass tripled its valuation to $2.75 billion when it announced that it’d raised $225 million in May 2021. In 2022, the company went through multiple rounds of layoffs.

I would expect MasterClass’ current valuation (and that of other private online education companies) to be significantly lower than during their last funding round.

Acquisitions

Since the pandemic, the number of independent online learning companies has been dropping slowly.

In 2021, we wrote about the shocking collapse of Treehouse, one of the oldest online learning companies. Due to mismanagement by the leadership, it had to lay off 90% of its employees. Treehouse eventually got acquired by Xenon Partners.

At the end of 2021, we saw another old player, Codecademy, get acquired by Skillsoft for $525 million in cash and stock. Codecademy predates MOOC players by just a few months. Codecademy made $42 million in 2021. Since the acquisition, Skillsoft’s stock price has cratered. Now, its market cap is just above $200 million.

2021 also saw Pluralsight acquire A Cloud Guru (reportedly for $2 billion) and 2U acquire edX for $800 million. Pluralsight, which had gone public in 2018, went private again at the end of 2020 after being acquired by Vista Equity Partners for $3.5 billion.

Just a few weeks ago, we learned that FutureLearn was acquired by Global University Systems (GUS). This occurred a week after FutureLearn conducted layoffs. The writing was on the wall when we learned that the company needed another £15M to survive FY2022.

Big Tech Tries and Fails at Online Learning

Early this year, Class Central wrote about Facebook and Amazon’s foray into online learning. And as I was doing research to write this section, I learned that both these projects had been shelved.

In the case of Facebook, it was a platform for live courses, while for Amazon, it was more of a marketplace for on-demand courses, like Udemy.

Just a couple of weeks ago, Google announced “Courses”, an LMS that will be available on YouTube in India:

“The company added that it will work on a revenue-sharing model with the creators, who will now be able to provide viewers with supplemental materials such as documents, images, PDFs and more. Monetisation will be similar to what YouTube does with other content creators, a 45-55 revenue sharing.”

Many of India’s edtech giants have relied heavily on YouTube to get started and market their products.

Platforms Report

Coursera’s 2022

| Revenue | 2019 | 2020 | 2021 | 2022 (till Q3) |

| Total | $184.4m | $293.5m | $415.3m | $381.6m |

| Consumer | $121m | $193m | $246.2m | $215.8m |

| Enterprise | $48.2m | $70.8m | $120.4m | $130.7m |

| Degrees | $15.1m | $29.9m | $48.7m | $35.0m |

| Net Loss | ($46.8m) | ($66.8m) | ($145.2m) | ($123.6m) |

2022 was Coursera’s first full year as a public company, and it saw the company’s valuation cut in half to $1.7 billion. Coursera is on track to cross well over half a billion dollars in revenue for 2022, and it’s expected to see its registered learner base reach almost 120 million.

By the end of Q3 2022, Coursera had reached 113 million total registered learners. The number of courses on the platform grew from 8,250 to 10,300.

| 2019 | 2020 | 2021 | 2022 | |

| Employees | 450+ | 600+ | 1,138 | NA |

| Revenue | $184.4m | $293.5m | $415.3m | $517–521m |

| Courses | 3,800 | 5,540 | 8,2501 | 10,3002 |

| Specializations | 400 | 570 | 820 | 10004 |

| Degrees | 16 | 25 | 34 | 39 |

| Learners | 45m | 76m | 97m | 118m3 |

[1] 6000 courses with 2250 Guided Projects from Coursera Project Network

[2] 6565 courses with 3740 Guided Projects from Coursera Project Network

[3] Estimated based on adding 5 million learners per quarter

[4] Including translations

While analyzing Coursera’s 2021 annual report (or 10-k), a couple of stats stood out to me:

- About 32% of Coursera’s revenue came from the courses and programs of 5 partners.

- About 66% of their consumer revenue came from learners registered before 2021.

In 2022, Coursera suffered a couple of setbacks which led to its stock to drop by 20% when it announced its second quarter results.

First, in 2022 Q2, Coursera’s degree revenue dropped to $11.4 million, compared to $13.3 million the prior quarter, and by 4% compared to the prior year. This happened despite the actual number of degree students increasing.

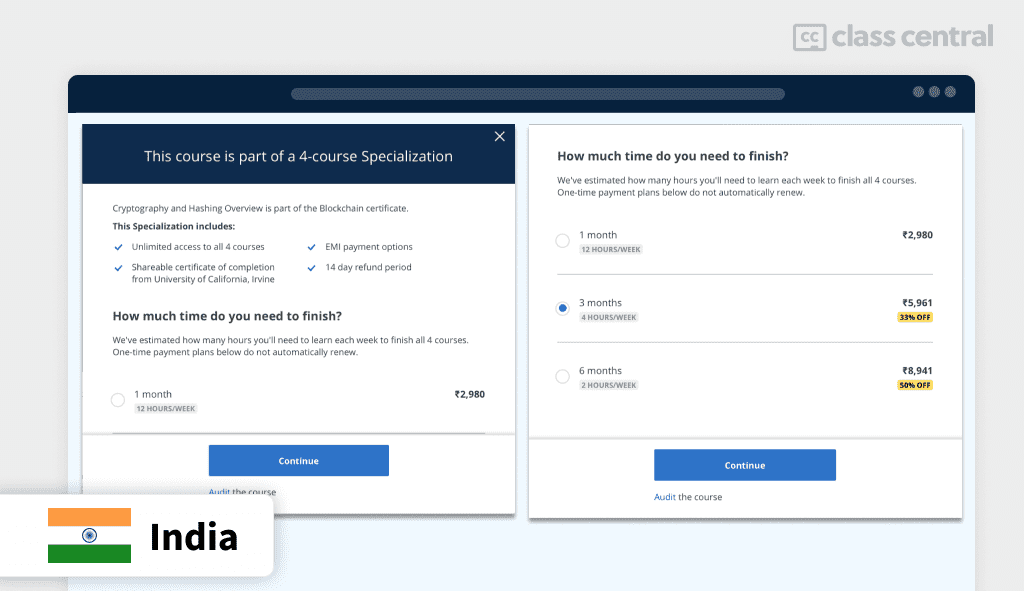

Second, Coursera’s revenue growth was lower than anticipated due to “several pricing and payment-related tests in markets around the globe that resulted in a negative impact on Consumer revenue.” The test which Class Central first reported was introduced in response to changes in credit card rules in India. The company introduced a one-time payment option for subscriptions.

Possibly in response to declining stock prices, Coursera conducted layoffs to “slow our rate of spending”.

Finally, Coursera sunsetted the world’s most popular online course. The machine learning course by Coursera co-founder Andrew Ng has been replaced by a toned-down specialization.

For our previous years’ analyses of Coursera, follow the links:

Udemy’s 2022

| 2019 | 2020 | 2021 | 2022 (till Q3) | |

| Total | $276.3m | $429.9m | $515.7m | $463.7m |

| Consumer | $225.5m | $326.4m | $328.7m | $240.4m |

| Business | $50.9m | $103.4m | $187.0m | $223.4m |

| Net Loss | ($69.7m) | ($77.6m) | ($80.03m) | ($101.7) |

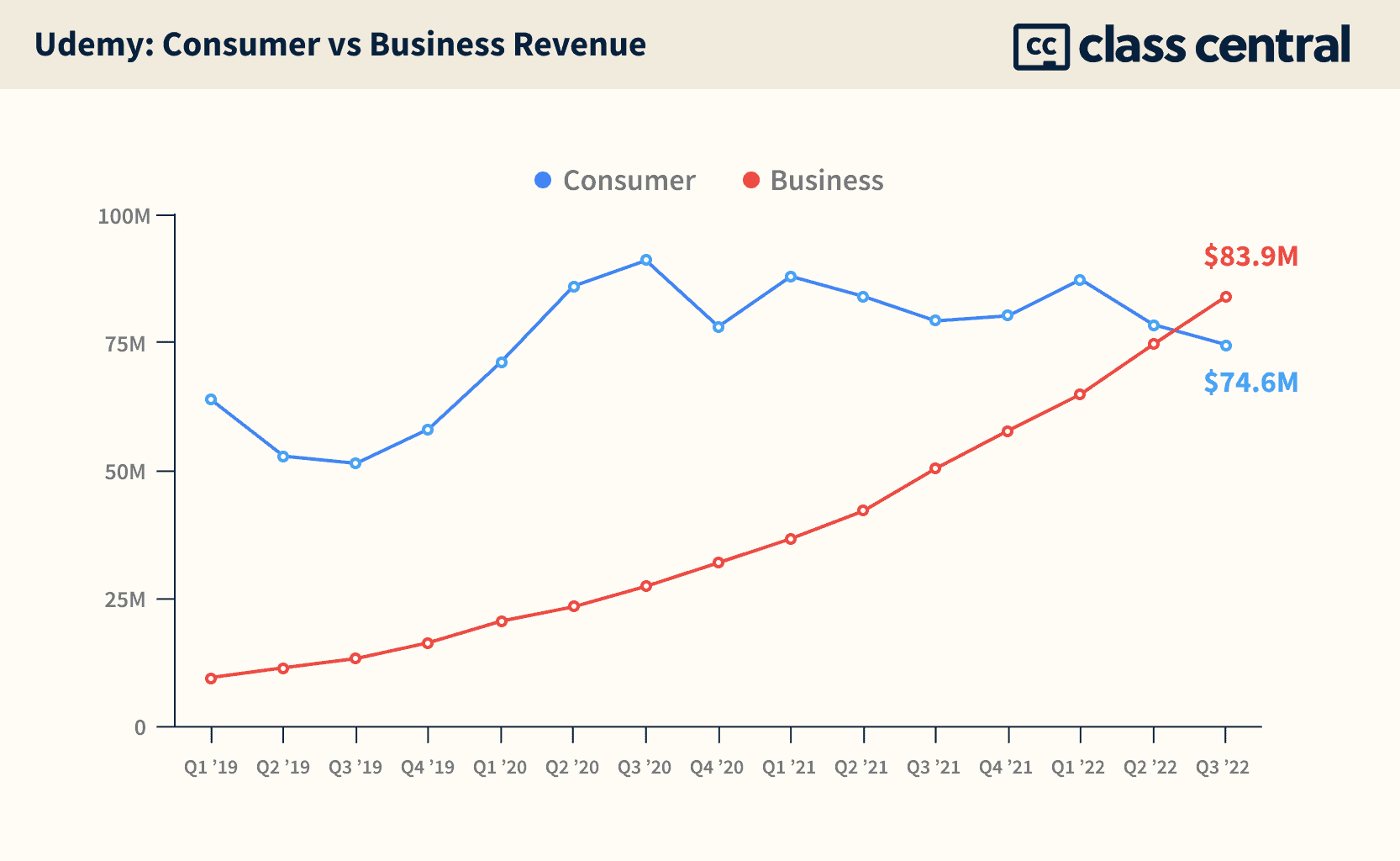

Like many other online education companies, Udemy saw its stock price collapse in 2022 — by 45%.

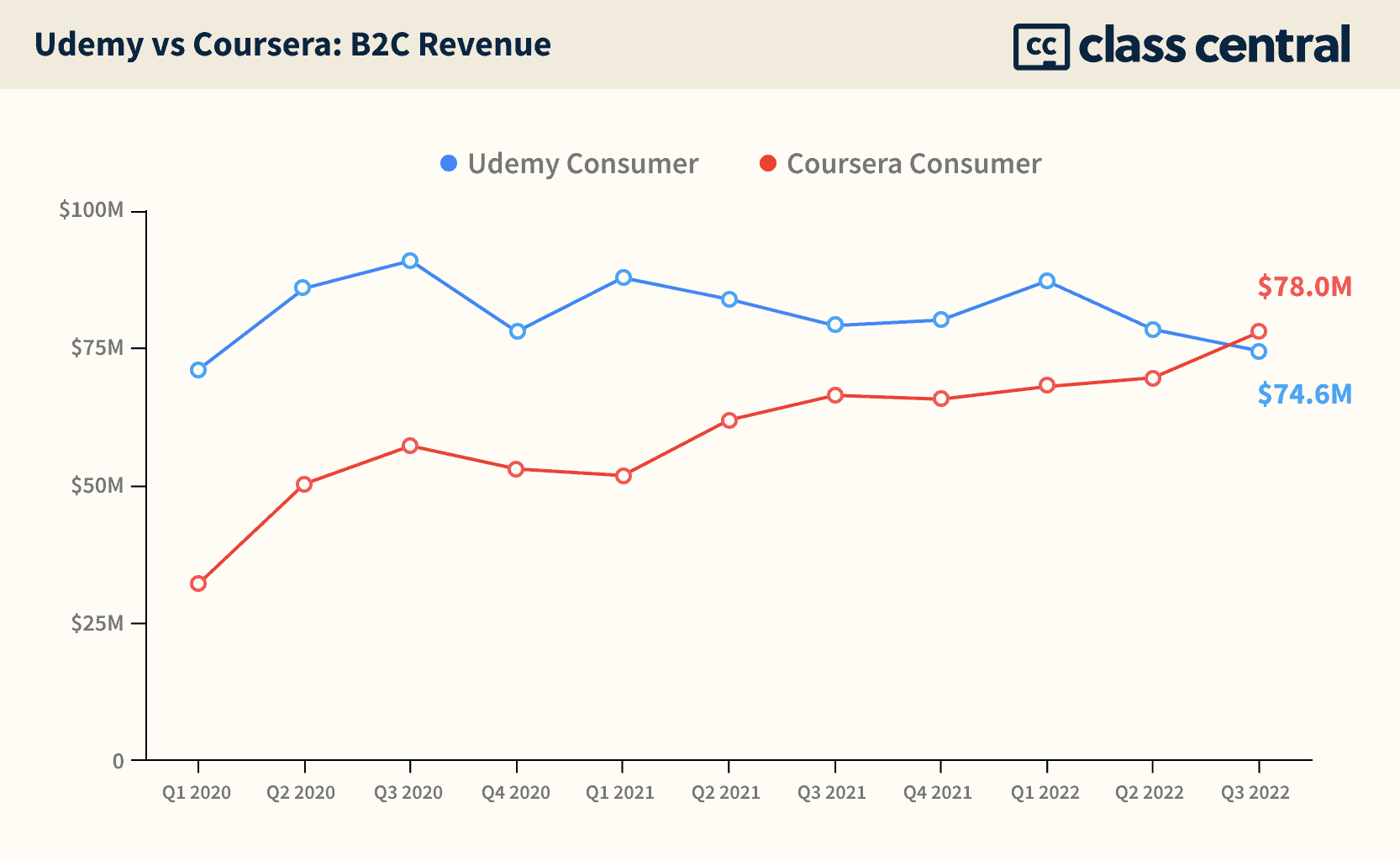

When I analyzed Udemy’s 10-k or annual report for 2021, I learned that Udemy B2C segment only grew by 1% in 2021. In 2022, it’s quite possible that Udemy made less than in 2021. In the third quarter of 2022, for the very first time, Coursera overtook Udemy in terms of consumer revenue.

All of Udemy’s growth hinges on their B2B segment. Previously, I had predicted that Udemy’s B2B might exceed Udemy’s B2C segment in 2022. And this is what happened in Q3 2022. Udemy’s B2B revenue stood at $83.9 million, compared to $74.6 million for its B2C segment.

edX/2U’s 2022

| 2019 | 2020 | 2021 | 2022 | |

| Courses | 2650 | 3090 | 3550 | 3852 |

| Microcredentials | 292 | 385 | 483 | 486 |

| Master’s Degrees | 10 | 13 | 13 | 13 |

| Learners | 25m | 35m | 42m | NA |

| Revenue | $76m | $84.7m | NA | NA |

In 2022, we saw edX transitioning to become the face of 2U. The transition is happening in two phases, the first phase was just listing 2U Degrees, GetSmarter courses, and Trilogy Bootcamps on edX.org. Class Central reported on this in May.

The second phase is where the 2U products are rebranded under the edX brand. When 2U laid off 20% off its workforce, it announced that it would become a “platform company” by unifying all its operations under the edX brand (which was valued at $250 million).

Former edX CEO Anant Agarwal took on a new role as first ever Chief Platform Officer. Previously, he was the company’s first ever Chief Open Education Officer, a job that lasted 9 months.

Currently, various 2U offerings are fully integrated on edX.org and are able to collect leads right there. In October, 2U sent out a press release announcing the “launch of edX bootcamps.” Originally, these bootcamps came from its $800-million acquisition of Trilogy. 2U has retired the “Trilogy Education Services” brand name.

But so far, all this hasn’t helped its stock price, which has fallen by 72% in 2022. Back in February of last year, I speculated that Google’s algorithm changes might be partially responsible for the drop of its stock. It’s something that affected Class Central too.

According to 2U CFO Paul Lalljie, in the first quarter of 2022, edX accrued $10.9 million in revenue and $18.3 million in expenses. In the earnings call, the 2U CEO boasted about adding 2 million learners without any marketing, growing the learner base from 42 million to 44 million.

If you extrapolate edX’s revenue numbers to the whole year, it amounts to $44 million. This is less than the $47 million it made in the FY2019 and the $72 million of FY2020. You can find a full table of the company’s revenues here.

For our previous years’ analyses of edX, follow the links:

FutureLearn’s 2022

| Year | 2019 | 2020 | 2021 | 2022 |

| Courses | 883 | 1,158 | 1,377 | 1969 |

| Microcredentials/Programs | 35 | 68 | 67 | 52 |

| Academic Certificates1 | 17 | 18 | 16 | 11 |

| Degrees1 | 23 | 28 | 24 | 24 |

| Learners | 10.0m | 14m | 17m | NA |

| ExpertTracks | 0 | 0 | 96 | 128 |

[1] Graduate and Postgraduate Certificates and Diplomas are listed under academic certificates, not under degrees

FutureLearn had a rough year, to say the least. Back in July, when FutureLearn filed its annual report, we learned that it had burned through the SEEK Funding and needed an extra £15M to survive 2022.

In 2019, SEEK Group invested £50 million in FutureLearn, becoming joint owners with the Open University. Since the investment, FutureLearn’s losses doubled and revenue didn’t grow in line with investment.

| Revenue | Losses | Learners | |

| 2021 | £11.3m | £16.1m | £16.5m |

| 2020 | £9.9m | £13.3m | £13.5m |

| 2019 | £7.9m | £6.6m | £9.5m |

| 2018 | £8.2m | £4.1m | £8.0m |

We knew changes were coming. FutureLearn first announced layoffs at the end of November, and immediately followed up with an announcement saying that it was acquired by Global University Systems.

FutureLearn’s acquisition leaves Coursera as the only major independent MOOC provider. Ironically, the platforms funded by universities — edX by MIT and Harvard, and FutureLearn by Open University — were the ones that had trouble staying independent and had to be gobbled by larger players.

According to Times Higher Education, GUS will buy the shares of both Open University and SEEK Group, who each own 50% of FutureLearn. Jo Johnson (Lord Johnson of Marylebone) will be the new chairman of the board. He’s also the younger brother of Boris Johnson, ex-Prime Minister of the UK.

For our previous years’ analyses of FutureLearn, follow the links:

- FutureLearn’s 2021: Year in Review

- FutureLearn’s 2020: Year in Review

- FutureLearn’s 2019: Year in Review

More Top Stories

Content vs Credential

In online education, which is more monetizable, content or credentials? Udemy and Coursera’s B2C revenues in 2022 Q3 might give us a hint.

On the surface, Udemy and Coursera are similar: they’re both marketplaces for online courses. Where they mainly differ is on who can offer these courses. But what they sell is quite different. On Udemy, you pay for the course, while on Coursera, the course is usually free-to-audit, and what you really pay for is the credential or certificate.

2U Powered Degrees Pricing Chart

How much do degrees powered by 2U actually cost? I decided to find out by manually collecting the price of 112 programs from 30 universities. I learned that 20% of the 2U-powered degrees cost learners north of $100,000.

DDoS Attack on Class Central

An attacker sent Class Central 200M fake users, taking the site offline for 36 hours. Here’s how it went down.

The attacker asked for $5,000 in Bitcoin for a “solution file to all the problems caused.” It was a ransom DDoS attack, and at least one online course provider (who is mentioned in this article!) had also been attacked.

Georgia Tech’s Online Master’s Becomes Even More Affordable

In Fall 2022, following the removal of the Special Institutional Fee, OMSCS will become ~18% cheaper. Even taking the degree at the slowest pace, the total cost of a degree is now below $6500.

| Total Semesters | Current Cost | New Cost | Decrease |

| 4 | $6604 | $5828 | 11.8% |

| 5 | $6905 | $5935 | 14.0% |

| 6 | $7206 | $6042 | 16.2% |

| 7 | $7507 | $6149 | 18.1% |

| 8 | $7808 | $6256 | 19.9% |

| 9 | $8109 | $6363 | 21.5% |

| 10 | $8410 | $6470 | 23.1% |

Khan Academy Tax Returns Analysis: $390M in Revenue, 118M Registered Users

I analyzed Khan Academy’s tax returns from 2008–2020. Cumulatively, it has seen $390M in revenue, out of which $316M were donations. You can read the whole report here.

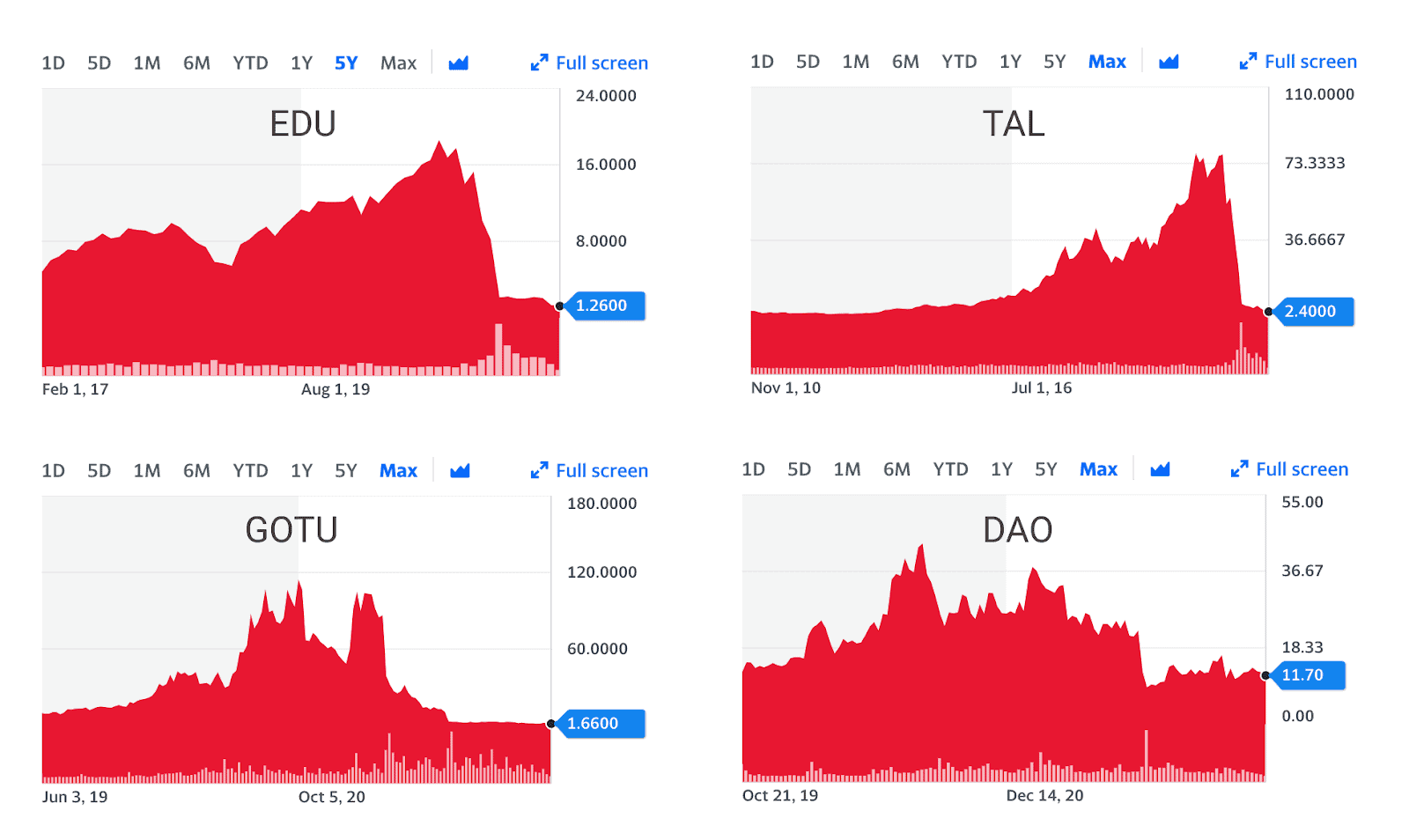

200K Layoffs, $100B Lost: The Tsunami of China’s Regulation on Education

In 2021, China began to heavily regulate edtech companies. After a series of fines and restrictions on for-profit online tutoring companies, China’s Ministry of Education released a final document titled “Opinions on further reducing the workload of students in compulsory education and the burden of off-campus training” on July 24, 2021, which is also called “The Double Reduction Policy.”

Class Central has extensively summarized the impact of these policies in China.

Tags

Gustavo

This behavior of “New Normal – that Wasn’t” also applies to big tech and many startups around the globe in different segments/verticals. In Brazil we have waves of layoffs in startups since early months of 2022 and venture capital is reducing and focusing. In March 2020 big tech started to loose talents to startup, now we receive lists of talents to recruit.

The economy´s digitization will happens via accommodation of investment, wages and sales. I hope in 2023 we (the industry) could grow according to plan and hire everybody back again in one part of tech industry or another.

John A. Lombardi

This is an excellent report.

If one chooses to obtain a Certificate verifying completion of a course, what is the average cost?