2U + edX Analysis: Win for 2U, Risk for edX, Opportunity for Coursera

2U is acquiring edX for $800M, and edX will no longer be a nonprofit.

In an unexpected turn of events, a nonprofit made hundreds of millions of dollars for its two nonprofit owners. Last week, we learned that the public company 2U is acquiring Harvard and MIT-backed edX for $800 million in cash, and that edX will no longer be a nonprofit.

The dominant narrative seems to be that this is a win-win for 2U and edX, and that their combination will pose a threat to Coursera.

I’ll argue the opposite: acquiring edX might help 2U sell its expensive programs, but it weakens edX by taking away its biggest (or probably only) advantage over Coursera — an ideological one at that.

I started Class Central as a side project a month before MITx, edX’s precursor, was announced in early 2012. I’ve been following the company since day 1, and over the years, I’ve published in-depth analyses about it:

- Edx’s 2020: Year in Review

- Edx’s 2019: Year in Review

- Edx’s 2018: Year in Review

- Edx’s 2017: Year in Review

- Edx’s 2016: Year in Review

I’m also an online learner who has completed two dozen MOOCs and observed the industry from its very beginning. As you can imagine, I have lots of thoughts about this acquisition.

Instead of jumping in with a hot take, I spent the last week doing research to write this article. I went through edX’s tax returns, read 2U’s annual and quarterly reports, analyzed Class Central’s data, and even reread some of my own articles about edX.

I’ll be more opinionated and speculative than I usually am, sometimes even blunt. EdTech media have often failed learners, letting companies get away with their narrative of choice. I’ll challenge some of these narratives through a 4500-word, data-driven analysis, uncovering some of the dark patterns I’ve seen used in the industry over the close to a decade I’ve been running Class Central and writing for The Report.

Stick with me till the end. I think you’ll learn a lot about this industry.

Index

Click on a section to jump to it:

- EdX & 2U: By The Numbers

- The Nonprofit’s For-Profit Acquisition

- EdX & 2U: a Match Made in…?

- 2U’s Why

- Online Degree Marketing Engine

- The edX Marketplace: How it Might Work

- Coursera vs edX

- EdX’s (Surrendered) Ideological Advantage

- EdX’s (No Longer Exclusive) Partnerships

- Public (Not Much) Benefit Corporation

- Edx’s Turnaround Plans?

- 2U’s Potential Cash Crunch

- Final Thoughts

EdX & 2U: By The Numbers

Before talking about the acquisition, let’s look at the state of edX in terms of catalog, learners, and revenue. The revenue numbers correspond to financial years (FY). For instance, FY2020 corresponds to the period from July 1st, 2019 to June 30th, 2020.

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Courses | 1290 | 1820 | 2275 | 2650 | 3090 |

| Microcredentials | 118 | 174 | 233 | 292 | 385 |

| Master’s Degrees | 0 | 1 | 9 | 10 | 13 |

| Learners | 10M | 14M | 18M | 25M | 35M |

| Revenue | $42M | $54M | $60M | $76M | $84.7M |

But these numbers don’t show the whole picture. EdX has two categories of revenue:

- Contributions & Grants — which consist of donations and membership dues (more on this later)

- Programs Services: — most from certificate sales.

| Contributions & Grants ($) | Program Services ($) | |

| 2020 | 11,438,680 | 71,803,832 |

| 2019 | 26,946,496 | 47,401,776 |

| 2018 | 19,770,580 | 37,144,085 |

| 2017 | 25,749,405 | 24,909,208 |

| 2016 | 23,826,449 | 14,878,188 |

| 2015 | 22,873,789 | 9,958,262 |

| 2014 | 17,184,161 | 3,411,758 |

| 2013 | 25,836,362 | 0 |

As you can see, contributions and grants have been rather steady over the years, except in FY2020, when the pandemic boosted edX’s revenue.

While edX’s catalog consists mainly of courses, 2U’s is dominated by their online degree programs and bootcamps, offered in partnership with more than 80 universities.

| Graduate degrees | 114 |

| Undergraduate degrees | 20 |

| Bootcamps | 159 |

| Certificate Programs | 3 |

| Short Courses | 199 |

The Nonprofit’s For-Profit Acquisition

Let me quickly summarize the terms of 2U’s acquisition of edX:

- 2U is acquiring “substantially all of edX assets” for $800M in cash.

- EdX ceases to be a nonprofit and converts into a Public Benefit Corporation (PBC).

- A new, yet-to-be-named educational nonprofit is created: “2U will transfer $800 million to a nonprofit organization, also led by MIT and Harvard, to explore the next generation of online education.”

- Open edX, the open-source platform behind edX, isn’t transferred to 2U; it stays at this new nonprofit.

- The MicroBachelors and MicroMasters trademarks are being transferred to the new nonprofit.

In a blog post about the acquisition, edX CEO Anant Agarwal, frames the upcoming changes as a positive and reaffirms some of edX’s commitments (the words “continue to” are used 13 times in the blog post).

The MIT news article presents the new nonprofit as edX’s successor and describes it with buzzwords like personalized learning and artificial intelligence.

Over the years, edX has received over $170 million in contributions and grants. Presumably, $80 million came from MIT and Harvard, and $40 million from partners’ membership dues. Where the remaining $50 million came from is unclear.

One thing seems clear, though: only MIT and Harvard are getting their money back and get to decide what to do with it; university partners and other donors who supported edX aren’t getting anything, as far as we know.

If edX was a for-profit organization, some of these contributors would have received stock and part of the proceeds of the sale. Instead, MIT and Harvard invested $80 million, raised $90 million from supporters without giving them equity, and are now pocketing $800 million. Something about this feels wrong.

One of the cool things about being a "nonprofit" university is you can spin up a new business, pay taxes on nothing, sell the business to a publicly-traded corporation, pocket the $$$$, and still pay taxes on nothing.

— Kevin Carey (@kevincarey1) June 29, 2021

EdX & 2U: a Match Made in…?

Regarding prices, edX and 2U started at the complete opposite ends of the spectrum.

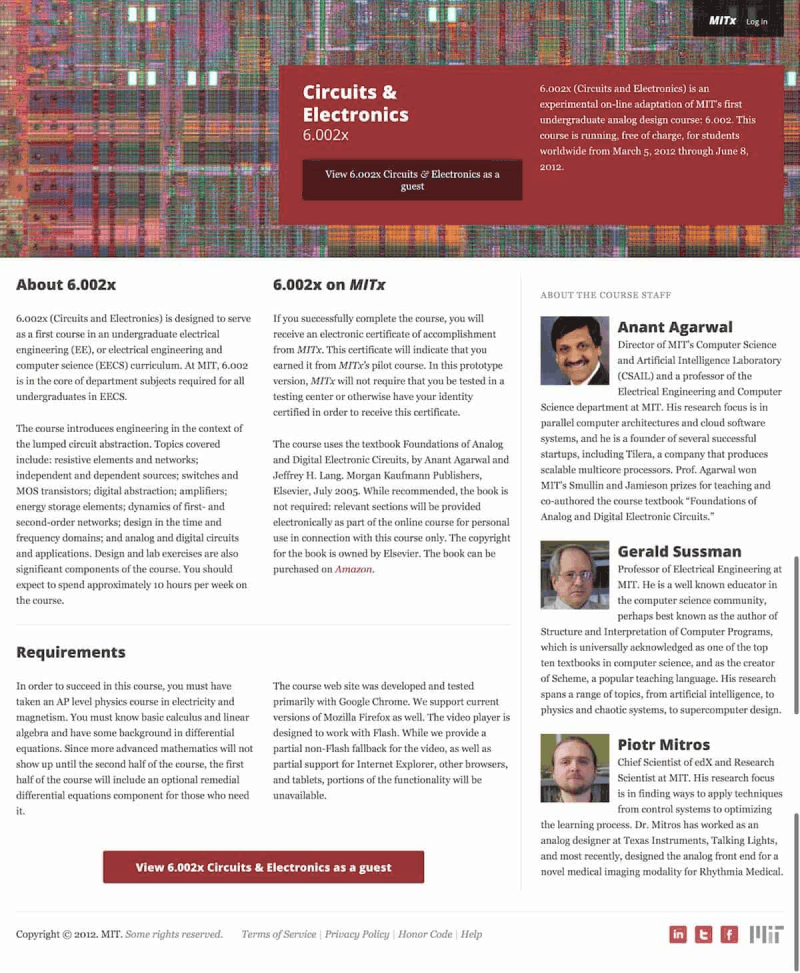

EdX’s first course, taught by its CEO Anant Agarwal, was 6.002x Circuits & Electronics. It launched on MITx on March 5, 2012. It was completely free, including a free certificate and free access to a textbook co-authored by Agarwal.

2U’s (formerly 2Tor) first online degree, an M.A. from the University of Southern California, went live in 2009. It cost $34k in tuition fees. Since then, 2U has launched many online degree programs with a wide variety of university partners. By acquiring Trilogy and GetSmarter, 2U also expanded into lower-price offerings.

In 2020, the company earned $487 million from its Degree Program Segment and $288 million from its Alternative Credential Segment, which presumably includes Trilogy bootcamps and GetSmarter courses. Trilogy bootcamps cost around $10k. A Class Central analysis shows that GetSmarter courses cost $700–$4400, with a median price of around $2k.

According to 2U’s 2019 transparency report, around 38% of 2U’s total revenue was derived from Title IV loans — that is, US student financial aid. In addition, as you’ll see below, Class Central found evidence that their Trilogy bootcamp students are also taking out personal loans to pay for the bootcamp.

In short, each year 2U makes hundreds of millions of dollars by putting students into debt. As much as the leaders of 2U and edX want to convince us they are “purpose aligned”, this is simply not true.

Yes, MOOCs aren’t as free as they used to be, and many providers have fully paid offerings including online degrees. But they’re not akin to 2U’s online degrees, which are often just as expensive as their on-campus counterparts.

Georgia Tech has three MOOC-based online masters degrees ranging from $7k–$10, two of them offered via edX. But a three-month Trilogy-powered bootcamp at Georgia Tech costs $10k. According to one Reddit commenter, Trilogy is “just using the university’s name and facilities”.

The contrasting nature of these programs shows how different edX and 2U are.

A two-year degree from a top-10 CS school is the same price as a three-month bootcamp that just physically takes place on campus. By leveraging the power of these university brands, this works well for 2U. This is why 2U paid $750M to acquire Trilogy Bootcamps two years ago.

2U’s Why

In 2020, 2U spent $390 million on marketing and sales to earn $775 million in revenue. This is their single biggest expense, accounting for 40% of all their expenses. This cost is why back in 2019, 2U’s stock dropped by 65% in a single day.

In 2020, 2U spent a whopping $3.9k on average acquiring a single student. This is more than the cost of any edX program, excluding their online degrees. It’s probably a blended cost spanning their different pricing tiers:

- GetSmarter: ~$2k

- Trilogy Bootcamps: ~$10k

- Online Degrees: $25k – 70k

The higher the cost of the program, the higher the average cost of a single student acquisition.

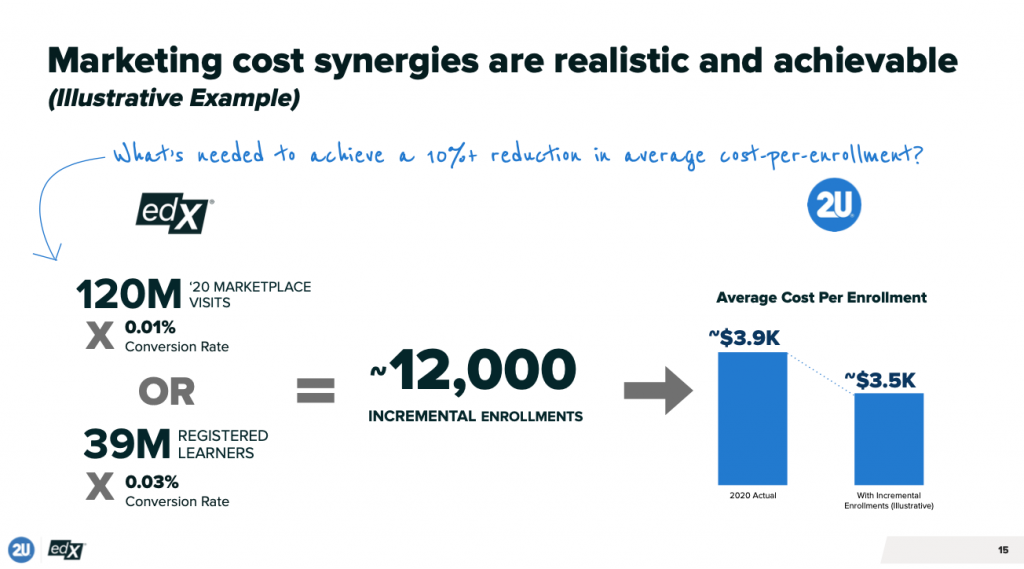

According to 2U, the edX acquisition can reduce these costs by 10–15%, resulting in $40–$60M in annual savings. Here’s their reasoning: if 2U could convert either:

- 0.01% of edX’s 120M “marketplace visits” (I’m assuming visits to edX.org); OR

- 0.03% of edX’s 39M registered learners;

this would result in an extra 12k enrollments, reducing the mean acquisition cost from $3.9k to $3.5k.

But there are two assumptions baked into this model that could make it fall apart.

First, the high cost of 2U programs make them inaccessible to most of the world.

| 2019 | 2020 | |

| United States | $90m | $143.5m |

| Europe, Middle East, Africa | $52.1m | $83.3m |

| Asia Pacific | $27.7m | $40.7m |

| Other | $14.7m | $26.m |

| Total | $184.4m | $293.5m |

Above is a table from my analysis of Coursera’s IPO prospectus. 51% of Coursera’s revenue comes from outside the US. And Coursera’s offerings are significantly cheaper than 2U’s programs. It’s safe to assume that 70–80% of 2U’s revenue, if not more, comes from the US.

Meanwhile, 80% of edX learners are outside the US. So we can estimate edX to receive about 24M “marketplace visits” from US users and have 7.8M registered users in the US. To simplify the math, let’s assume 100% of their revenue comes from the US. In this scenario, the estimated conversion rates required to reach the 10% savings target would be:

- 0.05% of the 24M US “marketplace visits”; OR

- 0.15% of the 7.8M US registered learners.

So the actual conversion rates required would be just slightly lower. These targets are significantly more ambitious than those floated by 2U in their original model.

Second, edX itself hasn’t done well converting their learners to their 13 online degrees, which are significantly cheaper than 2U degrees.

We know this from edX’s tax returns. In FY2020, edX had a “tuition revenue” of $3 million, up from $1.2 million a year before. By contrast, Coursera earned $29.9 million from its Degrees Segment in 2020. EdX makes 10 times less from their degree programs than Coursera. While they have three times fewer learners and half as many degrees, this difference is still disproportionate. Put simply, edX has a hard time converting users to their degrees.

And it seems edX has given up on its degree ambitions. In 2020, they announced just 4 new degrees (and lost 1). In fact, it’s been a year since they last announced an online degree.

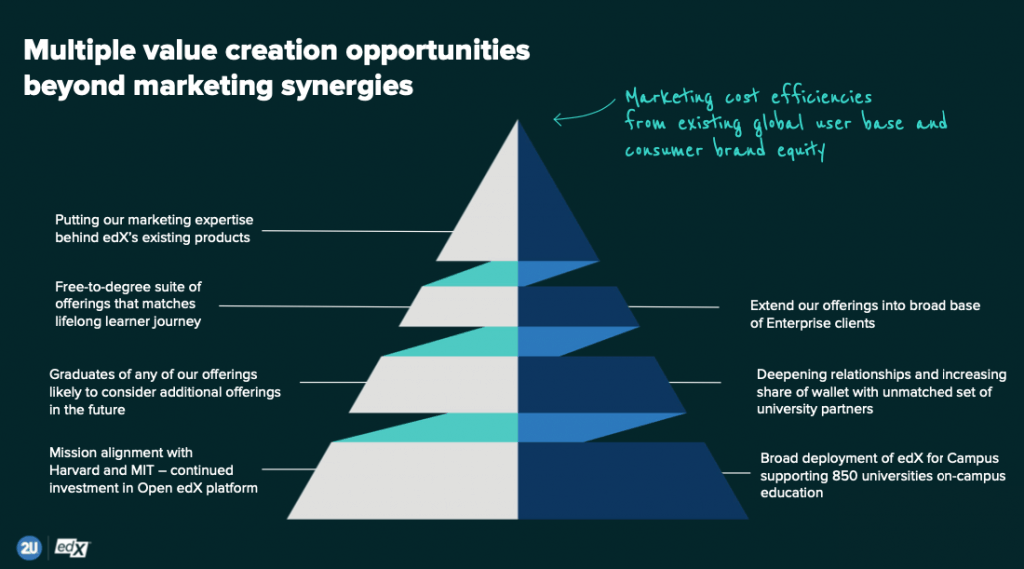

So why does 2U think they can do better? It’s because of their “proven marketing engine”.

Online Degree Marketing Engine

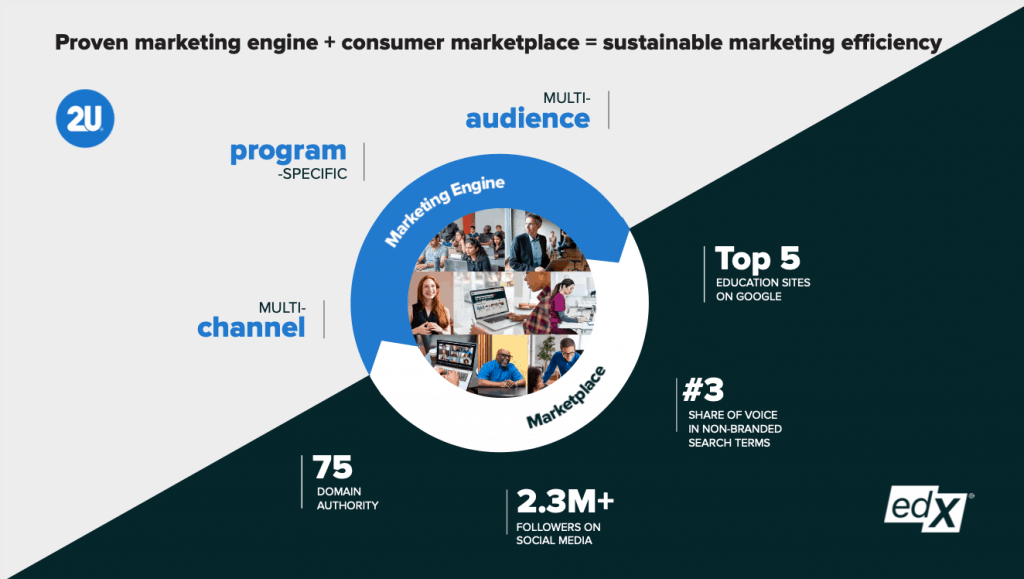

In their investor presentation for the edX acquisition, 2U describes the edX “marketplace” rather concretely, referencing numbers like social media following. By contrast, they described their “marketing engine” rather vaguely, using terms like “program-specific”, “multi-audience”, and “multi-channel”.

Doesn’t this seem odd? In 2021, 2U will spend upwards of $400M on marketing and sales, but how’s that money used exactly?

This is the dirty little secret of online degree marketing, and it’s not limited to 2U. I’ll try to describe it as generally as possible, because I have limited experience. But I do know a bit about it, since becoming part of this “marketing engine” is precisely what kills aggregators like Class Central, which is why it’s something we’ve been careful to avoid.

There are two parts to this marketing engine:

- Acquiring “leads” — that is, potential students.

- Converting these “leads” into enrollments.

Step 1: Lead Acquisition (Marketing)

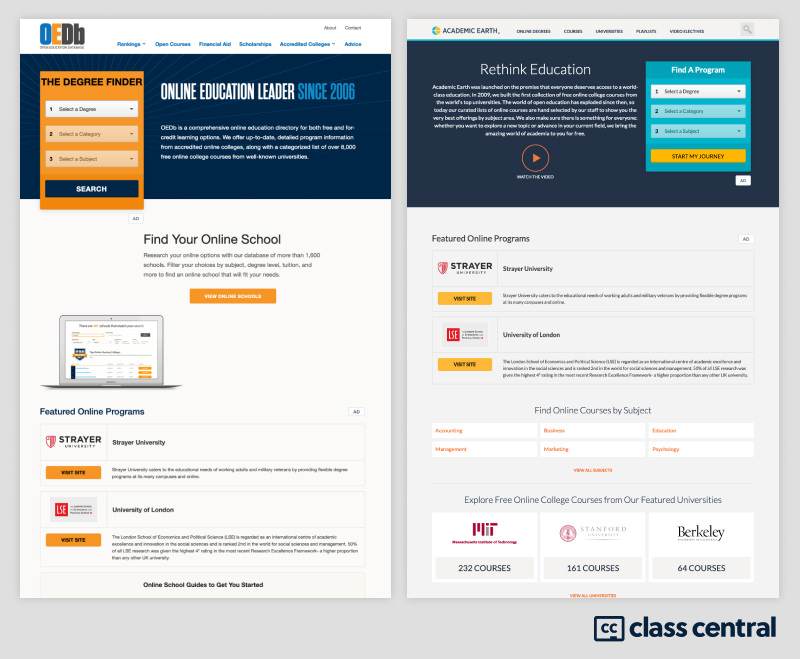

Course aggregators like oedb.org and academicearth.org used to be similar to Class Central. That’s until they were acquired by companies that help online degrees acquire leads. After the acquisitions, these aggregators changed a lot.

The homepages of both sites were overhauled to promote online degrees. The new versions had nothing to do with the original purpose of the websites.

“The Degree Finder” or “Find a Program” that you can see on the homepages is how these sites make money. It can be extremely lucrative. In just a couple of clicks, they direct you to a degree program and ask you for your email, phone number, and more. If you show interest by filling the form, you’ve just become a “lead” — and the site owners can earn as much as $40 per lead.

There might be other ways to acquire leads, but this is the one I’m most familiar with. So when you have deep pockets, a common strategy to generate leads is to acquire sites that potential students might visit, or to create sites targeting specific search terms, so they rank high on Google.

These sites pretend to provide helpful information to learners, often presenting themselves as impartial catalogs of the “best” online degrees. But generally, they’re just geared toward promoting specific degree programs — those of whoever they have a financial arrangement with.

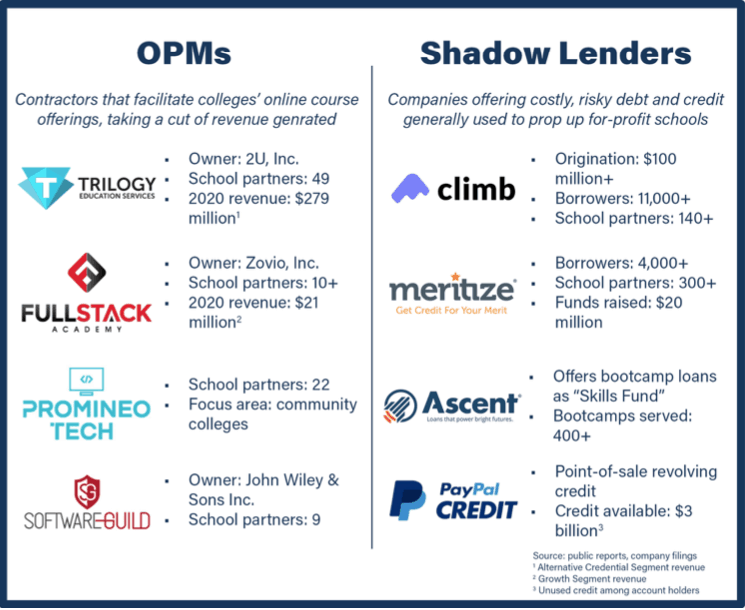

And there’s another layer to this: there are entire companies out there that specialize in building and buying websites to help higher education institutions acquire leads.

Let me demonstrate. Assume you’ve never heard of Georgia Tech’s groundbreaking Online Masters in Computer Science, which costs $7k and has become the world’s largest master’s degree program. Go to Google and try to search for “online computer science masters” and see if you can reach the program’s homepage, omscs.gatech.edu, especially from degree aggregator websites.

The huge marketing budgets of 2U and other Online Program Managers (OPMs) are making it difficult for prospective students to find accurate information about online degree offerings.

2U itself runs a number of lead gen sites — for instance, mastersindatascience.com, onlinecounselingprograms.com, and onlinephysicaltherapyprograms.com. Check the websites’ footers: they’re “owned and operated by 2U”.

This is why 2U was willing to fork over $800 million to acquire edX. In 2U’s slide above, edX’s “marketplace” strengths are mainly described in terms of how well edX does on Google:

- Top 5 education sites on Google

- #3 share of voice in non-branded search terms

- 75 domain authority

Last year, when I analyzed the SEO content strategy of Coursera, MasterClass, and edX, I noted that, combined, these companies get half a billion dollars worth of traffic from Google every year. At Class Central, around 60% of our 1+ million learners come from Google every month.

| SEMrush | Ahrefs | SpyFu | SimilarWeba | |

| Coursera | 7.6M | 7.8M | 16M | 11.6M (20%) |

| edX | 3.4M | 3.9M | 5M | 4.07M (23%) |

| MasterClass | 7.8M | 2.8M | 10M | 3.27M (50%) |

| Class Centralb | 604k | 261k | 849k | 1M (57%) |

a. In parentheses: estimated fraction of traffic coming from search engines.

b. In September 2020, Class Central’s actual traffic was 766k, according to Google Search Console.

In the future, I wouldn’t be surprised to see a native ad similar to “The Degree Finder” or “Find a Program” on every edX page. If this turns out to be a viable channel, they might be able to reduce their advertising cost.

Step 2: Admissions (Sales)

In this step, the admissions team tries to convert a “lead” into an actual enrollment through email marketing or direct calls. Companies tend to be really secretive about this and go out of their way to pretend it doesn’t happen.

We can get some insights via 2U’s job posting for an Admissions Counselor. A couple of “Responsibilities” stood out to me (my emphasis in bold):

- Persistence coupled with a passion for education

- Ability to develop relationships with prospective students via phone in a high-volume call environment and via email as needed

I would recommend reading Glassdoor reviews for this position to get a glimpse of what the role entails.

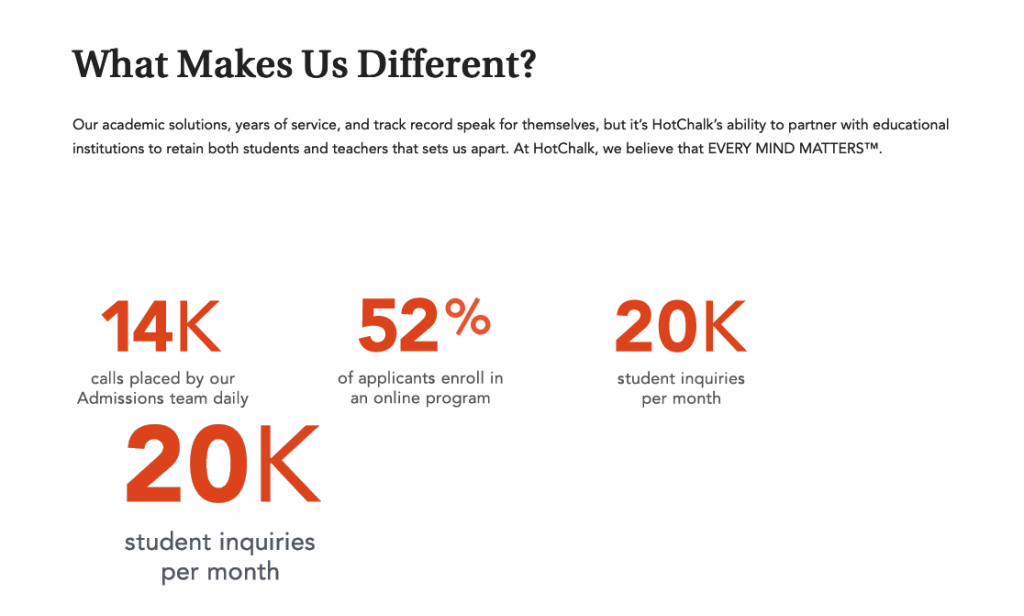

I wouldn’t be surprised if there are hundreds of employees at 2U each making dozens of calls daily to prospective students. The now defunct HotChalk, an OPM like 2U, boasted about making 14k calls daily on its website.

What happens in these calls is a mystery. One thing I learned through Reddit comments about Trilogy bootcamps is that these Admissions Counselors also help you apply for loans.

In 2U’s Transparency Report for 2019 (published in Nov. 2020), the company estimated that 38% of 2U’s 2019 revenue was derived from Title IV loans. But it failed to disclose how many students were getting loans from private lenders.

A recent report by the Student Borrower Protection Center (SPBC) highlighted the issue of universities promoting private lenders as a way to finance studies:

“a webpage for a Trilogy-facilitated data science bootcamp at the University of North Carolina at Charlotte does not market any specific student loan company’s products, but it does indicate that “[a]fter acceptance into the program, you will connect with admissions to discuss which financial option works best for you.”

In short, 2U’s expertise in Admissions (Sales) may be why they’re confident they’ll be able to effectively convert the “leads” acquired via edX into actual enrolments, when edX couldn’t.

The edX Marketplace: How it Might Work

In all the communication put forward about the acquisition, edX is referred to as a “marketplace”, something edX has never called itself.

It might be a telling way to communicate to investors the role 2U envisions for edX in their strategy. So how could this work? As someone who kinda built an online courses “marketplace”, I have some ideas.

- Combined listings: 2U products will be listed in edX’s catalog. When you visit edX and search for a course, you’ll see programs from edX and 2U combined, with 2U products potentially given priority.

- Email marketing: registered users might start receiving targeted emails regarding 2U programs based on their activity on the website. For instance, if you enrolled in a data science course, they will send you promotional emails for data science degrees or GetSmarter courses.

- Landing pages: 2U might also take advantage of edX’s strong presence on Google to create specific landing pages for their online degrees or bootcamps.

My advice to learners: if edX asks you for your phone number in the future, don’t give it to them. Actually, don’t give your phone number to any course provider.

Coursera vs edX

In my opinion, to put it bluntly, Coursera is better than edX for both universities and learners.

On Coursera, universities:

- Can reach more learners.

- Earn more without paying a membership fee.

- Provide better financial aid (free vs edX’s 90% off).

For learners, on Coursera:

- Courses are more open (edX has time-based paywalls).

- The user experience is better (edX UX hasn’t changed much over the years).

- Certificates are cheaper.

Some of the learner benefits I’ve listed might also be favored by universities, like an unlimited audit mode. Vice versa, some university benefits might be favored by learners, like better financial aid.

Like I did with Coursera’s IPO filing, I dug into edX’s tax returns to see how much money they’ve given their partners earned over the years.

| Fiscal year ending in June | Membership Dues | Royalties |

| 2020 | 6,676,979 | 38,579,123 |

| 2019 | 7,149,809 | 24,631,270 |

| 2018 | 7,449,454 | 19,247,734 |

| 2017 | 8,089,816 | 13,728,543 |

| 2016 | 6,351,691 | 8,436,336 |

| 2015 | 4,010,218 | 4,019,119 |

| 2014 | 554,998 | 509,641 |

| 2013 | 0 | 0 |

| Total | 40,282,965 | 109,151,766 |

Analyzing edX’s 2013–2020 tax returns, I found that they paid their partners $110 million in royalties. But edX also charges its partners “membership dues” for offering courses on the platform, amounting to $40 million. So since it was founded, edX has given $70 million net to its partners.

Contrast this with Coursera who has paid its content creators $281 million just in 2017–2020 (not counting degree revenue). In 2020 alone, Coursera partners received over $100 million.

From a financial standpoint, Coursera is clearly the better partner for universities. So this raises a question: why do some universities exclusively partner with edX?

EdX’s (Surrendered) Ideological Advantage

Some argue this acquisition threatens Coursera. I suspect the opposite: it could make Coursera even stronger, since edX is surrendering its biggest, and possibly only, defence against Coursera. Let me explain.

Based on conversations that I’ve had over the years with industry actors, edX’s advantage boils down to a single word: “nonprofit”. Some universities simply prefer to partner with nonprofits like edX rather than VC-funded companies like Coursera.

EdX’s nonprofit status helped compensate for some of its shortcomings. Over the years, they’ve wielded this status to secure exclusive partnerships with universities, despite charging membership fees. Coursera, on the other hand, doesn’t charge membership fees, and they’re significantly better at monetization.

So I believe edX losing its nonprofit status could make some universities rethink their partnerships, creating an opportunity for Coursera to convince some of them to offer courses on their platform, or even switch platforms entirely.

EdX’s (No Longer Exclusive) Partnerships

But MIT has already announced it’ll launch a new platform called MITx Online based on Open edX, specifying that “MIT faculty may choose to continue to offer their courses through the new edX after the transaction is completed, or move them to MITx Online.”

The announcement adds that edX’s acquisition “imposes no restrictions on these institutions’ [i.e. edX partners] freedom to offer their courses through other means, or to depart edX.”

To me, this provision signals that some faculty might not be comfortable offering their courses on a for-profit platform, so they’ve been provided a way out.

According to their 2020 impact report, MITx accounted for 4.4 million learners and 9.6 million edX enrollments. Basically ~10% of edX’s learners are enrolled in MIT courses. And some of these courses might now move to MITx Online. So this acquisition already cost edX their exclusive access to the offerings of one of the world’s most famous universities.

Does edX have a plan to retain these institutions? EdSurge tried to ask the 2U CEO what he’s doing to convince colleges to stay:

He said the company has long believed that “universities are in control, 2U is not” when it comes to any partnerships with the company. “We have to do right by the stakeholders every single day,” he added.

Basically a non-answer from a seasoned executive.

Some universities like the University of Michigan are already multi-platform, sometimes offering the same course on Coursera, edX, and FutureLearn. One of my colleagues, @pat, took Dr. Chuck’s popular course Programming for Everybody on each platform and compared them.

Public (Not Much) Benefit Corporation

As part of the acquisition, EdX is becoming a Public Benefit Corporation (PBC), just like Coursera did before going public earlier this year.

EdX and Coursera like to pretend this is some high bar that’ll hold them accountable. The reality is quite different. Here’s the line that Coursera added to its Certification of Incorporation that made it possible to become a PBC:

“The specific public benefit purpose of the Corporation is to provide global access to flexible and affordable high quality education that supports personal development, career advancement, and economic opportunity.”

I believe most online course providers could claim the same and become PBCs. Terms like “affordable” and “high quality” are relative. Given the cost of education in the US, even a $20k bootcamp can argue it’s affordable.

Edx’s Turnaround Plans?

2U’s people, technology, and scale will expand edX’s ability to deliver on our mission and enable all learners to unlock their potential. #freetodegree

— anant agarwal (@agarwaledu) June 29, 2021

In 2021, 2U will spend as much on just marketing and sales as Coursera will spend in total.

As detailed earlier, 2U has been very specific on how edX fits into its plans: reducing their user acquisition costs. That’s why 2U is spending $800 million in cash buying edX. EdX is a marketing channel for 2U.

By contrast, they haven’t specified how they plan to grow edX. The general message is that 2U has marketing expertise that will help edX, somehow.

As covered earlier, 2U’s “marketing engine” is built around higher-priced programs involving high-touch activities like sales. It might work for some of edX’s higher-priced microcredentials. But it doesn’t necessarily translate to lower-priced offerings.

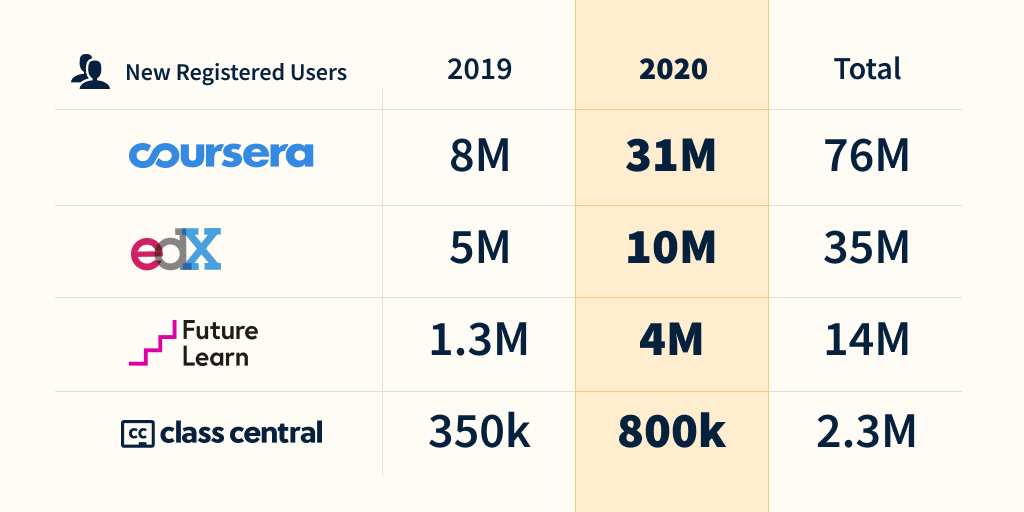

2U might help edX in some aspects. As I’ve mentioned before, Coursera’s pandemic response has been the best I’ve seen amongst course providers, and it has put them way ahead of the pack: Coursera gained almost as many learners in 2020 alone as edX did since its launch 9 years ago.

By contrast, edX’s response was slow and tame. They benefited from the pandemic boost, but couldn’t capitalize on it like Coursera. Maybe if the 2U acquisition happened before the pandemic, they could have helped edX execute better.

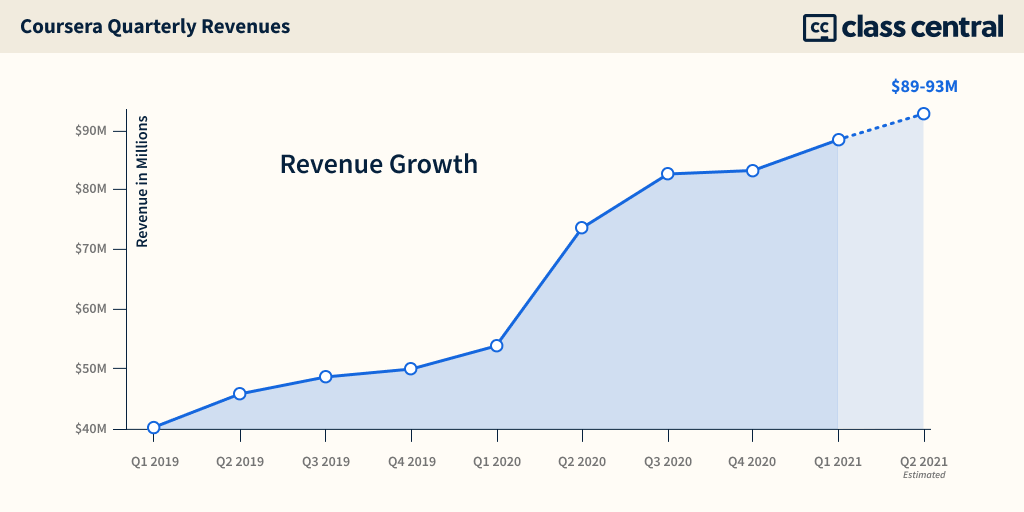

Below, you can appreciate how much the pandemic bumped Coursera’s revenue in early 2020.

But marketing savvy only goes so far. At a minimum, for edX to grow and be able to compete with Coursera, 2U would need to invest hundreds of millions of dollars over the next few years. But is 2U willing to do that? Scratch that. Can 2U even afford to do that?

2U’s Potential Cash Crunch

In FY2020, edX earned $84.7M, with operating losses of $17.4M. But $11.5M of this revenue came from grants and membership dues, which are both under threat once edX becomes part of 2U. So the losses might further increase.

Before the edX acquisition, 2U expected 2021 losses in the range of $165M to $175M. To acquire edX, 2U took out a loan of $475 million “with attractive terms”. But if I understand it correctly (and I probably don’t), the loan term is 3.5 years with “~$42 million of annual interest expense”, according to the investor presentation.

So this means 2U is taking an additional expense of ~$178 million a year to acquire edX. 2U’s losses are going to increase for the next few years, even if they hit the peak of their $40–$60M savings estimate facilitated by the edX acquisition.

At the end of Q1, 2U had $505 million in cash balance, and it just spent $325 million acquiring edX. edX FY2020’s expenses were about $100M. Will 2U be able to invest another $50–$100 million per year to grow edX?

Maybe if 2U’s stock price keeps going up, they’ll be able to secure another loan. But this puts edX at the whims of the “market”. Perhaps I’m over-analyzing and there’s always money in the banana stand public markets. We’ll know some of the details soon, when 2U releases their 2021 Q2 report and guidance for the rest of the year.

Final Thoughts

If you’ve made it this far, you probably have figured out by now that I’m extremely disappointed with this development. As someone who’s followed edX and the MOOC space since day 1, this just looks like capitulation.

For years, edX presented itself as a morally superior alternative to Coursera due to its nonprofit status. But now, they’re relegated to the status of a “marketplace” that might push thousands of learners into debt.

Donald Clark

Relying on philanthropic grants is basically relying on rich tech guys and families to keep you afloat – very much a US model. MOOC world has companies like FutureLearn, who have always been private. We are seeing MOOCland evolve from public v private top hybrid models. The real battle is over the nature fo the technology. MOOCland is actually quite flat tech with little use of AI and data. The private sector is changing fast as AI and data models through LXPs are hitting the market and having good traction with customers. this is about the next generation of tech in learning and needs a hybrid approach.

Sonal Patel

Thank you Dhawal for this thoughtful and data backed comparison. Many detail covered here are eye opening. Appreciate your time in educating us all. I am a learner with edX since March 5, 2012 and was introduced to Coursera and Khan Academy through edX. Lets hope for the better future for the world’s underrepresented, poor and disabled communities. Only the time will tell, which edTech will be able to balance profit with true impact and reach the world’s underrepresented communities.

Michał

Wow. This article is amazing. Yes, it’s opinionated… but all those opinions seems very justified. Great read.

I’m also worried, and disappointed. For no-us users, it doesn’t seem like an amazing deal. Online courses that can only be considered “cheap” if compared with outrageously-priced-offline-degrees-that-I-would-never-even-take-into-consideration is not appealing at all.

Ajay

There is one thing missing in the article which is what makes a great MOOC platform? It is the quality of the courses and here the quality of edx courses is way way better than any other platform in my opinion especially the MITx courses. If MIT stop offering their online courses on edx platform then it is a big loss for edx.

I have been taking MOOC courses for the past 4 years and for me completing courses on coursera , future learn and others is a struggle (completed 2 courses) but with edx MITx courses it is complete satisfaction of having learnt a lot and the joy I get out of completing their courses( more than 40 courses so far completed). The only good news in this acquisition is the news of MITx online and I guess many students will move on to MITx online rather than stay on edx if MIT stops their courses on edx. Only time will tell whether this acquisition is good or bad for learners like me.

Dhawal Shah

Ajay, my experience has been different. Somehow over the years, I have never finished one edX MOOC: https://www.classcentral.com/@dhawal

edX courses, specially MIT ones tend to be a lot more rigorous and in-depth. Finishing a MIT course isn’t easy. I remember I had to drop a 12 week course Probability course at week 5 because I forgot at week 1. To me it seemed like a real MIT course and I wasn’t able to devote enough regular effort. Not something I could just binge and catch up, like I have occasionally done with other courses.

As many MOOCs are now targeted towards a beginner audience, so sometimes the depth is lacking. But generally speaking I think edX courses do tend to have much more depth than other platforms from what I have observed.

John A. Lombardi

Dr. Shah, thank you very much for your outstanding explanation and analysis of the online learning environment.

I am considering trying a course in the business area, but plan to read all of your attachments regarding these various MOOC and for- profit options. As a guy who is interested in ” filling in” certain parts of my education, I am also wondering whether taking an online credit course directly from a university might not be as good, or better, a choice. For example, the Universities of Alabama, Arkansas, Florida, Illinois, and Texas all offer affordable tuition to students regardless of residency. I’m interested in Coursera as well. I’ll reach a decision in the Fall.

Best wishes, and I greatly appreciate your wonderful insights on these complex issues.

John A. Lombardi

Shivani G

Agree with you Ajay , I like mitx courses because of the fact that they are rigorous , class oriented , other course I have tried on various platforms(and I have tried many ) doesn’t offer that much depth.

Though I don’t know how the acquisition will go for future , time will tell.

Jim

We’ve long realized that independent MOOCs need to monetize in order to be sustainable. Nonetheless, an independent MOOC can partially monetize while preserving its non-profit status. Did edX actually meet its own non-profit mission though, in educating with minimal tuition?

Compared with Coursera, I suspect that the number of edX learners sharply decreased after its paywall was put up. I also suspect a trend of institutions either moving courses away from or at least ending their exclusivity on edX. Assuming my suspicions are valid, I didn’t see edX change its strategy to improve the numbers.

Paul Walsh

Dhawal, can you clarify the edX membership dues at all? Is there a sliding scale based on how many course an institution offered or develops each year? Are “Contributing Charter Partners” paying less or at all or is this too tied to making the partner a content engine?

Fei

I took quite some MOOCs before starting my master’s degree, mostly done on Coursera. I like Coursera’s user experience, and there were good courses too. I wanted to try some courses on edX, but I just couldn’t bear with edX’s usability. Maybe I was too biased towards Coursera. Nonetheless, I agree edX has some really great courses. Some MIT classes there were just great. So instead, I turned to Youtube videos to watch these courses and do assignments published on MIT open courseware. What I’ve been hoping is these great courses on edX could be co-offered on Coursera as well. But I know this is not easy.

Marcus

Excellent Analysis Dhawal Shah ! The edX development was inevitable, because in conclusion every MOOC provider must earn money. Despite that fact, i must say i´m also disappointed edX goes this way. I also agree with you, this could be a (big) advantage for Coursera, because one competitor is “out of the market” with their transforming to a marketing site.

After the announcement, i visited the site of 2U to see who is the buyer. And my feeling is the same as yours: 2U needs edX as marketing platform for their own expensive courses and programs. MIT and Harvard says, edX should continue to offer affordable education, but i personally dont believe in this.

My personal favorite is Coursera, because the same reasons you mentioned. The biggest thing what disturbs me on edX is the fact nearly all courses are session based and when the time is up, they are out of the catalogue and you have no chance to do courses with a certificate. Which benefits has “achieved courses” ? In my view nothing. In conclusion: Good Bye edX!

By the way: I´m a regular reader, and you doing great work with your site!

Amit

Once again Dhawal has come out with a great analysis. Thank you from the bottom of my heart, I have been contributing to EDX for a while and this is a slap in the face.

Garrett Tedeman

Really (really) fascinating article. As a software consultant and frequent participant in online learner systems myself, very much appreciate these points and analysis of recent data. …To use a lovely term, appropriate to the context (ahem), It’s such a dynamic “marketplace”. All of this was evolving so rapidly, and then the Covid/WFH-period hit, pretty much like an explosion.

How all of this plays-out will be vital to track for any of us with investments in online or online-focused learning, and will also have major implications for any with investments in education generally, as the shifting and branding of these players continue to ripple through the ecosystem. …Here’s coverage today, which largely agrees the tough take:

https://www.chronicle.com/article/mit-and-harvard-have-sold-higher-educations-future

Adrian Marrullier

Thanks for your excellent analysis Dr. Shaw. As someone who helped create the OPM industry starting in 2002, I found your analysis to be 100% on target on all levels. I created a relationship with US News & World Report in 2007 as a way to fight the proliferation of lead aggregator websites (ClassesUSA etc.) and circumvent the Google Casino (AKA Paid Search) so I appreciate the strategic thought behind this acquisition. Unfortunately, I don’t agree with the underlying cost of acquisition assumptions (many of which you point out) and see this as a poor acquisition that may in fact be the demise of both edX and 2U given their collective inability to turn a profit. As someone who works with universities to help them run their online programs in an unbundled fashion I only see this trend accelerating as universities realize that their corporate partners are not fair actors in the process.

Lacking your analytical skills, I recently summarized my views with the following MEME https://www.linkedin.com/feed/update/urn:li:activity:6816834599822397440/

Roger S

Great analysis and summary ! We rely on your unbiased views of an evolving learning environment. Thank-you so much.

Fabio Dantas Fernandes

Well, I’m not surprised. It seems pretty obvious that after this industry saw such a spur during pandemic it would attracted the sharks attention. I understand your frustration but It’s how everything works now. Probably they will be backed by some investment fund to keep the astronomic marketing budget running, just like any contemporary counter-part would do.

Nancy Nathan

Wow, this is reallllly insightful. Thank you!

Brian Mulligan

This is a great analysis, particularly in relation to costs (And practices) in marketing and recruitment. It occurred to me when I read about this deal that perhaps 2U were not fully confident in their existing business model and that access to edX would allow them to pursue a different, lower-cost, business model in parallel – an “each way bet”. Do you think this is at all possible?

Saul Carliner

Thank you for this well-researched, thorough, and insightful analysis.

John A. Lombardi

I have read the latest new comments, and thank all who have written them for the excellent information provided. All of you are rendering a great service to those of us who are new to the MOOC online learning systems.

Many thanks.