Concrete Details Emerge on edX’s Role After 2U Acquisition

We learn about how 2U is benefitting from edX, but very little about how edX benefits from 2U.

Last week, 2U published its Q1 2022 quarterly report. Originally, it was supposed to be published this week, but 2U moved up the publication by a few days.

But it was during the earnings call that the CEO and CFO shared specific details about edX’s integration with 2U, following the acquisition. These details are what I will be focusing on today.

Broadly speaking, 2U’s motivation for acquiring edX boils down to acquiring two assets:

- edX.org website — the “marketplace,” as 2U referred to it during the acquisition.

- edX brand.

What we haven’t seen yet is how 2U is planning to turn edX around and compete with Coursera. 2U’s “marketing engine” was supposed to help with this aspect.

Since the acquisition, 2U’s stock has dropped dramatically, and at the time I’m writing this article, 2U’s market cap is at the same amount as the cost of the edX acquisition.

EdX.org: Marketplace & Lead Acquisition

During the acquisition announcement, 2U presented edX as a marketplace and speculated that it would bring an additional 12,000 enrollments by lowering the average student acquisition cost down from $3.9k to $3.5k.

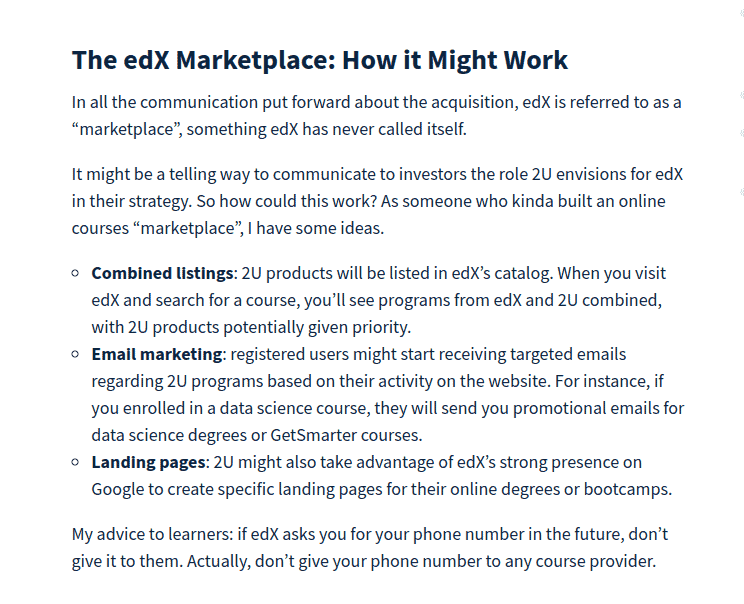

In my analysis of 2U’s acquisition of edX, I speculated about how the marketplace could work, saying it might entail combined listings, email marketing, and new landing pages.

The first two have already happened, and the third one is in progress. I also mentioned that 2U products might be given priority, which is what’s happening on the edX homepage.

When you visit the homepage, the first section shows programs from 2U and other companies 2U acquired, and none from edX. And 2U programs also show up when searching on edX.

So how is this all working for 2U? Here some specific quotes from 2U CEO Chip Paucek:

- “We are seeing run rates of 500,000 leads per year coming to the 2U prospect forms on edX in 2022. This represents nearly 10% of our lead volume company-wide, with no additional marketing costs involved. And better, we expect to be able to triple this amount over the next 18 months.”

- “University of London and LSE Undergrad are an example of a 2U degree benefiting from this new lead flow. Over Q1 alone, edX already represents 20% of our lead volume and our largest non-paid channel for this degree. And those leads are submitting applications at a 30% plus better rate than leads from our paid channels.”

If you are wondering what “leads” are, I’m no expert, but here’s a brief explanation I wrote about the online degree marketing engine. SEO or Search Engine Optimization is a big part of the “leads generation” — that is, the process of finding prospective customers.

2U itself runs a number of “lead gen” sites — for instance, mastersindatascience.com, onlinecounselingprograms.com, and onlinephysicaltherapyprograms.com. But these sites might be susceptible to Google’s algorithm changes (which Class Central also has suffered from).

According to the 2U CEO, “Right out of the gate post close, SEO and content publishing have been a core focus of our team.”

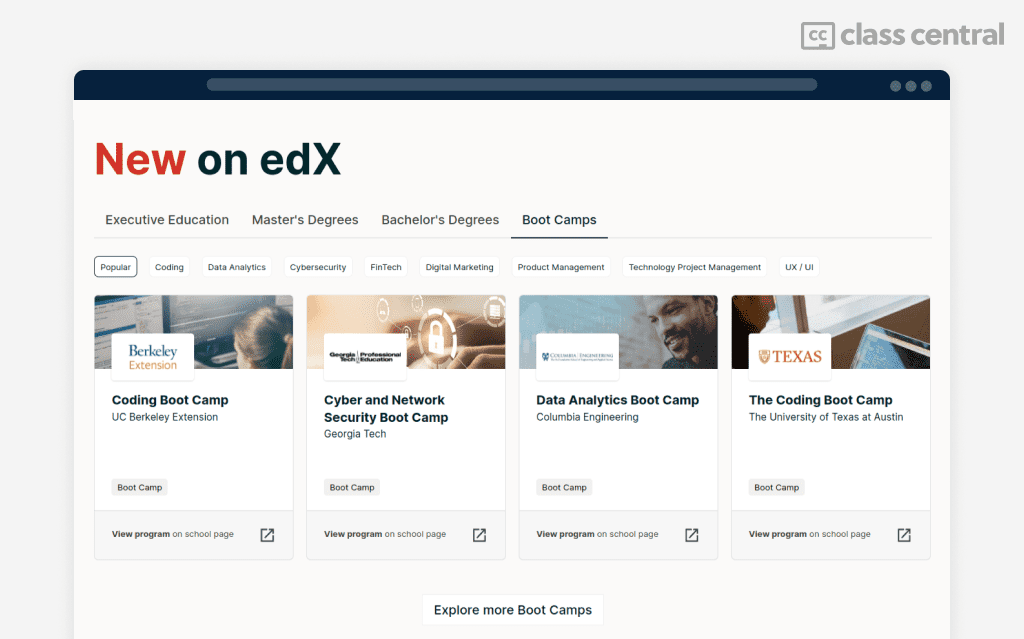

In my analysis, I stated 2U might also take advantage of edX’s strong presence on Google to create specific landing pages for some of their offerings. I found some examples of these landing pages for 2U bootcamps and master’s degrees, like the cybersecurity bootcamps shown below.

In the future, I might do a detailed analysis of 2U and edX’s SEO strategy. Previously, I had analyzed the SEO Content Strategy of top providers like Coursera, Masterclass, and edX before its acquisition.

Currently, all these programs link to pages outside of edX.org. But 2U has plans to “unify registration across the entire 2U system.” This probably means that, eventually, each 2U degree, Trilogy Bootcamp, and GetSmarter Executive Education course will have a dedicated page on edX.org — “lead acquisition and/or conversion” will happen right on edX.

EdX Brand

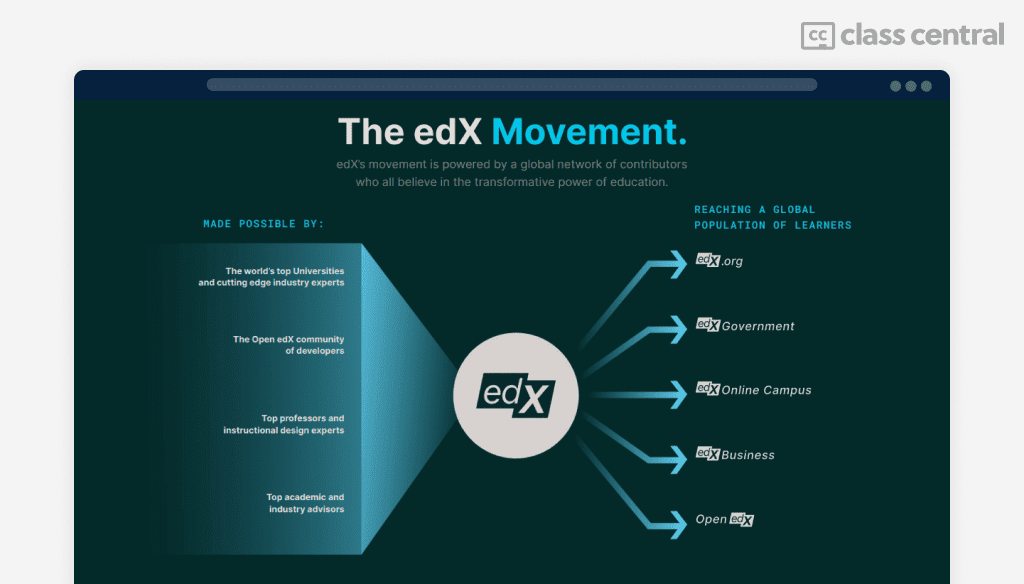

Generally, Online Program Management (OPM) players like 2U work behind the scenes and are invisible to the general public. With the acquisition of edX, 2U plans to “transition to a platform company” with edX becoming its consumer-facing brand.

According to 2U’s CEO, “Higher education, like so many industries is becoming consumer centric, a dynamic only accelerated by COVID and we believe that the companies who best understand this learner centric shift and can offer students the education and skills they want when they need it throughout their working lives will win.”

That is why 2U valued the edX brand at $250 million, which I discovered while analyzing 2U’s 2021 annual report.

2U has also integrated all their enterprise business offerings under the edX For Business brand. We know from both Coursera and Udemy that the consumer channel helps drive adoption and sales for their Business/Enterprise customers.

EdX’s Turnaround

| Coursera | edX | 2U | |

| New Learners | 5 million | 2 million | NA |

| Degree Revenue | $13.3 million | $2.7 million | $154.2 million |

| Total Revenue | $120.4 million | $10.9 million | $253.3 million |

When the edX acquisition by 2U was announced, the dominant narrative seemed to be that this was a win-win for 2U and edX, and that their combination will pose a threat to Coursera.

Even the edX leadership touted that 2U and its “marketing engine” will boost edX. Here is a quote from the acquisition announcement on the edX blog:

This was the right time to seize an opportunity to create a step-function increase in our impact in a way we couldn’t do otherwise. The combined scale, reach, capabilities, marketing efficiency, and relationships of 2U and edX will unlock unprecedented opportunities to reach and serve more learners worldwide.

I was skeptical and claimed that this would take away edX’s biggest ideological advantage: being a nonprofit.

So far, we have seen little evidence either way. As far as I can see, the acquisition hasn’t yet had any impact on the original edX business.

According to 2U CFO Paul Lalljie, in the first quarter of 2022, edX accrued $10.9 million in revenue and $18.3 million in expenses. In the earnings call, the 2U CEO boasted about adding 2 million learners without any marketing and growing the learner base from 42 million to 44 million.

In 2021 and 2019, edX’s registered learner base grew by 7 million, roughly adding 2 million each quarter. Boosted by the pandemic, in 2020 edX gained 10 million new registered learners.

If you extrapolate edX’s revenue numbers to the whole year, it amounts to $44 million. This is less than the $47 million it made in the fiscal year (FY) 2019 and the $72 million of FY 2020. You can find a full table of the company’s revenues here.

Coursera, on the other hand, adds 5 million learners each quarter and recently crossed 100 million learners. It also made $120.4 million in Q1 2022, compared to $10.9 million edX made.

Recently, edX went through an RFP process, awarding $1 million in total to create 10 courses. The 2U CEO also claimed that they have “30+ MicroMasters in negotiation with our university partner base.”

From a 2U perspective, focusing on MicroMasters makes sense since they can be an on-ramp to their online degrees, but it probably won’t make much of a difference to the edX bottom line.

The distance between edX and Coursera is growing, and it is unclear whether 2U is willing or has the resources to “turn around” edX.

Tags