2U/edX Lays Off More Employees as Stock Continues to Decline

A year ago, 2U had already laid off staff as it recentered its strategy around edX, which it acquired for $800M.

| Year | Full-Time Employees | Part-Time Employees | Total Employees |

|---|---|---|---|

| 2016 | 1,119 | 90 | 1,209 |

| 2017 | 1,808 | 114 | 1,922 |

| 2018 | 2,583 | 86 | 2,669 |

| 2019 | 3,749 | 2,099 | 5,848 |

| 2020 | 3,772 | 2,834 | 6,606 |

| 2021 | 3,982 | 3,206 | 7,188 |

| 2022 | 3,445 | 3,699 | 7,144 |

Last year, 2U laid off a significant number of employees as it shifted to a “platform strategy” built around edX, which it acquired for $800 million in mid-2021.

2U’s CEO Chip Paucek contends that this new strategy is proving successful. Last week, he announced that additional layoffs are necessary to realign the company’s operations with its new business model.

Despite the positive spin, there is evidence that the platform strategy is not working well. Here is a quick recap of platform strategy:

- Reduce expenses by reducing personnel and by closing offices.

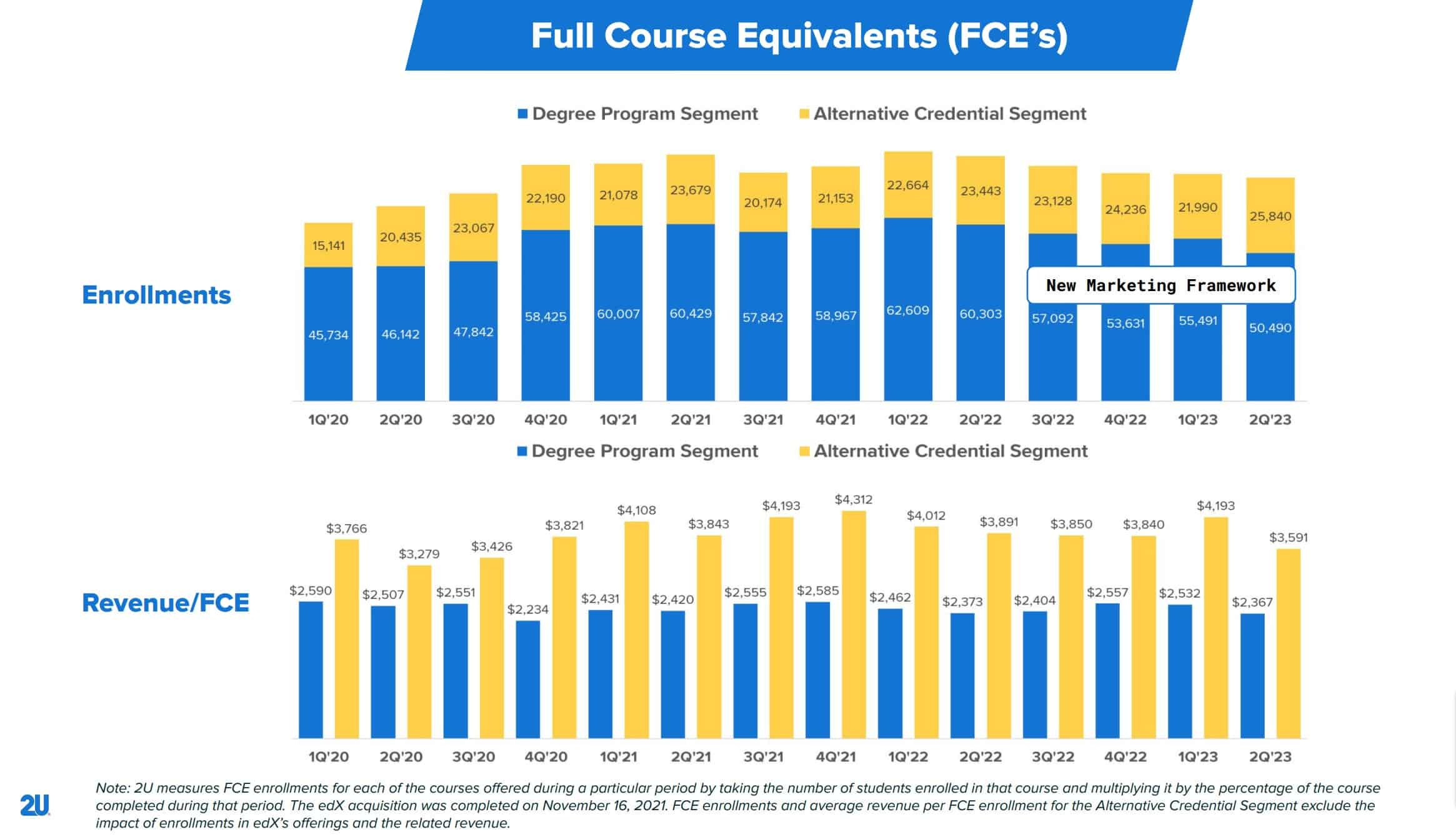

- Adopt a new marketing framework, using edX’s organic reach and moving away from paid ads.

- Lower tuition costs, leading to an increase in enrollments.

As part of this strategy, 2U would become a “platform company” by unifying all its operations under the edX brand, which 2U valued at $250 million.

2U has cut costs but has seen a decline in degree enrollments with the adoption of the new marketing framework, resulting in a drop of ~10,000 enrollments.

It is unclear whether any existing 2U partners have reduced tuition costs, which was supposed to boost enrollments. Last time I looked, I found 20% of 2U degrees cost more than $100,000.

The stock market is not impressed with 2U’s changes. The company’s stock price has dropped by 60% this year and 97% in the last five years. Its market capitalization is now just $200 million, well below the $800 million it paid for edX.

Tags

Sulaiman Mack

Thanks for your help and support

Jeff Winchell

$100K online degrees??? No wonder they quartered their valuation.

Marcus

Great to hear from you! 2U and edX, it seems that ends not well! I think, 2U doesnt really know what they should do with edX and how the platform fits in their portfolio. 2U bets on the big money they make with edX, because it was founded by strong university brands Harvard and MIT.

edX needs a new owner who understands the MOOC market, and is able to develop the platform. The sale was a big mistake by the founding partners, but they have done this because 2U buy edX: See the big money.

Dennis

Strange, there is an increase in part time staffing in edX.

Yes I admit the courses fees too expensive for students (non-credit) ones.

The lesson learnt is not all M&A are beneficial.

Wendell Asadang

I have not noticed yet and increase of part staffing.

Why did you increase the fees in case the subjects undertaken are not credit?

Lesson learn here are beneficial, good upgrade for your CV.