Why Coursera Stock Dropped by 20%

Degree enrollments slowdown in the US, headwinds for Consumer and Business in Europe.

Last week, Coursera announced their results for the second quarter of 2022, leading to an immediate stock price drop of around 20%.

Here’s how Coursera’s CEO Jeff Maggioncalda summarized it:

“Our overall revenue growth was lower than anticipated, particularly the performance in our Consumer and Degrees segments.”

In my previous quarterly reports for Coursera, I’ve usually kept it simple, presenting numbers in a straightforward way. But because of Coursera’s changing fortune, I learned new information about their business during this quarter’s earnings call, which I’ll summarize below.

| Consumer | Enterprise | Degrees | Total | |

| 2021 Q1 | $51.9M | $24.5M | $12.0M | $88.4M |

| 2021 Q2 | $62.0M | $28.2M | $11.9M | $102.1M |

| 2021 Q3 | $66.5M | $31.8M | $11.6M | $109.9M |

| 2021 Q4 | $65.8M | $35.9M | $13.3M | $115.0M |

| 2022 Q1 | $68.1M | $39.0M | $13.3M | $120.4M |

| 2022 Q2 | $69.7M | $43.7M | $11.4M | $124.8M |

Degrees

In 2022 Q2, Coursera’s degree revenues dropped to $11.4 million, compared to $13.3 million a quarter ago, and by 4% compared to a year ago.

Coursera attributed this to “lower-than-expected student enrollments, particularly in mature U.S. and European degree programs where our revenue is concentrated today.”

What I learned from the earnings call is that the majority of Coursera’s degree revenue comes from four graduate degrees, and these “saw limited to negative revenue growth year-over-year and three of these four in the US”. One of those programs is probably iMBA from the University of Illinois, Coursera’s first online degree.

Last year, during the Coursera Partner Conference, we learned that iMBA had 4,500 enrollments, and that the University of London’s online bachelor’s in computer science had 3,000 enrollments. At that time, these two degree programs accounted for more than half of Coursera’s degree enrollments.

But overall Degree enrollments did increase to 17,460 from 16,481 a quarter ago. So why did the revenue drop so much?

The reason is lower student activity — that is, students are taking fewer credit hours per semester, which effectively results in lower revenue.

It’s not just Coursera; 2U also saw a decline in degree enrollments and a drop in revenue per enrollment.

Consumer

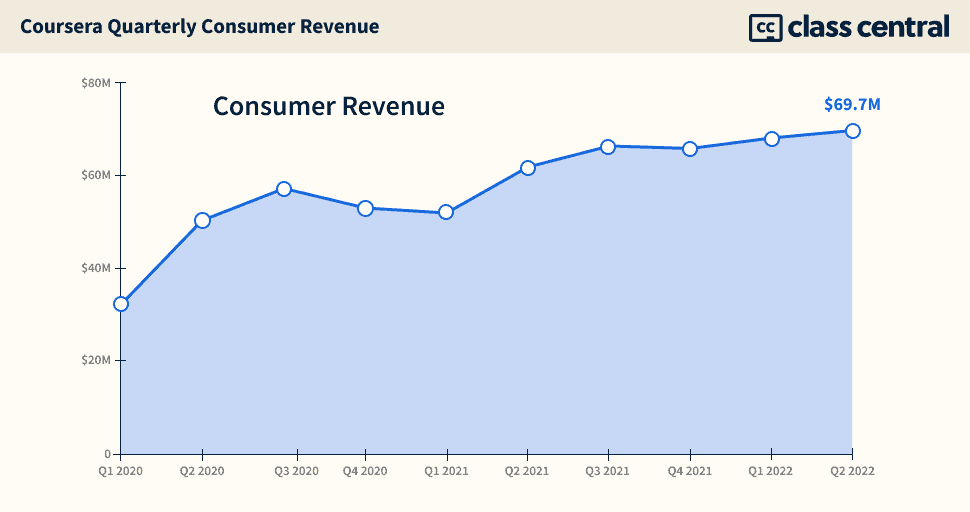

In Q2 2022, Coursera earned $69.7 million in Consumer Revenue, up from $68.1 million in Q1. Like last quarter, the company gained 5 million learners, taking their total learner base to 107 million users.

Coursera’s revenue growth was lower than anticipated. The company’s CFO, Kenneth Hahn, attributed this to two reasons:

“First, we saw softness in several markets outside of the U.S., particularly in EMEA, with new payer conversion rates that were below our seasonal expectations and may reflect ongoing macroeconomic challenges in the region. Second, we conducted several pricing and payment-related tests in markets around the globe that resulted in a negative impact on Consumer revenue.”

Further on, it was noted that the challenges were particularly in Europe.

In a Class Central exclusive back in April, we reported about Coursera’s pricing experiment. Due to changes in credit card rules in India, the company introduced a one-time payment option for subscriptions. In our research, we found that besides India, this payment option had also been made available in Brazil.

But according to Maggioncalda, when these experiments were expanded to Europe, they resulted in a revenue decline, prompting a roll back. Moving forward, Coursera will be “ensuring a few new sign offs as we look at future experiments.”

Another thing I noticed was Coursera’s increasing “segment gross profit” for the Consumer Business. This is the amount of money the company keeps after paying content creators. This quarter it was 73%, up from 71% last quarter and 66% a year ago.

According to the CFO, this is due to “lower content cost rate associated with higher consumption of industry partner content.” The industry partner content Coursera is referring to is Coursera Professional Certificates. These come from the likes of Google, Meta, and IBM. And “lower content cost” refers to how much Coursera pays course creators.

So for professional certifications, Coursera probably keeps a higher portion of the revenue compared to university partnerships. It was also mentioned that, “Research and development expense was 26% of revenue, up from 22% in the prior year period, driven by content development investments associated with our entry-level Professional Certificates.”

So it’s quite possible that Coursera funds the creation of these professional certifications.

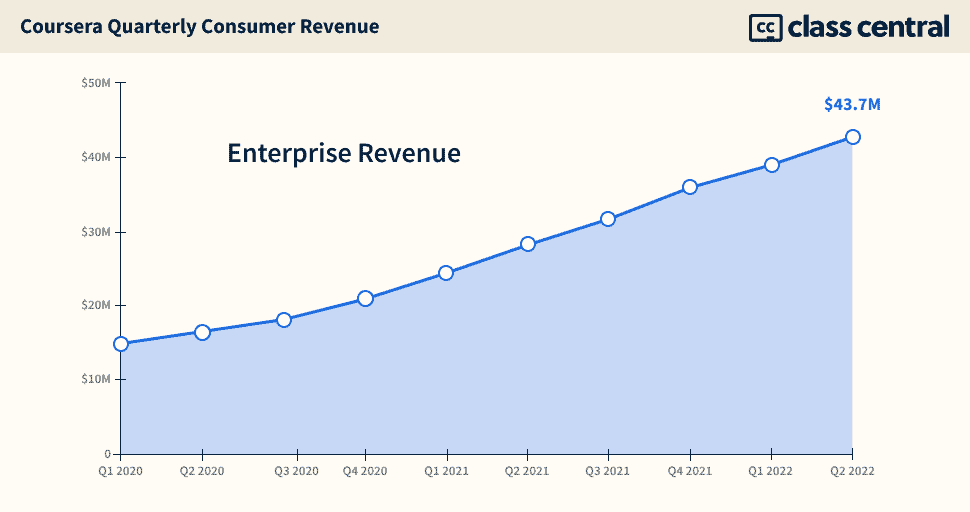

Enterprise

Overall, Enterprise was where Coursera showed strongest growth: a 41% year-over-year increase.

Its Enterprise business consists of three segments:

- Coursera for Campus

- Coursera for Business

- Coursera for Governments

Coursera for Business is facing challenges in Europe. According to Coursera’s CEO, the challenges are related to the “pipeline development process, as opposed to the churn rates.”

Headwinds

With 2U, we already received a second set of information validating the decrease in degree enrollments.

The closest player similar to Coursera is Udemy, which also went public last year. They will be posting their Q2 2022 report later in the week. We will learn then if they are facing similar challenges regarding their Consumer and Business segments, like Coursera.

I had previously noted in my analysis of Udemy’s 2021 annual report, that their Consumer segment wasn’t growing much and was, in fact, possibly declining. Even in 2021, they only grew by 1%.

But their B2B projections were above 60%. If they are facing similar headwinds as Coursera, we might also see Udemy’s stock drop to new lows.

Tags