Thinkific Lays Off 75 More Employees, After the 100 of Last March

As we enter 2023, layoffs in online education continue. Thinkific just underwent a 2nd round of layoffs.

In my analysis of 2022 titled The “New Normal” that Wasn’t, I wrote about how online learning companies overplayed their cards last year, leading to a number of layoffs and stock drops. Unfortunately, 2023 is not providing a reprieve.

Vancouver-based Thinkific, which went public in April 2021 (here’s my analysis of their IPO filing), has announced a second round of layoffs impacting about 75 people. These come in addition to 100 people the company laid off in March 2022.

The simplest way to describe Thinkific is as an ecommerce platform where creators can launch online courses under their own brand.

Looking at Thinkific’s numbers, their journey reminds me very much of FutureLearn. In their quest for growth, both dramatically increased their losses, without it having a proportional favorable impact on their revenue.

Last year, Class Central reported that FutureLearn had burned through the £50 million it raised from SEEK, and that the company needed an extra £15 million to survive.

| Revenue | Losses | Learners | |

| 2021 | £11.3m | £16.1m | £16.5m |

| 2020 | £9.9m | £13.3m | £13.5m |

| 2019 | £7.9m | £6.6m | £9.5m |

| 2018 | £8.2m | £4.1m | £8.0m |

The table above shows how FutureLearn’s losses increased once it raised money from SEEK in 2019. This culminated in layoffs in late 2022 and in the company being acquired by Global University Systems (GUS).

Thinkific is in a similar situation. The one big difference is that it should still have plenty of money in the bank, since it was able to raise $150+ million during its IPO.

| 2018 | 2019 | 2020 | 2021 | 2022 (Q1 – Q3) | |

| GMV | $68M | $112M | $276M | $414.8M | NA |

| Revenues | $6M | $9.8M | $21M | $38M | $37.7M |

| Net (loss) | $230K | $291K | ($1.3M) | ($26.3M) | ($32.8M) |

| Paying Customers | 7.1K | 10.9K | 24.6K | 32.3K | NA |

| Headcount | 70 | 102 | 223 | 450 | NA |

As the table above shows, Thinkific was profitable in 2018 and 2019. But in 2020, they raised $22M, doubled headcount, increased spending from $7.4M to $18.1M, and ended up with a net loss of $1.3M.

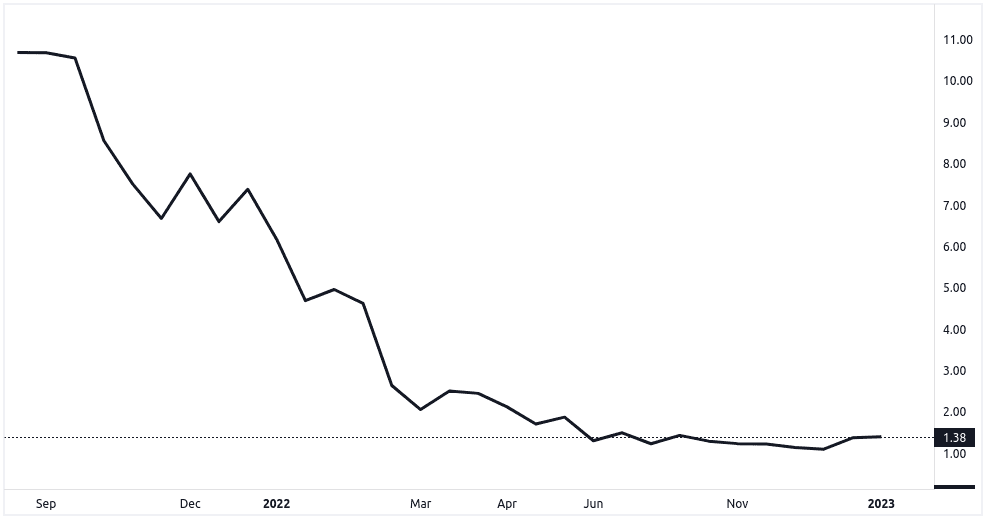

In 2021, the losses increased 20 times, from $1.3M to $26.3M, while in comparison, the revenue just doubled from $21M to $38M. The stock price has also suffered a lot since Thinkific’s IPO, dropping by 87%.

The downturn has led Thinkific to lay off 175 employees within a 10-month period. According to the letter published by Thinkific’s CEO and Co-Founder Greg Smith, these changes are supposed to make the company profitable by the end of 2023.

Wilson Thomas

I’m moving. Been with them for 6 not-so-smooth years. Now… customer support is non-existent. “Contact Support” link goes to FAQs and support topics; nothing to help “Contact Support”. You go round and round trying to get help and some links go to “404” pages, etc etc.

It is obvious experiencing the support cluster-*** that Thinkific is on it’s downward spiral. Stock price going to $2… Company is in really bad shape and has no grip on it’s SG&A expenses; these have increased over 800%!!!