Coursera’s 2023: $636M in Revenues, 24M New Learners, Shift Towards Proprietary Content

The company saw its strongest growth since 2020, adding 24M new learners for a global total of 142M.

Online learning platform Coursera announced its fourth quarter and full year 2023 financial results on February 1st, showing continued growth in both users and revenue.

The company added 24 million new learners last year, growing its total global learner base to 142 million. This was the highest number of new learners added in a year since 2020, when the COVID-19 pandemic drove elevated demand for online learning.

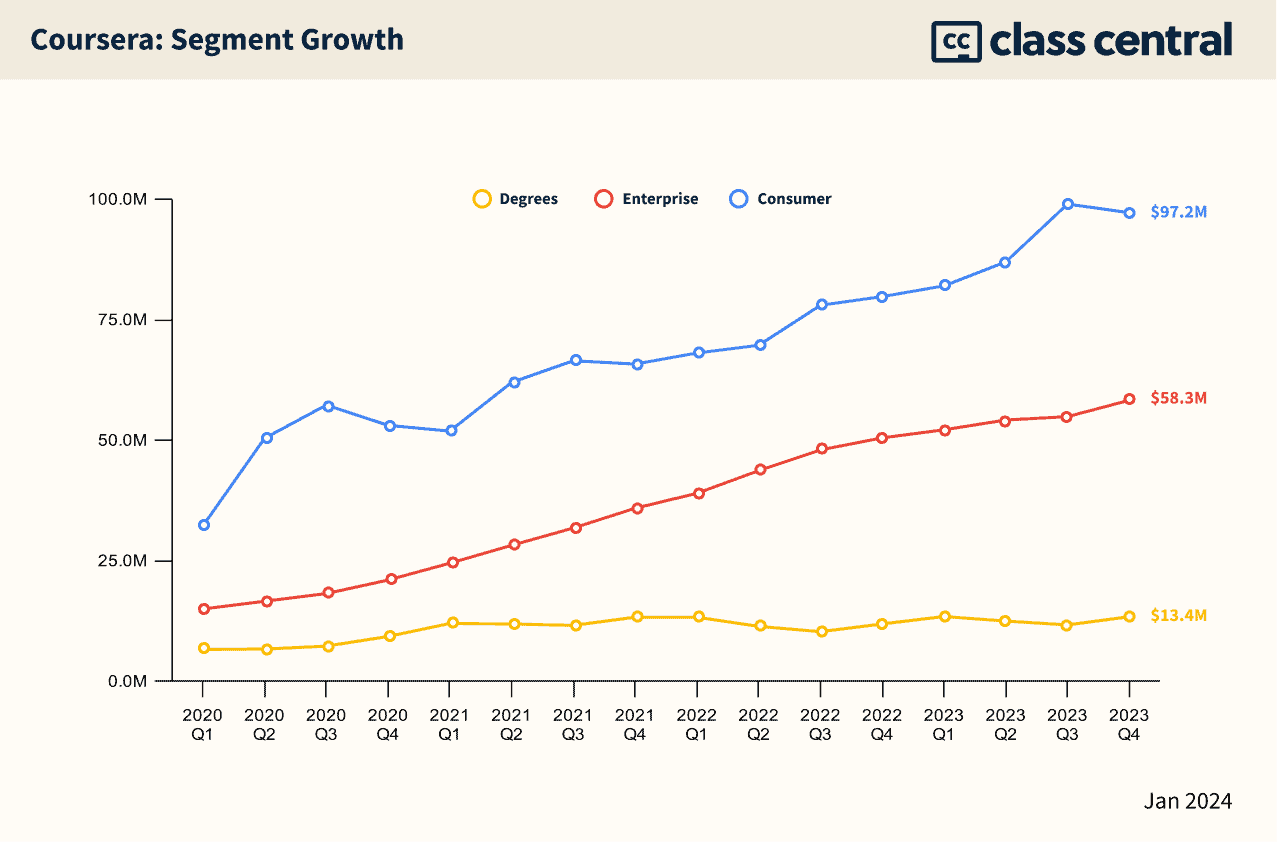

Full year revenue for 2023 grew 21% compared to 2022, reaching $636 million. Growth was primarily driven by Coursera’s consumer business, which includes entry-level courses and professional certificates. The enterprise business, serving business and government customers, and the degrees business also contributed to top-line growth over 2023.

Industry Partners Driving Consumer Growth

A key driver of Coursera’s strong 23.6% year-over-year consumer revenue growth continues to be its partnerships with major tech companies like Google, IBM, and Microsoft.

Coursera now offers close to 50 professional certificate programs in fields like data science, cloud computing, and digital marketing.

Back in early 2023, Class Central estimated that Google’s professional certificates alone could generate around $100 million in annual revenue for Coursera. With nearly 50 such programs now, it would not be surprising for industry partner content to be Coursera’s largest source of consumer revenue.

In 2024, Coursera mentioned they are focused on adding new job roles from new industries with new and existing partners.

Strategic Shift Towards More Proprietary Content

During the earnings call, Coursera also highlighted plans to increase investments in proprietary content production to enhance their catalog exclusivity. Proprietary content also has better margins for the company. Coursera expects to spend roughly $20 million on content assets in 2024, a significant increase from the $5 million spent in 2023.

Enterprise Growth Slowing

In 2023, Coursera’s enterprise business grew 21% compared to 50% a year earlier. This is close to where Coursera’s consumer business stands, but the revenue base is much lower.

Coursera in previous quarters had pointed to “headwinds” as a reason for slower growth in enterprise. However, Udemy has been able to grow enterprise revenue significantly over the same period. As shown in the graph above, Udemy’s enterprise growth remains strong while Coursera’s seems to be plateauing.

It seems that Coursera struggles in enterprise while Udemy struggles in consumer. My theory for this is that Coursera’s biggest strength is credentials which fare well for consumers, while Udemy’s extensive catalog covers almost any topic imaginable, making it better suited for companies.

Degrees Segment

Degree revenue expanded just 8.9% in 2023 even as total degree enrollments rose to 22,025 students. Monetizing degree programs appears to remain difficult.

Generative AI Investments

Throughout the call, Coursera kept highlighting its investments in generative AI. To that end, Coursera has launched a Generative AI Academy featuring partners like Microsoft, Stanford, and Google Cloud.

As part of the executive program, CEO Jeff Maggioncalda launched a new course called “Navigating Generative AI: A CEO Playbook.” “Generative AI for Everyone” course by Coursera co-founder Andrew Ng, became the fastest growing course of 2023.

Last year, Coursera also launched a virtual AI teaching assistant called Coursera Coach to 25% of paid learners. The assistant remains in beta testing.

2024 Outlook

For 2024, Coursera expects continued strong growth, with initial full year guidance calling for 21–25% revenue expansion to $730–740 million. If met, it would mark Coursera’s third straight year of over 20% revenue growth.

The company achieved positive Adjusted EBITDA for the first time in Q4 2023 and expects further improvement in 2024, with anticipated Adjusted EBITDA between $26–32 million.

Tags