Coursera’s New Deal with Google Could Cost the Company Millions

According to Coursera CFO, the new terms represent a significant “shift”. Let’s dig into the numbers.

Last week, Coursera published its 2022 annual report. I’ll post a detailed analysis soon, like I did last year.

But in this article, I’d like to focus on what Coursera’s CFO Ken Hahn described earlier this month during Coursera’s earnings call as a “geography shift within the P&L” of the company.

Let’s dig into it.

The Change

So what’s this “geography shift” about? Well, it stems from a significant event at Coursera: the “multi-year contract extension we secured with our largest industry partner in this new year”, as Hahn puts it.

This largest industry partner is Google. Basically, Google renegotiated certain terms with Coursera — in particular, their revenue share agreement. To understand the significance of the new agreement, we have to first look at the old one. Here’s how Hahn described the previous arrangement:

“In lieu of a higher revenue share, some industry partners prioritize additional spend to promote their brand, global reach, and social impact initiatives, which is included as part of our operating expenses, primarily as sales and marketing efforts and content production.”

Put simply, industry partners let Coursera get a bigger cut of the revenue generated by their offerings, and in return, Coursera invested into sales, marketing, and content production, which benefited their partners.

For Coursera, this tradeoff had two immediate effects:

- Higher margins: Since Coursera got a bigger cut of the revenue, their margins improved. This is particularly notable in their consumer segment.

- Higher operating expenses: Since Coursera invested more in sales, marketing, and content production, their operating expenses increased.

I was able to verify this to a certain point by looking at Coursera’s segment margin and losses over the years. I came across these during my analysis of their IPO filing (S–1) and 2021 annual report (10–K).

| Consumer Margin | Enterprise Margin | Total Margin | |

| 2017 | 50% | 64% | |

| 2018 | 54% | 71% | |

| 2019 | 53% | 71% | 51% |

| 2020 | 55% | 69% | 53% |

| 2021 | 66% | 67% | 60% |

| 2022 | 73% | 70% | 63% |

| 2023 (Projected) | 52% | 52% |

Here’s how Coursera defines the Segment (Consumer, Enterprise, and Degrees) Gross Margin:

Segment gross profit represents segment revenue less content costs paid to educator partners; segment gross margin is the quotient of segment gross profit and segment revenue.

Google’s first Professional Certificate on Coursera, the Google IT Support Certificate, was announced back in 2018. But it was only in March 2021 that Google introduced three new certificates on the platform. As you can see above, in 2021, Coursera’s consumer margin jumped to 66%, from 55% the prior year.

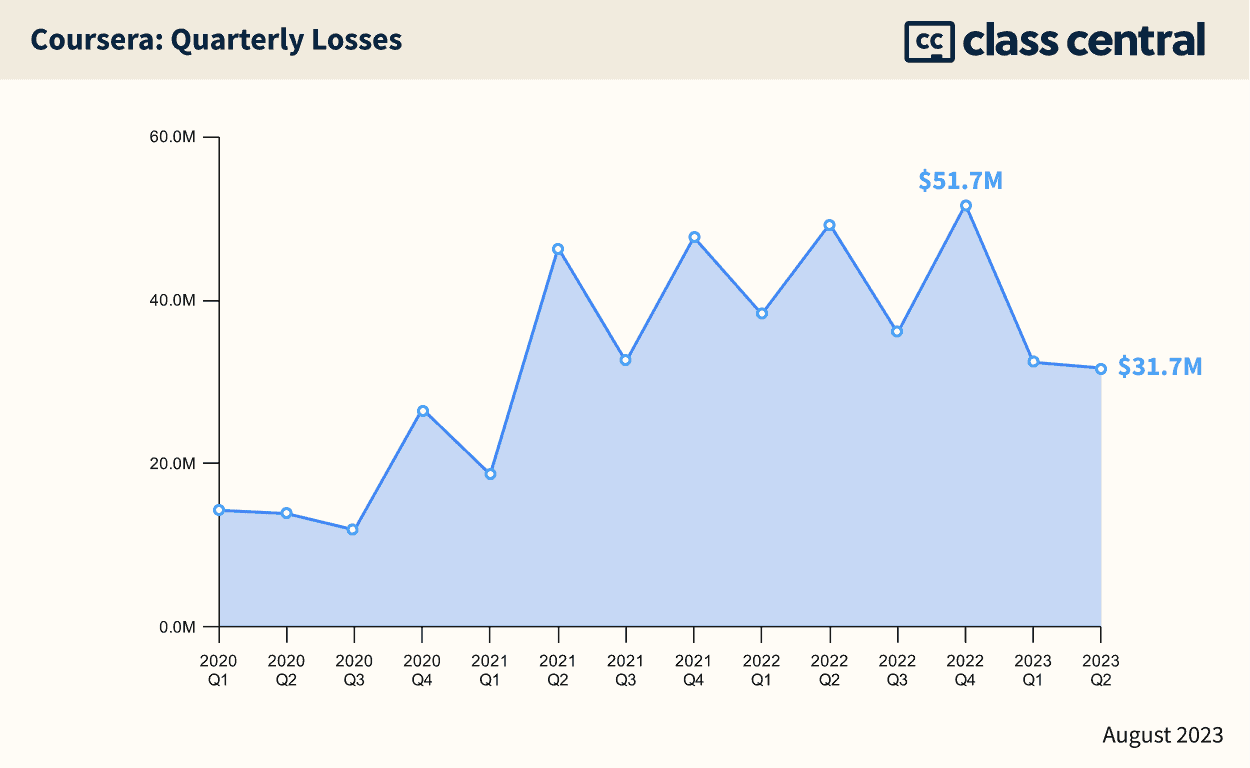

And in Q2 2021, Coursera’s losses increased significantly, from 18.7M to 46.4M, as you can see below.

So the expansion of Google’s offering coincided with a higher consumer margin and higher losses on Coursera’s side. This seems consistent with Hahn’s description of their prior agreement, suggesting that the losses might stem from the additional “sales and marketing efforts and content production”.

Those were the old terms. Now, let’s look at the new ones.

The Impact

Under the new terms, Google and Coursera are switching to a more “standard revenue share”. And this transition is what is supposed to bring about the “geography shift” discussed earlier. Here’s how the CFO put it in the earnings call:

“First, the transition to a more standard revenue share will result in a geography shift within the P&L of an estimated 10 percentage points of total revenue, from operating expense to cost of revenue. We now expect both total gross margin and our Consumer segment margin to be approximately 52% this year.”

In Coursera’s 2021 annual report (10–K), the “cost of revenue” is defined as follows:

“Cost of revenue consists of content costs in the form of a fee paid to educator partners and expenses associated with the operation and maintenance of the Company’s platform. These expenses include the cost of servicing both paid learner and educator partner support requests, hosting and bandwidth costs, amortization of acquired technology and internal-use software, customer payment processing fees, and allocated depreciation and facilities costs.”

But I think in this case, it’s mainly the content costs, in the form of a fee paid to partners. Per Coursera’s annual report, other expenses don’t seem to be factored into segment margins:

“Expenses other than content costs included in cost of revenue are not allocated to segments because they are managed at the consolidated corporate level.”

In other words, Google will now take a bigger cut of the revenue generated by its offerings. But Coursera won’t be required to invest as much into sales and marketing. So for Coursera, content costs go up, but the operation expenses go down. This is the “geography shift” Hahn was talking about.

But for 2023, the Coursera CFO expects the company to “incur expenses of $25 million in 2023, which will be similar in nature to our historic spend for the program, including sales and marketing efforts, content production, and product development.”

Google’s Share of Coursera’s Revenue

So this begs the question: how much revenue does Google contribute to Coursera?

| 2022 | 2023 | |

| Total Revenue | $523M | $600M |

| Gross Margin | 63% | 52% |

| Gross Profit | $329M | $312M |

In 2023, Coursera expects revenue in the $595–605 million range, up from $523 million in 2022, which represents an increase of about 15%. But despite this growth, Coursera expects its 2023 gross profit to be less than in 2022. This is largely due to Coursera’s new contract with Google.

If the new terms between Coursera and Google had come into effect a year earlier — that is, if the gross margin in 2022 had been 52% — Coursera’s gross profit in 2022 would have been $272M. That’s $57M less than what they actually made. So, can we assume that all this money is going to Google?

In addition, we also know from Coursera’s annual report that “30% of our total revenue comes from the content and credentialing programs of five partners”. So for 2022 this amounts to $157 million.

This puts Google’s revenue in the $57–157 million range. Therefore, it’s quite possible that Coursera makes around $100M from Google courses. The new terms impact Coursera’s margin on this revenue, hence the “geography shift”.

To learn more about the business side of Coursera, read our previous coverage: