The Business of Online Education: A Deep Dive Into Coursera’s Financials

Discover how Coursera makes money, its different segments, revenue growth, margins, and more.

Coursera started out as a noble experiment: offering free courses from top universities to anyone with an internet connection. But free courses don’t pay the bills, so Coursera had to figure out how to make money from its millions of learners.

The company tried various things over the years: limiting free access, charging for certificates, selling subscriptions, partnering with companies and governments, creating degrees and credentials…

Now, Coursera is a big business with more than half a billion in annual revenue. I’ve previously written about how Coursera got to this point.

But where does its money come from? How much does it earn? How profitable is it? I have dug into Coursera’s financials, using its public filings and earnings calls. Read on to learn more.

You can find Class Central’s entire coverage of Coursera on The Report here.

Quick Coursera Statistics

Before going in depth, here are some quick stats about Coursera.

- $524M in revenue in 2022, at a loss of $175.4M.

- 47% of revenue came from learners outside of the U.S.

- 60% of the 2022 Consumer segment revenue came from individual learners who were registered on Coursera as of December 31, 2021.

- 118M total registered learners.

- At the end of 2022, in spite of layoffs, Coursera grew to 1,401 full-time employees from 1,138 the previous year.

- Before the pandemic, Coursera Consumer’s growth rate was 12.6%, down from 25.4% a year earlier. In 2020, during the pandemic, it grew by 59.5%.

- 30% of revenue comes from the content and credentialing programs of five partners. In 2022, this amounts to $157M.

- Class Central estimates that Google’s content generates $100M in revenues for Coursera.

How Coursera Makes Money: A Product at Every Price

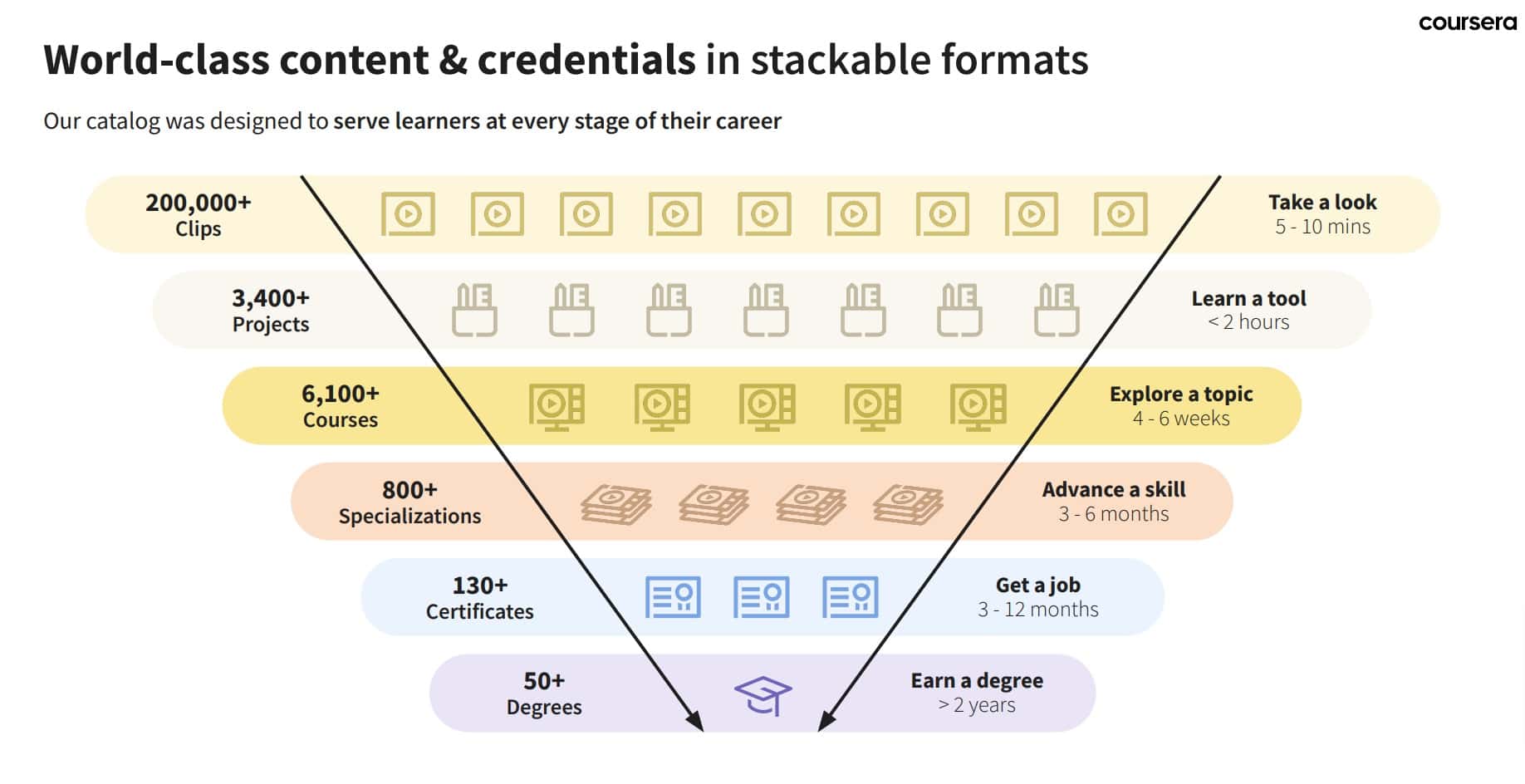

Coursera’s investor presentation includes a nice little image to showcase their catalog of products — with tiers ranging from $10 project to $45k online degrees. In 2020, Coursera introduced a catalog subscription called Coursera Plus which gives access to a majority of the provider’s middle tiers (courses and some microcredentials) for $399 a year or $59 per month.

Five years ago, I described this strategy in Six Tiers of MOOC Monetization as follows:

Courses produced by brand-name institutions (now including some corporate entities in addition to universities) remain at the heart of what the MOOC platforms offer. Additional features (e.g. credentials, additional services) are layered on top of the courses. Each tier of pricing adds some value on the tiers below. Essentially, the same product (the one that anyone can register for, free of charge) is being monetized at different pricing levels, with the free product acting as a marketing channel that feeds customers into other, higher priced products.

Now we can see it fully played out. Coursera calls it the “freemium flywheel”.

Learners can audit most of Coursera’s courses for free, but they usually need to upgrade to get certificates and graded assignments. They can buy a single course, subscribe to a specialization, or subscribe to almost the whole catalog. The options depend on the course.

Guided Projects are the result of Coursera’s 2019 $10-million acquisition of Rhyme, an edtech startup based in Sofia, Bulgaria. Guided Projects are created by “subject matter experts” and cost $9.99.

Coursera’s divides its business into three different segments:

- The Consumer segment targets individual learners.

- The Enterprise segment is focused on serving businesses, governmental organizations, and academic institutions.

- The Degrees segment partners with universities to deliver fully online bachelor’s and master’s degrees.

The Consumer segment generates most of Coursera’s revenue (56% of the total), but the Enterprise segment is growing faster. In the Enterprise segment, organizations and governments can buy access to most of Coursera’s catalog for their employees.

In my report for Class Central, I described how these segments started and evolved during Coursera’s monetization journey.

Coursera Revenues

| Total | Consumer | Enterprise | Degrees | Net Loss | |

| 2022 | 524m | 295.6m | 181.3m | 46.9m | ($175.4m) |

| 2021 | 415.3m | 246.2m | 120.4m | 48.7m | ($145.2m) |

| 2020 | $293.5m | $193m | $70.8m | $29.9m | ($66.8m) |

| 2019 | $184.4m | $121m | $48.2m | $15.1m | ($46.8m) |

| 2018 | $141.8m | $107.5m | $26.0m | $7.4m | ($43.6m) |

| 2017 | $95.6m | $85.7m | $7.4m | $2.5m | ($53.3m) |

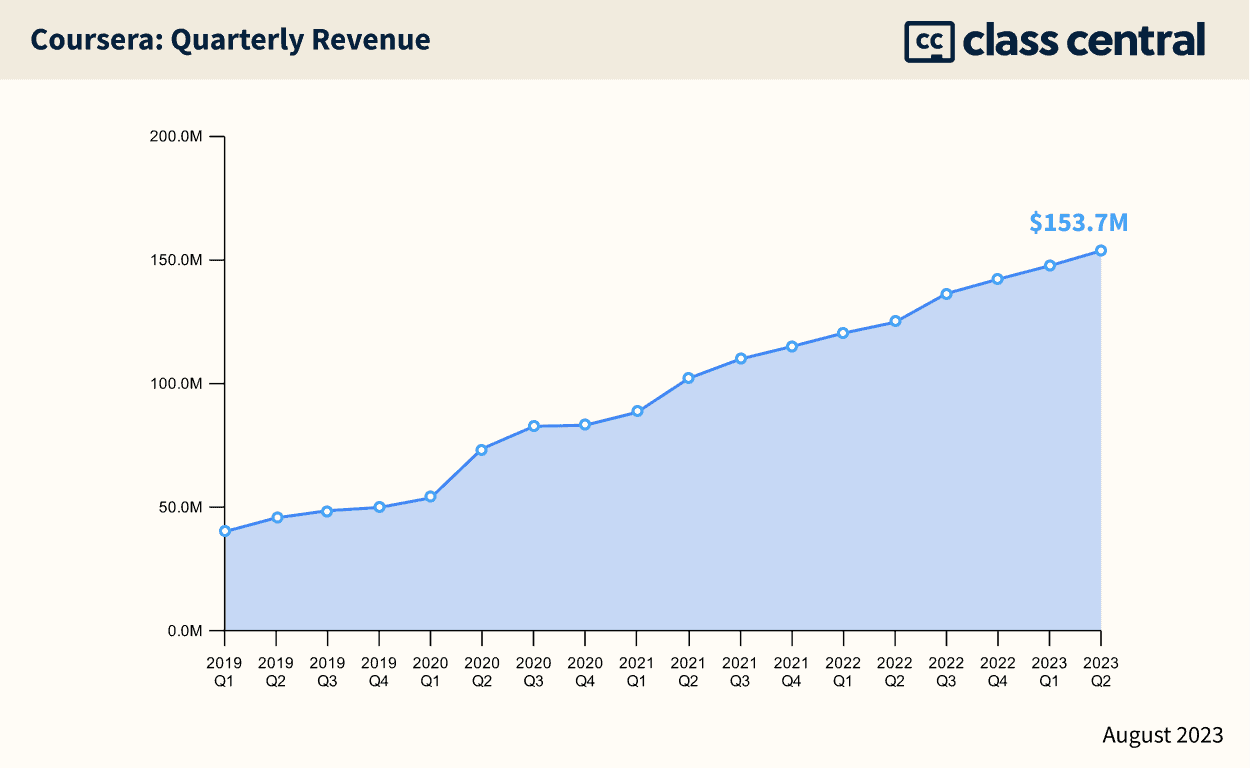

In 2022, Coursera’s revenues increased by 26% year-over-year from $415.3 million to $524 million, while losses grew from $145.2 million to $175.4 million.

For 2023, the company projects revenues in the range of $595 million to $605 million, which represents an increase of approximately 15% over 2022.

In 2022, almost 47% of Coursera’s revenue came from outside the United States, compared to 49% in 2021. And no individual country outside the US accounted for more than 10% of Coursera’s revenue.

| 2022 | 2021 | 2020 | 2019 | |

| United States | $276m | $210.5m | $143.5m | $90m |

| Europe, Middle East, and Africa | $130.6m | $112.6m | $83.2m | $52.1m |

| Asia Pacific | $68.9m | $54.8m | $40.7m | $27.7m |

| Other | $48.2m | $37.368m | $26m | $14.7m |

Coursera’s Revenue Growth Rates By Segment

| Total | Consumer | Enterprise | Degrees | Net Loss | |

| 2023 (Projected) | 15% | 10% | 20–25% | 10% | |

| 2022 | 26% | 20% | 51% | -4% | 21% |

| 2021 | 41% | 28% | 70% | 63% | 117% |

| 2020 | 59% | 60% | 47% | 98% | 43% |

| 2019 | 30% | 13% | 85% | 104% | 7% |

| 2018 | 48% | 25% | 251% | 196% | -18% |

The Consumer segment accounted for 56% of total revenues, down from 59% in 2022. As Coursera grows, the Enterprise segment is expected to account for a larger share of total revenue. This trend is similar to that seen with Udemy, where B2B revenues exceeded B2C revenues.

The impact of the pandemic on Coursera’s Consumer segment is evident. In 2019, Coursera’s Consumer growth rate was only 12.6%, down from 25.4% the previous year. However, in 2020, due to the pandemic, the growth rate shot up to 59.5%.

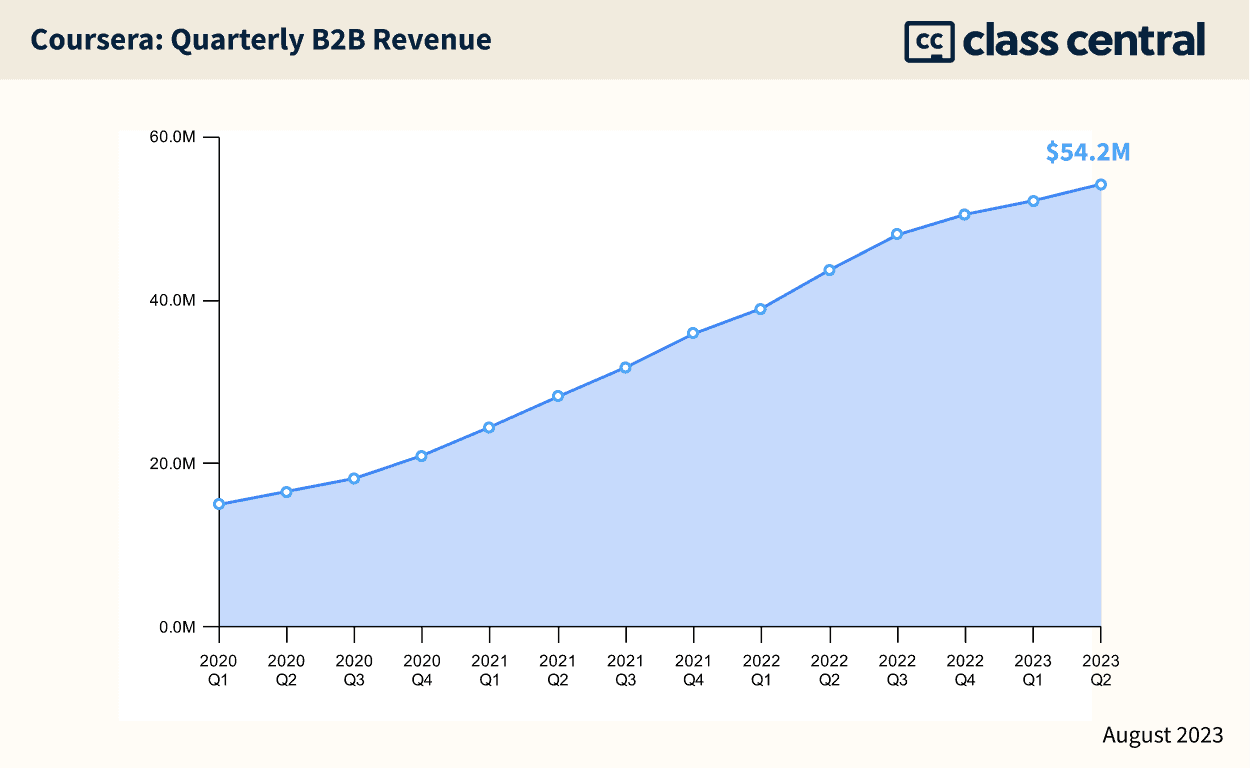

Over the past two years, the Enterprise segment has been Coursera’s fastest-growing segment. Additionally, in 2022, the Enterprise segment grew at a rate of 50.6%, compared to 20% for the Consumer segment and -3.7% for the Degrees segment.

Coursera projects its lowest growth rate for 2023. The enterprise segment will grow by 20-25%, and the consumer and degrees segments by 10%. Overall growth rate may be 15%.

Coursera’s Segment Margin and Gross Margin

| Consumer Margin | Enterprise Margin | Total Margin | |

| 2023 (Projected) | 52% | 52% | |

| 2022 | 73% | 70% | 63% |

| 2021 | 66% | 67% | 60% |

| 2020 | 55% | 69% | 53% |

| 2019 | 53% | 71% | 51% |

| 2018 | 54% | 71% | |

| 2017 | 50% | 64% |

Here’s how Coursera defines Segment (Consumer, Enterprise, and Degrees) Gross Margin:

Segment gross profit represents segment revenue less content costs paid to educator partners; segment gross margin is the quotient of segment gross profit and segment revenue.

Over the years, Coursera’s gross and individual segment margins have been increasing. In particular, the Consumer segment experienced a significant jump in 2021 but is expected to drop again in 2023.

The reason for this is due to Coursera’s largest industry partner, Google, renegotiating their agreement as part of a “multi-year contract extension.” Previously, Google had been sharing a higher percentage of revenues earned from their content and certificates with Coursera. However, in 2023, Google and Coursera will switch to a “standard revenue share,” which is impacting Coursera’s margins.

Google’s first Professional Certificate on Coursera, the Google IT Support Certificate, was announced back in 2018. But it was only in March 2021 that Google introduced three new certificates on the platform. As shown above, Coursera’s Consumer margin jumped to 66% in 2021 from 55% the prior year.

During the earnings call, Coursera’s CFO referred to a “geography shift within the P&L” of the company. According to my analysis, Google’s share of Coursera’s revenue could be in the proximity of $100 million.

If you find this type of information interesting, you may want to read my in-depth analysis on how Coursera’s new deal with Google could cost the company millions.

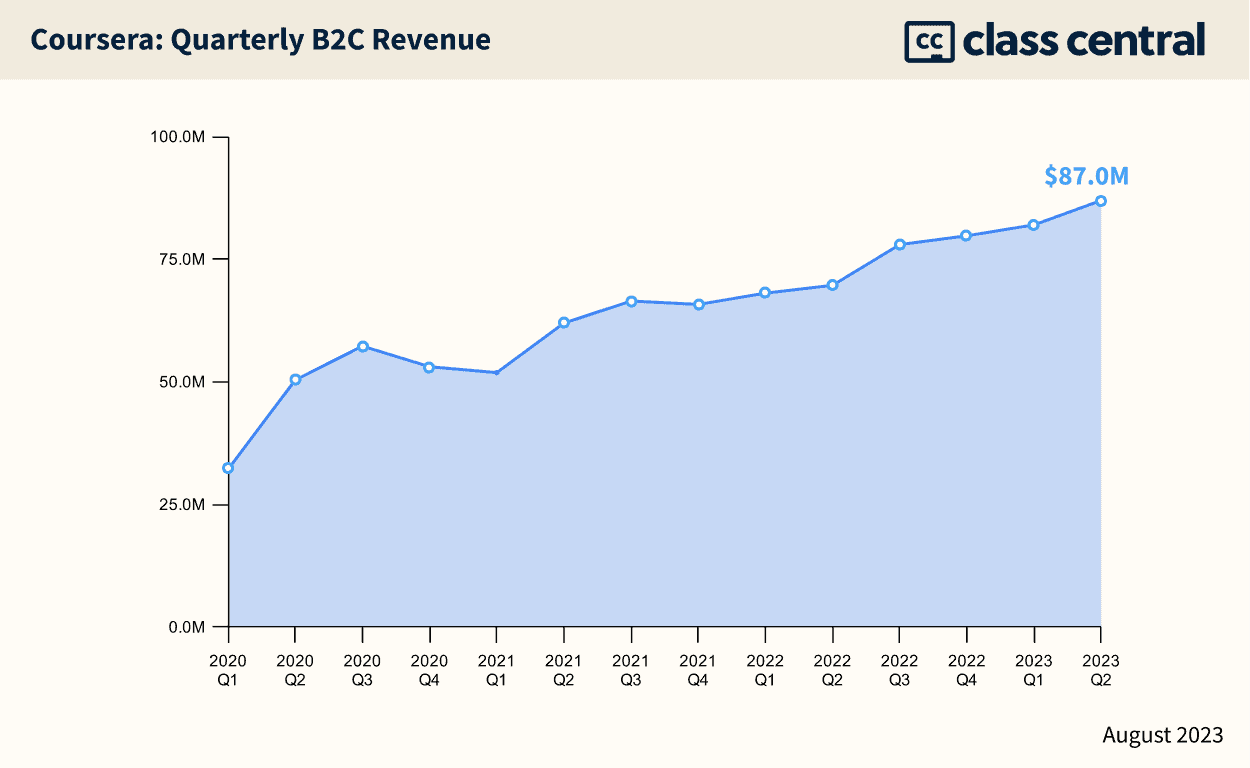

Consumer Segment

Coursera’s consumer segments account for the majority of its revenues. In just three years, Coursera’s consumer segment revenue has grown from $32.1 million a quarter to almost $80 million a quarter. But the freemium-model also attracts learners who may later enroll in its Degrees and Enterprise segments.

In 2022 Q2, Coursera suffered a slight setback in its Consumer segment which was partially responsible for a 20% stock price drop. According to the company’s CFO Kenneth Hahn, one of the reasons for slower than anticipated growth is: “several pricing and payment-related-tests in markets around the globe that negatively impacted consumer revenue”.

In a Class Central exclusive, we reported about Coursera’s pricing experiment. Due to changes in credit card rules in India, the company introduced a one-time payment option for subscriptions. In our research, we found that besides India, this payment option had also been made available in Brazil.

But according to coursera CEO Jeff Maggioncalda, when these experiments were expanded to Europe, they resulted in a revenue decline, prompting a roll back. Moving forward, Coursera will be “ensuring a few new sign offs as we look at future experiments.”

For 2023, Coursera expects the Consumer Segment to grow by 20%.

Enterprise Segment

Overall, Enterprise was where Coursera showed strongest growth: a 51% year-over-year increase. The segment revenue grew from $120.4 in 2021 to $181.3 million in 2022.

Its Enterprise business consists of three segments:

- Coursera for Campus

- Coursera for Business

- Coursera for Governments

For 2023, Coursera expects a growth rate of 20-25%.

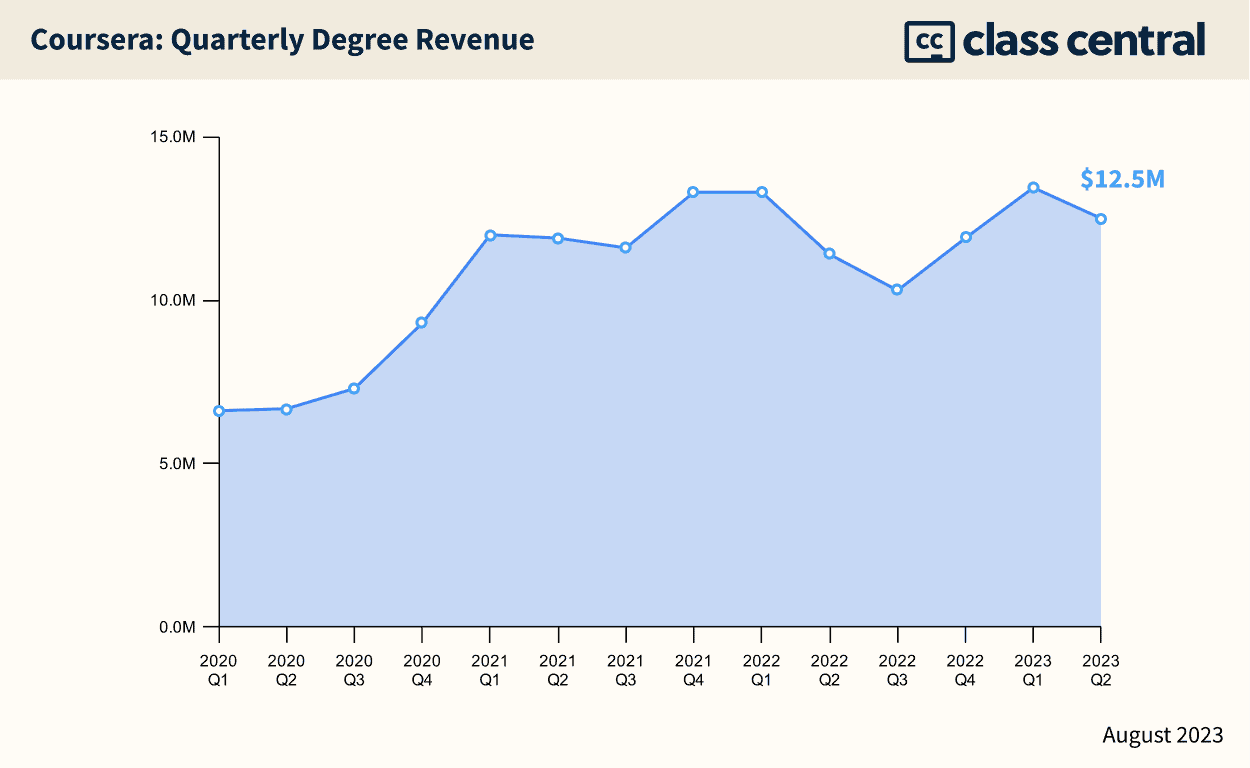

Degrees Segment

Overall, Coursera’s degrees segment is its slowest growing segment and in 2022 it declined by 4% from $48.7 million in 2021 to $46.9 million in 2022.

Coursera attributed this to “lower-than-expected student enrollments, particularly in mature U.S. and European degree programs where our revenue is concentrated today.”

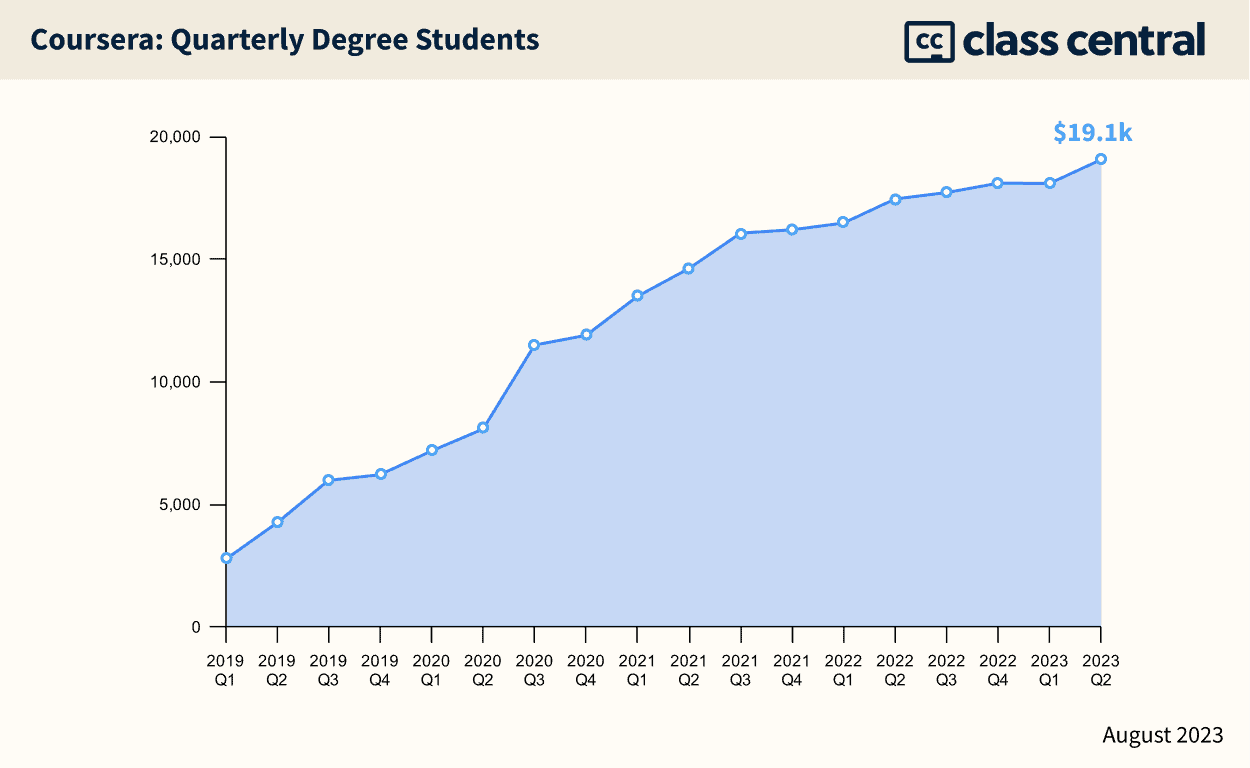

In 2022, we saw 2 quarters of declining revenue while enrollments increased (as shown below). The reason is lower student activity — that is, students are taking fewer credit hours per semester, which effectively results in lower revenue.

At the end of 2022, the total number of degree enrollments crossed 18,000 across its 40+ Masters and Bachelors programs.

DeepLearning.AI Revenues

| Revenue | |

| 2019 | $5.9 million |

| 2020 | $6.1 million |

| 2021 | $6.5 million |

| 2022 | $5.7 million |

| Total | $24.2 million |

In their S-1 prospectus, Coursera shared how much it paid Deeplearning.AI — the company of Coursera’s co-founder and Board Member Andrew Ng — which offers courses on the platform.

In the 10–K, it refers to Deeplearning.AI as a “related party”:

During the year ended December 31, 2017, we entered into a content sourcing agreement with a related party in the normal course of business and under standard terms. Content fees earned by the related party during the years ended December 31, 2022, 2021, and 2020 were $5,679, $6,558, and $6,171, respectively.

These numbers are a bit different from the ones Coursera disclosed in their S-1.

The “standard terms” can be found in the ONLINE COURSE HOSTING AND PLATFORM SERVICES AGREEMENT between Coursera and DeepLearning.AI. To summarize, the revenue is shared 50-50.

Back in 2017, almost six years after he introduced his Machine Learning class, Andrew Ng announced that he would launch a Deep Learning Specialization. Since then, DeepLearning.AI has expanded to 80+ courses and specializations.

Most notably, Deeplearning.AI courses are not part of the Coursera Plus subscription. This probably means that they get a higher percentage of the revenue share.

Tags

Arjun

Very well written and researched article. Loved reading it and better understanding one of the biggest edtech companies in the world.

Would love to have a similar deep dive on non-public companies as well (can understand data would be sparse and maybe inaccurate!)

Anil P. Agarwal

Dhawal,

Your articles are informative and insights full. Thanks for your efforts!

Adil saadouni

Your articles are informative and insights full. Thanks for your efforts!

Wabiner Douglas Ferrinho

Dhawal,

I was always curious to know the coursera data and better understand some concepts. Thanks for the matter!

Seun

Very insightful and informative article.

Great Job Dhawal