2U/edX’s Disastrous Q3: Split with USC, Layoffs, and Pearson’s OPM Portfolio Takeover

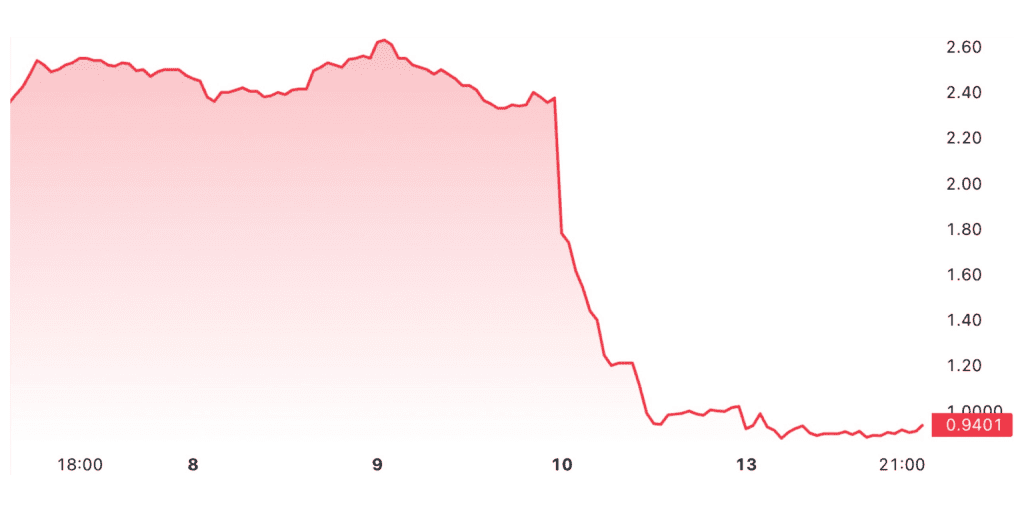

2U’s 2023 Q3 results triggered a 50% stock drop. The company is currently valued at below $80 million.

Last week, 2U announced its 2023 Q3 results, sending its stock price plummeting more than 50%. At the time of writing, 2U is valued at less than $80 million. This comes just two years after the company acquired edX for $800 million in cash. As of the end of Q3 2023, 2U holds $883.1 million in debt.

Last year, Coursera’s stock price crashed by 20% following the announcement of its 2022 Q2 results. During such turbulent times, companies are often more forthcoming with information during investor earnings calls.

I have thoroughly reviewed the Q3 earnings report, the earnings call transcript, and conducted some additional research. I have uncovered details that you will not find anywhere but on the Class Central Report. Continue reading to learn more.

2U Loses Its Most Expensive Degree

| Degree | Price |

| Doctor of Education in Organizational Change and LeadershipUSC | $92K – $128K |

| Doctor of Physical TherapyUSC | $201K |

| Doctorate of Social WorkUSC | $86K |

| Master of Arts in TeachingUSC | $60K |

| Master of Arts in Teaching – Teaching English to Speakers of Other LanguagesUSC | $51K |

| Master of Education in School CounselingUSC | $105K |

| Master of Science in Integrated Design, Business and TechnologyUSC | $81K |

| Master of Science in NursingUSC | $100K |

| Master of Social WorkUSC | $86K |

Last year, I compiled pricing data for all online degrees listed on 2U’s website. Among the 112 programs analyzed, 20% exceeded a total cost of $100,000. The priciest was USC’s Doctor of Physical Therapy at $201,000.

Recently, 2U and USC jointly announced the termination of their partnership, describing the decision as “mutually agreed upon”.

“After much thoughtful consideration, 2U and USC have mutually agreed to conclude our relationship with respect to 2U providing services for USC’s online degree programs… Over the next 15 months, 2U and USC will work together to effectively transition the delivery and administration of these programs to the university.”

As part of this agreement, USC will pay 2U a $40 million “break fee.” This payment falls under 2U’s “Portfolio Management” strategy, aimed at exiting programs misaligned with its strategic direction. More details on this strategy are discussed below.

USC’s decision was influenced by a desire to regain control over its online programs and tuition revenue, and the diminishing financial returns from the partnership. The Masters of Social Work program, 2U’s inaugural online degree offering with USC, has recently come under fire. In 2021, the Los Angeles Times Editorial Board criticized the program’s recruitment tactics in an op-ed titled “USC tarnishes its reputation again, this time with for-profit recruitment tactics.”

The USC-2U partnership faced numerous challenges, including lawsuits from students. A 2021 Wall Street Journal report highlighted the partnership’s issues, pointing out the high debt and low earnings of graduates from USC’s online social-work master’s program. The report also exposed aggressive recruitment tactics targeting low-income minority students, significant student debt, and a mismatch between program costs and the economic benefits for graduates.

According to the Wall Street Journal, USC paid 2U approximately $398 million from 2013 to 2020.

“Portfolio Management”

The termination of the partnership with USC isn’t an isolated incident for 2U, though it was the only one highlighted in a press release. 2U labels this process as “Portfolio Management”. CEO Chip Paucek elaborated on this during the earnings call:

“As we discussed previously, our platform strategy includes phasing out degree programs that underperform financially, have unfavorable debt-to-earnings ratios, strained partner relationships, or other issues. We describe this phasing out as ‘portfolio management’, wherein we and our partners mutually agree to discontinue certain programs, typically in exchange for a fee.”

As the CEO indicated, 2U earns an exit fee from these terminations. By October, agreements worth $96 million had been signed, with an additional $49 million expected in the fourth quarter of 2023. These funds will be received over the next 12 to 24 months.

2U portrays the termination of partnerships with universities as their own decision, so it remains unclear why the universities are obligated to pay the associated fees.

Interestingly, 2U accounts for this revenue in the quarter when the agreement is signed. Therefore, in Q3 of 2023, the company recognized $26 million in revenue, corresponding to the fee agreed upon with the university (not specified) for program transitions.

Additionally, 2U anticipates accounting for another $80 million in Q4 of 2023, including $40 million from USC. Despite this influx of funds, 2U has lowered its full-year revenue forecast to between $965 million and $990 million, a decrease from the previous estimate of $985 million to $990 million.

2U Takes Over Pearson’s OPM Portfolio

Part of 2U’s “portfolio management” strategy includes rotating out certain degree programs. Previously, 2U planned to launch 50 degrees, but this target has now been increased for 2024. CEO Chip Paucek explained:

“We’re set to launch over 80 degrees in 2024, up from our initial target of 50, with over 70 being flexible programs. We’ve already signed contracts for more than half of these, as detailed in our earnings release. We anticipate these new degrees will generate $120 million in revenue at their steady state, effectively replacing the revenue from the degrees phased out through our portfolio management strategy.”

He added, “The average tuition for our flexible degree programs is $40,000, which is about 50% lower than our traditional full model degree programs.”

CFO Paul Lalljie shared his insights as well:

“Many of the over 80 programs we plan to launch in 2024 are ones we’re taking over from another provider. These are already operational, so we expect them to reach steady state cash generation quicker than programs we develop from scratch.”

The mention of taking over programs from another provider caught my eye. Last week, 2U announced the launch of 50 new online degrees in partnership with six universities. A quick search revealed that some of these universities were previously associated with Pearson.

In March, Pearson sold its Online Program Management (OPM) business to Regent, a private equity firm. This business generated £155 million in revenue but suffered £26 million in adjusted operating losses in 2022. These figures seem to align with the $120 million revenue 2U anticipates at “steady state” for its newly acquired programs.

Coding Bootcamps in Trouble

2U experienced a setback in the third quarter with fewer students signing up for their coding bootcamps, which was an unexpected issue for the company.

While interest in coding bootcamps has decreased to levels seen before the pandemic, other programs like Cybersecurity and Data Science are seeing more enrollments.

Due to this decline in interest in coding, 2U might be considering closing some of these bootcamps. The CFO mentioned they are facing challenges with coding bootcamp enrollments and are working on making these programs profitable more quickly.

Layoffs Savings

| Year | Full-Time Employees | Part-Time Employees | Total Employees |

|---|---|---|---|

| 2016 | 1,119 | 90 | 1,209 |

| 2017 | 1,808 | 114 | 1,922 |

| 2018 | 2,583 | 86 | 2,669 |

| 2019 | 3,749 | 2,099 | 5,848 |

| 2020 | 3,772 | 2,834 | 6,606 |

| 2021 | 3,982 | 3,206 | 7,188 |

| 2022 | 3,445 | 3,699 | 7,144 |

Last month, Class Central reported that 2U had implemented layoffs just before the end of the third quarter. We now understand the full scale of these cuts. The company reduced its workforce by 12%, which is expected to save approximately $55 million per year.

Tags

Marcus

3 days later Chip Paucek is out as CEO, CFO takes over. All these actions you mentioned in the article and the CEO change is a sign, 2U to force the profitability and a higher stock price, whatever it takes. They wont admit yet that the whole edX acquisition was a (huge) failure, but i speculate and say when 2U dont see significant progress, they shut down edX.

Dwight Walker

I hope they don’t shutdown edX because I did several courses through them and don’t want to lose all my online notes from those courses. If they don’t want edX then they should sell it to another company like Udemy. Don’t trash the courses for the students.

Marcus

I agree with you Dwight Walker! But it could possible 2U lost the patience with edX, and we all dont know whats inside the management brains. edX is not my first choice and sometimes i criticized them under several articles here, but before 2U dont want edX anymore, they should sell the company to maintain the option for users to have the free choice.

Ezra C.

Former board member close to former President

Used as a bargaining ‘chip’, but funnel goes two ways

Money from partners and partner clients stolen

Every meal is a feast, yes?

Curt Carpenter

From great hope for a new era defined by shared experiences in global education in 2014 — to a grim reminder of our “show me the money” cultural reality nine years later. An opportunity lost for humanity, and a tragedy.

Marcus

I hope i can post here two links to interesting articles about the situation of 2U Inc, because the company faces a bankruptcy:

– https://www.cnbc.com/2024/02/15/2u-earnings-miss-adds-pressure-to-debt-rankled-online-education-firm.html

-https://bnnbreaking.com/finance-nav/2u-inc-the-struggling-online-course-provider-facing-bankruptcy